Analyzing Ethereum’s Position in Mid-2025: A Deep Dive into Market Dynamics and Emerging Trends

—

Ethereum continues to be the cornerstone of Web3 and decentralized finance (DeFi), with its market movements and technological developments captivating investors and technologists alike. As of May 2025, Ethereum’s behavior reflects complex interplay between technical trading indicators, evolving decentralized applications, and broader market sentiment. This report explores the nuances of Ethereum’s market activity by focusing on recent volume-weighted average price (VWAP) analysis, the impact of novel AI-powered DeFi analytics tools, and the token’s positioning within the larger blockchain ecosystem.

Understanding Ethereum’s Rally and VWAP Resistance

Volume Weighted Average Price (VWAP) is a crucial technical indicator that combines price action with traded volume, offering traders a more nuanced benchmark for assessing trend strength and entry/exit points.

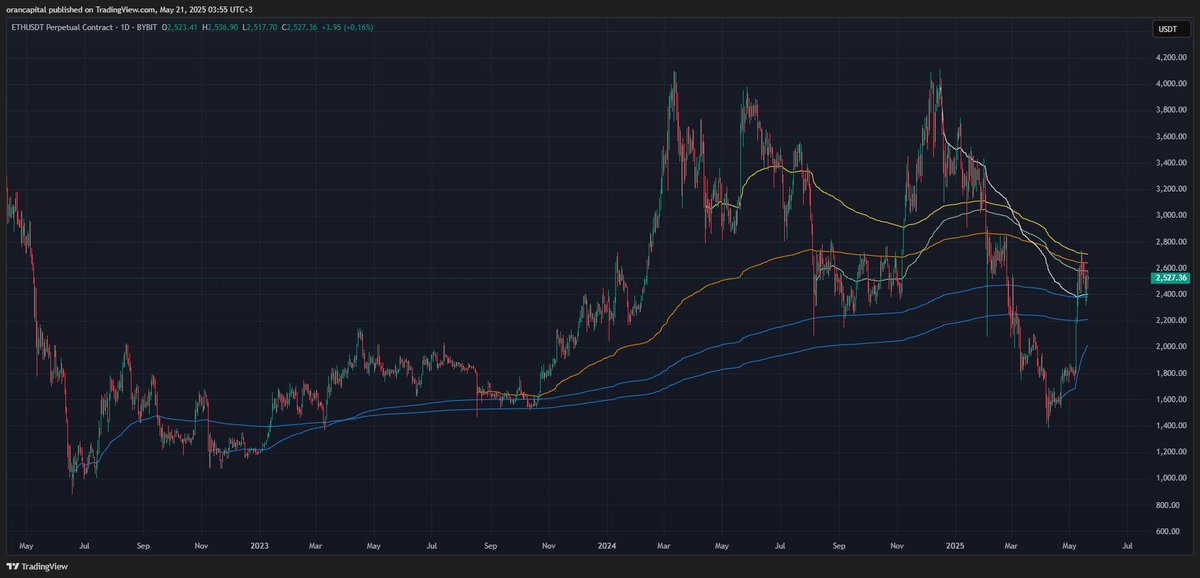

In early May 2025, Ethereum experienced a notable rally that appeared to be met with resistance at the anchored VWAP derived from the April 2024 low, indicated in a yellow overlay on trader charts. This VWAP resistance level, which slightly surpasses another VWAP anchored at the low of August 2023, acted as a ceiling to further upward momentum in ETH’s price.

This suggests that while the rally had buying enthusiasm, market participants viewed these VWAP levels as critical resistance zones. Anchoring VWAPs to historical lows creates a reference price that reflects institutional or long-term investor sentiment and volume-weighted average cost basis, guiding short-term trading decisions. Ethereum’s inability, at this point, to breach above these anchored VWAPs underscores a psychological and technical barrier that many traders and automated algorithms respect.

Notably, VWAP in this context shows how past accumulation phases are influencing current price struggles and highlights the layering of investor behaviors over different periods. It also indicates that despite bullish signals, Ethereum may need significant catalyst events or broader market optimism to sustainably push past these resistance benchmarks.

AI and On-Chain Data: Revolutionizing DeFi and Ethereum Analytics

Ethereum’s ecosystem is evolving rapidly, not only on-chain but also in how data from the network is processed and interpreted. The introduction of artificial intelligence tools tailored for DeFi analytics marks a significant development.

