“`html

The Chicago Mercantile Exchange (CME) just witnessed its largest Bitcoin futures gap ever after U.S. President Donald Trump unveiled a bold plan involving a strategic crypto reserve. This momentous development caused Bitcoin’s value to skyrocket, leaving a substantial gap in CME Bitcoin futures. Let’s dive into the implications of this gap and how it might steer Bitcoin’s future value.

Unraveling the Enigma of CME Bitcoin Futures Gaps

CME Bitcoin futures gaps crop up thanks to time disparities between the CME and global cryptocurrency markets. While cryptocurrencies bustle round the clock, CME futures trading takes a breather from Friday dusk till Sunday eve. If Bitcoin undergoes a significant price shift during this hiatus, a gap emerges between Friday’s closing price and the following Sunday’s opening price of CME futures.

The Breakaway Moment: Trump’s Ripple Effect

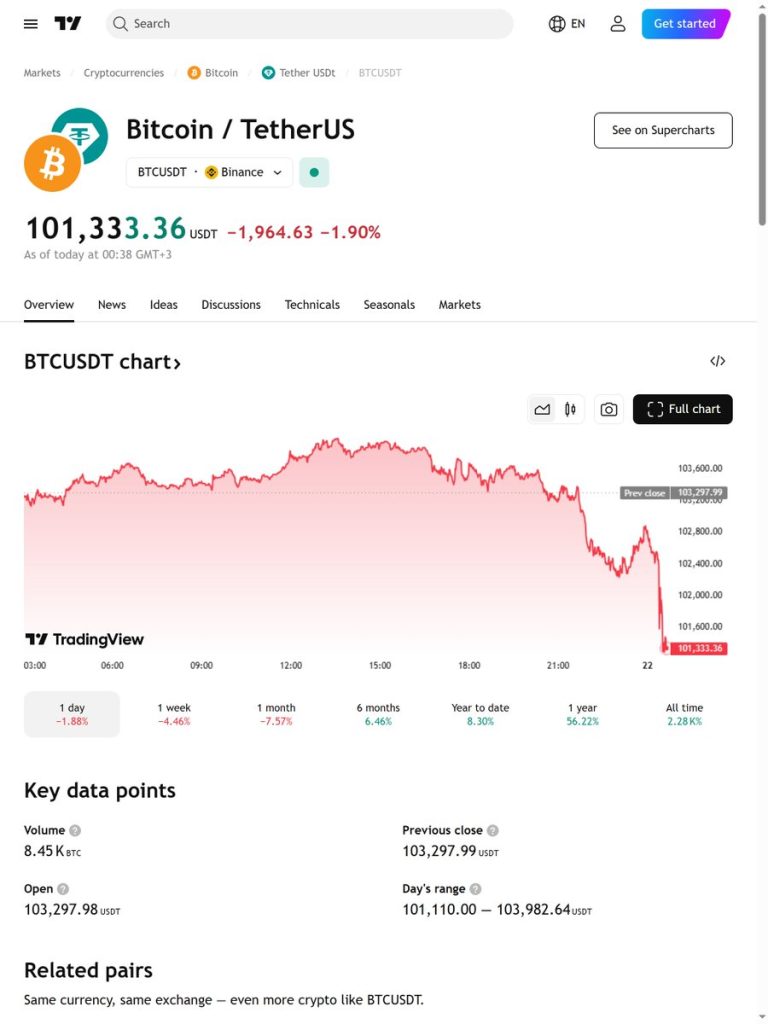

The latest gap sprouted from President Trump’s bold announcement of a U.S. strategic crypto reserve that embraced Bitcoin and its digital companions. This groundbreaking declaration injected a whopping $300 billion into the spot markets, prompting Bitcoin’s value to catapult from about $85,000 to nearly $95,000. Consequently, CME Bitcoin futures wound down at $84,650 and sprang back to life at $95,000, gaping wide at a staggering $10,350. This eclipsed the prior record gap of slightly over $4,000 traced back in August 2024.

Market Pulse Check and Deep Dive Analysis

- Price Surge and Gap Genesis: The abrupt price leap triggered by Trump’s decree birthed what traders dub a CME gap. This chasm bears significance as it marks a price disconnect that often acts as a potential foothold or barrier in future trade sessions.

- Historical Standpoint: Historically, Bitcoin exhibits a habit of “filling” these gaps, meaning its value tends to revisit the gap level before forging ahead in any direction. But pinning down the precise timing of gap filling can prove capricious and might elongate to weeks or even months.

- Market Tides: The recent spike in Bitcoin’s value also triggered a dip in its market supremacy, dipping below 50% from 55.4%, as rival altcoins notched up gains. This transition mirrors changing market dynamics, with investors spreading their stakes across different cryptocurrencies.

Peering into the Crystal Ball

Here’s what lies on the horizon:

- Gap Reconciliation Probability: Traders eye the present gap vigilantly, envisioning Bitcoin circling back to the $85,000 threshold. Yet, this journey could drag out, mirroring past patterns where gaps closed during subsequent bear markets.

- Coming Crypto Conclave: The White House is all set to host its inaugural crypto summit on March 7, possibly casting light on the U.S. crypto reserve scheme and its repercussions on the market. This gathering might sway investor sentiment and potentially sway Bitcoin’s trajectory.

Epilogue

The unprecedented CME Bitcoin futures gap spawned from President Trump’s crypto reserve proclamations underscores the hefty sway of regulatory and political currents on cryptocurrency markets. As traders await the possible bridging of this gap, the imminent crypto summit and broader market shifts will prove pivotal in steering Bitcoin’s future value.

- CME Bitcoin futures gap rises, price retracement likely. Crypto News, March 3, 2025.

- CME Records Largest Bitcoin Futures Gap After Trump’s Crypto Reserve Announcement. Binance, March 3, 2025.

- CME Bitcoin futures set record with gap of more than $10,000. Bitget, March 2, 2025.

- CME Bitcoin futures set a record gap of over $10,000. ChainCatcher, March 3, 2025.

- Bitcoin (BTC) Price: Trump’s Crypto Reserve Announcement Creates Largest CME Gap in History. CoinCentral, March 3, 2025.

“`

Related sources:

[1] crypto.news

[2] www.binance.com

[3] www.bitget.com

[5] coincentral.com