Navigating the Evolving Landscape of DeFi, NFTs, and Crypto Projects: An In-Depth Analysis of Emerging Trends and Tools

The decentralized finance (DeFi) and non-fungible token (NFT) ecosystem have become vibrant playgrounds for innovation, speculation, and community building. Projects like Gumbino XYZ and tools like UnleashNFTs Snap reflect the fascinating fusion of entertainment, finance, and cutting-edge technology while traditional markets continue grappling with economic indicators and stock performances influenced by these digital currents. This report delves into the multi-faceted world of blockchain projects, crypto analysis tools, educational initiatives, and their broader market implications unveiled around May 2025. Through this lens, we examine how projects approach user engagement, transparency, and decision-making assistance, highlighting key market movements and underlying economic signals.

—

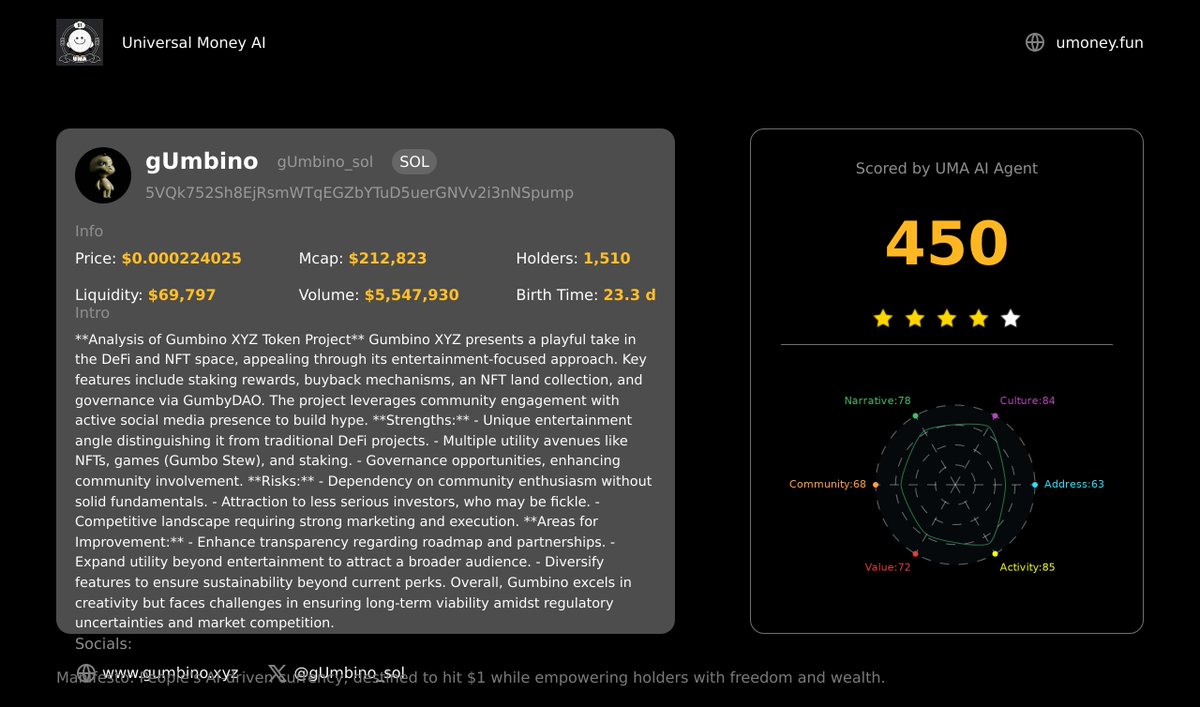

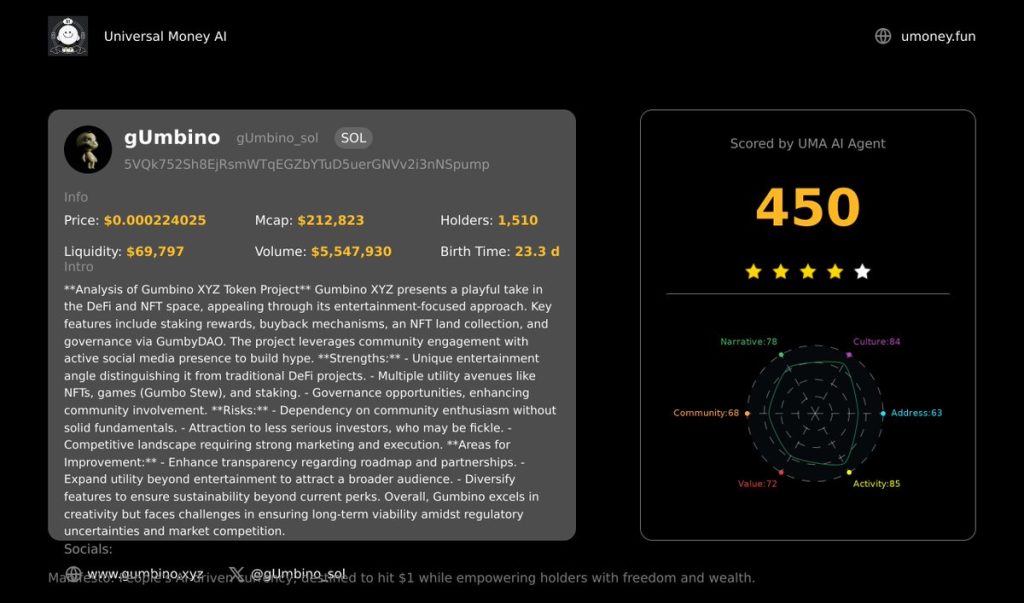

A Playful Yet Serious Approach: The Case of Gumbino XYZ

Gumbino XYZ is carving a niche by blending entertainment with DeFi and NFTs, presenting a “playful take” on what can otherwise be dry financial constructs. With a market capitalization of approximately $212,823 and a score placing it in tier A (a rating system presumably based on some composite metrics), Gumbino embraces a user-focused approach that leans heavily on engagement and entertainment value rather than purely financial utility.

The Appeal of Entertainment-Driven DeFi and NFTs

Traditionally, DeFi projects emphasize financial gains, liquidity mining, and yield optimization. NFTs, while often collectible, have ventured into art, music, gaming, and identity. Gumbino’s approach exemplifies how projects now creatively synthesize fun elements with serious financial underpinnings. This hybridization can attract broader audiences who might otherwise shy away from purely technical or finance-heavy projects. It also recognizes that emotional resonance and community engagement often fuel long-term ecosystem vitality.