For instance, “Validation Cloud’s” launch of the Mavrik-1 AI Engine on the Hedera network aims to democratize access to complex DeFi data analysis. While not exclusive to Ethereum, this engine feeds off cross-chain information, including Ethereum-based data, to provide granular insights into decentralized finance, NFTs, and market behavior.

Similarly, DexCheck_io’s integration of GPT-powered plain-English insights has transformed how traders interact with token, wallet, and NFT data. By stripping away jargon and visual clutter such as charts, this tool enables a wider audience to comprehend whale moves, holder behavior, and floor price trends instantly.

These technological improvements are essential because they lower the barrier to entry for analyzing Ethereum’s sprawling ecosystem. They empower users beyond just the technically savvy, further spurring mass adoption and smart participation in the Ethereum-driven economic paradigm.

The NFT Factor and Community-Driven Valuation Methods

Ethereum’s robust NFT marketplace continues to push innovation and valuation complexities. The speculative and nascent nature of NFTs makes valuation challenging, yet new methods are emerging.

One community-driven example comes from the project One Gravity, where independent NFT analysts employ bespoke valuation tools to estimate the intrinsic value of NFT collections based on behavioral and transactional data. Though subjective and speculative, these methods reflect the maturing discourse around NFT asset valuation.

This approach is indicative of a growing trend where community sentiment, data science, and on-chain analytics converge to create more structured frameworks for assessing digital asset worth — a necessary evolution for Ethereum as NFTs move from speculative enthusiasm to recognized digital art and asset classes.

DeFi and Entertainment: Broadening the Ethereum Use Case

Ethereum’s DeFi landscape continues to diversify with projects like Gumbino XYZ, which merge traditional financial instruments and NFT mechanics with entertainment value. This “playful” approach offers users gamified experiences, social engagement, and novel investment structures, adding layers to how value is created and perceived within the Ethereum ecosystem.

This growing trend of entertainment-focused DeFi contrasts with pure yield farming or lending protocols, hinting at a more holistic, culturally integrated Web3 economy where finance, art, and social interaction intersect.

Education and Skill Development in Web3: A Parallel Growth Story

A noteworthy development supporting Ethereum’s ecosystem is the rise of education platforms such as Profunda W3 Academy, which currently offers free courses spanning project management, marketing, content writing, DeFi research, community management, and NFT art design.

This educational push addresses a critical bottleneck: talent and knowledge scarcity in blockchain and Web3 fields. By enhancing skill acquisition and community cohesion, these learning initiatives reinforce Ethereum’s long-term vitality and innovation capacity.

Market Sentiment and Broader Crypto Context

Ethereum’s price action must also be contextualized within general cryptocurrency sentiment tracked by firms like Rhinosmart and others. As of late May 2025, there are reports of strong inflows into Ethereum, despite headwinds in wider markets driven by USD weakness and forex fluctuations.

These dynamics signal that while global macroeconomics influences crypto volatility, Ethereum benefits from a dedicated base of investors and traders who continue to see its core value proposition intact.

—

Concluding Reflections: Ethereum’s Intricate Web of Technical and Fundamental Drivers

Ethereum in mid-2025 sits at a fascinating intersection of technological evolution, market psychology, and emerging utility paradigms. The recent rally’s struggle at anchored VWAP levels reveals how historical price-volume dynamics weigh on present market behavior. Meanwhile, the integration of AI-driven analytics, NFT valuation innovation, and education initiatives testify to Ethereum’s maturing ecosystem infrastructure.

Investors, developers, and enthusiasts would do well to appreciate these layers — price movements are not just numbers on a chart but manifestations of collective sentiment, technological progress, and cultural shifts.

As Ethereum’s ecosystem continues to expand and experiment with new models of decentralization, finance, and entertainment, its trajectory will likely remain dynamic, challenging, and richly rewarding for those who navigate its intricacies with informed strategies and a long-term perspective.

—

References & Further Reading

– HurryNFT on Ethereum VWAP Analysis

– Validation Cloud Mavrik-1 AI Engine Announcement

– DexCheck_io GPT Insights Overview

– One Gravity NFT Valuation Speculation

– UMA Token Project Gumbino Analysis

– Profunda W3 Academy Courses

– Rhinosmart Ethereum Market Analysis

—

The synthesis of Ethereum’s technical signals with its broadening utility landscape paints a compelling narrative about digital asset evolution. Whether you are trading, building, or simply observing, these pulse points signal that Ethereum remains a pivotal player in crypto’s unfolding story.