Introduction

In the realm of the Bitcoin market in South Korea, a fascinating phenomenon dubbed the “Kimchi Premium” has been making waves. Picture this: the price of Bitcoin on local exchanges soaring high above its international counterparts, creating a tantalizing curiosity. Since the dusk of 2024, this premium has glittered like a rare gem, captivating attention with its unparalleled shine. Let’s embark on a journey to uncover the secrets behind this enigmatic premium and its impact on the wider cryptocurrency domain.

The Kimchi Premium Unveiled

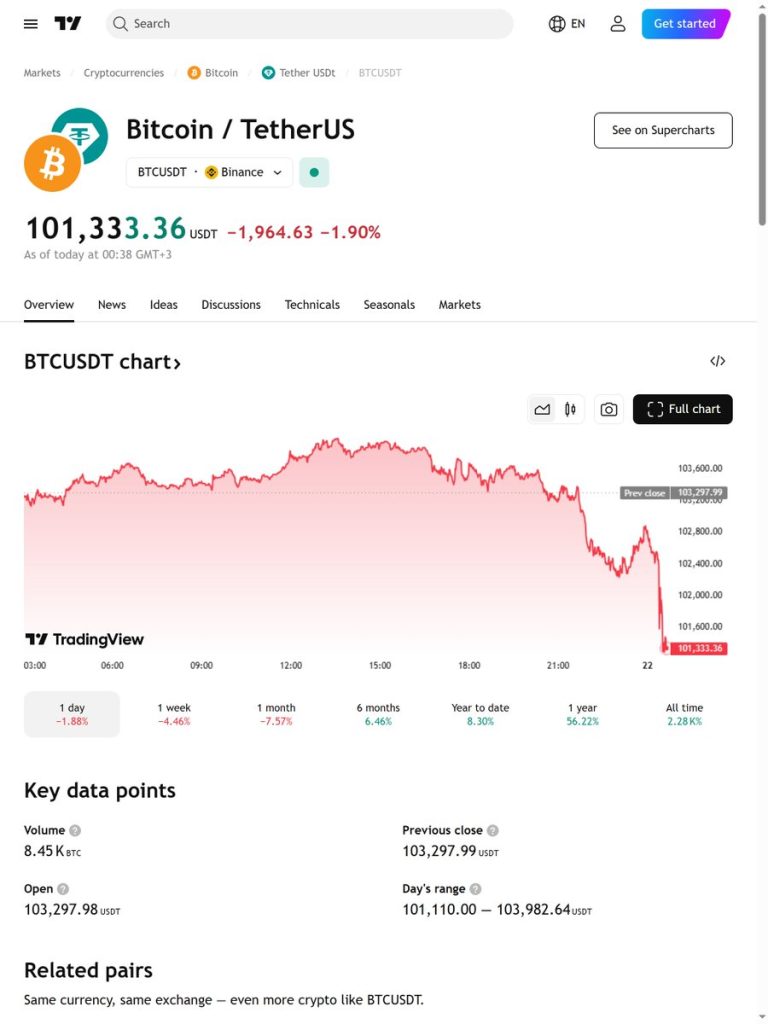

Imagine a bubble floating in the vast ocean of finance, embodying the essence of the Kimchi Premium. This bubble signifies the price gap between Bitcoin trading on South Korean exchanges and the global market. Recently, this bubble has swelled to a remarkable 12%, reaching heights unseen in the past three years, even as the global Bitcoin price dipped to around $95,000. The allure of this premium is not solely born from frenzied buying in South Korea, but it dances to the tune of unique market dynamics native to the country.

Factors Nurturing the Kimchi Premium

- Capital Controls: South Korea stands guard with formidable capital control regulations, fencing off foreign investors from local exchanges and limiting domestic traders from engaging in grand-scale arbitrage across international platforms. It’s akin to a garden with a tall hedge, nurturing a closed ecosystem that breathes life into the premium.

- Absence of Futures Trading: Unlike its global counterparts, South Korea lacks a futures trading arena for cryptocurrencies. This absence shields the local market from the cascading liquidations witnessed in global downturns, ensuring that local prices remain buoyant amidst turbulence.

- Retail-Driven Market: In the colorful mosaic of the South Korean cryptocurrency market, retail investors paint vibrant strokes, overshadowing the institutional players. This unique hue flavors trading patterns distinct from the international arena, bringing a touch of unpredictability to the canvas.

- Demand and Supply Dance: Picture a seesaw of demand and supply in South Korea, with the weight of demand eclipsing the limited supply due to capital controls. Local traders, motivated by fervor, are willing to fork out more for Bitcoin than their distant counterparts, diverging the market’s melody.

Recent Chronicles and Market Sentiments

Amidst the tumultuous winds of geopolitical uncertainties, including the echoes of U.S. tariffs reaching lands as distant as Canada, Mexico, and China, the South Korean Bitcoin market emerges as a beacon of stability. While global tides sway, the local prices stand firm, undeterred by the echoes of a high U.S. Dollar Index. The harmony of the Kimchi Premium remains unscathed amidst the turmoil.

Implications Unraveled

Market Sentiment Enigma: The Kimchi Premium, once a cherished oracle of local market moods, now unveils a tapestry of complexities. Structural undercurrents, not just raw demand, dictate the premium’s journey, questioning the traditional beliefs.

Arbitrage Maze: The premium beckons with promises of arbitrage adventures, whispering of hidden treasures awaiting discovery. Yet, the barriers of capital controls and regulations cast a shadow, limiting the voyagers’ exploits.

Global Symphony: The Kimchi Premium sings a song of the peculiar rhythms of local markets, dancing to its unique tune as global trends watch from afar. This divergence serves as a reminder of the intricate web that binds sentiments and strategies across borders.

Conclusion

The Bitcoin Kimchi Premium in South Korea tells a tale spun from threads of regulations, markets, and geopolitics intertwined. As the world of cryptocurrencies continues its dance of evolution, understanding these nuances becomes imperative for those navigating the maze of local and international markets. While the premium flaunts a facade of resilience in the local realm, its whispers may hold clues to the broader trends that lie ahead.

Related sources:

[2] www.binance.com

[3] cryptoslate.com

[4] u.today

[5] www.ainvest.com