While $GUMBINO remains relatively modest in market cap size, its A-tier designation and community interest suggest a project worth watching. Entertainment-centric DeFi models can diversify blockchain adoption pathways by lowering psychological barriers to entry and promoting organic growth cycles.

—

Learning and Empowerment: The Expansion of Blockchain Education

Crypto literacy remains a pivotal force for ecosystem maturation, influencing user decisions from investment to governance participation. Profunda W3 Academy’s offering of five distinct blockchain-related courses illustrates the growing demand for structured knowledge. These courses include:

– Project Management & Marketing

– Content Writing

– DeFi Research & Analysis

– Community Management & Collaboration

– Graphics & NFT Art Design

Why Education Matters More Than Ever

Complexity in DeFi protocols, NFT valuation, and cross-chain interoperability necessitates education beyond mere surface-level understanding. Free registration for these courses democratizes access, fostering an environment where users not only consume but also contribute to innovation. For example, understanding DeFi research can improve strategic investment choices, while community management skills enhance decentralized governance efficacy.

Such educational initiatives function as clearinghouses for reliable information, counterbalancing misinformation that often plagues the crypto space. They boost user confidence to navigate rapidly evolving landscapes and improve the quality of community interaction around new projects.

—

Cutting-Edge Tools: MetaMask Snap Meets NFT Analysis

A notable breakthrough in usability comes with tools like UnleashNFTs MetaMask Snap, which converts a standard wallet experience into an intelligent NFT valuation assistant. Instantly providing AI-generated fair value estimates for NFTs, this enables users to avoid blind purchases and make decisions grounded in data.

Transformation of Wallets into Smart Asset Managers

Integrating NFT analytics directly into wallet interfaces disrupts traditional, multi-step research routines. This convenience mitigates risks stemming from asymmetric information and improves asset pricing efficiency. Wallets equipped with such extensions not only serve as funds custodians but evolve into comprehensive management suites with real-time insights, alerts, and even scam prevention features.

This merges the financial due diligence environment commonly found in traditional markets with the decentralized ethos, promoting safer and more transparent NFT ecosystems. Tools like OWL-IN-ONE reiterate this evolution by bundling token analysis, wallet cybersecurity, and scam monitoring into unified dashboards.

—

Market Sentiments and Economic Data: The Broader Context

On the traditional finance and stock market front, ongoing economic indicators reflect nuanced trends impacting investor psychology and capital flows:

– Piramal Pharma exhibits a negative return on equity (ROE) over three years (-0.36%), signaling underperformance in profitability compared to equity investment.

– National Fertilizer records a modest ROE of 7.22%, reflecting relatively stable but unspectacular returns amidst its product portfolio.

– KDDL presents mixed signals; revenue has risen yearly, but profit-after-tax (PAT) fell, and EBITDA margins shrank—pointing to operational pressures despite top-line growth.

– Karur Vysya Bank charts a technical breakout, hinting at bullish momentum within the stock market potentially tied to macroeconomic or sectoral recovery.

These snapshots reinforce that even as blockchain markets surge and innovate, traditional equities are still grappling with fundamentals and volatility driven by both micro and macroeconomic factors.

—

The Pulse of Crypto Community Analyses and Insights

Social media and curated content constitute powerful axes where market narratives materialize:

– Influencers such as Loki dissect NFT projects ranging from blue-chip leaders to speculative gems, providing sentiment and market cycle interpretations.

– Updates on projects like $DREAM highlight remarkable token growth, doubling market cap and boosting NFT floor prices, showcasing how narrative and utility synergize to drive value.

– Critical views encourage skepticism toward paid trading strategies when free macroeconomic analysis remains accessible and often superior.

This decentralized flow of intelligence represents a democratization of market research, where varied voices help shape collective knowledge and investor behaviors.

—

Towards a Smarter, More Engaged Crypto Ecosystem

The ongoing convergence of entertainment, education, powerful analytical tools, and active community discourse points to a maturing crypto space. Projects infused with creativity, robust educational frameworks, and accessible analytics create fertile ground for:

– Increased user confidence and reduced entry friction,

– Enhanced transparency and valuation accuracy,

– Robust community governance and innovation cycles.

However, fragmentation remains—differentiating reliable projects and tools from fleeting hype is an evolving skill requiring continuous vigilance and learning.

—

Conclusion: The Road Ahead for DeFi, NFTs, and Market Analysis

As the line between finance, technology, and entertainment blurs, the blockchain ecosystem presents a mosaic of opportunities and challenges. Gumbino’s entertainment-driven model, coupled with educational pushes like Profunda W3 Academy and analytical advancements via MetaMask Snap tools, illustrate a broadening of approaches to engagement and empowerment.

Traditional market actors observe with interest as these digital-native models inject vitality into investor behavior, asset classes, and narratives. For participants, embracing both the technical nuances and shifting emotional landscapes of these intertwined worlds is crucial to navigating what’s fast becoming a sophisticated, interconnected financial ecosystem.

The future belongs to projects and tools that not only add financial value but also cultivate knowledge, trust, and meaningful connections in a decentralized spirit — transforming spectators into active architects of the crypto economy.

—

References and Further Reading

– Gumbino Official Twitter and Project Info

– Profunda W3 Academy Free Courses

– UnleashNFTs MetaMask Snap Announcement

– Rhinosmart Ethereum Market Analysis Twitter

– Technical Analysis Unbiased View on Indian Stocks

– Neslie_eth $DREAM and NFT Collection Update

– Ry’s Crypto Strategy Insights

—

Dive into blockchain insights and boost your crypto savvy with Profunda W3 Academy’s free courses—start learning now at Profunda W3 Academy Free Courses!