Ethereum’s Unfilled Price Gaps: What They Mean and Why to Watch Them Closely

—

Cryptocurrency markets are famously volatile, swinging dramatically within minutes or hours. Amid these wild price movements, savvy traders often look for “gaps” on price charts—moments when the market opens at a significantly different price than it closed previously. Ethereum, one of the major players in crypto, currently has several such gaps to watch, and these gaps could signal important market dynamics in the near term.

Understanding Price Gaps in Crypto

Unlike traditional stock markets that open and close at fixed hours, crypto markets trade 24/7. Still, price gaps occur due to the way some technical analysis tools aggregate data on discrete intervals—like daily or hourly candles on a chart. A “gap” shows when the opening price of a period is sharply different from the closing price of the last period, leaving a visible blank space or “gap” on the chart.

In Ethereum’s case, these gaps are often created during periods of high volatility or after major news events, when prices leap over specific ranges without trading within them. The result: charts show unfilled gaps representing potential support or resistance levels, which many traders watch as likely future price targets.

Why Ethereum’s Gaps Matter Now

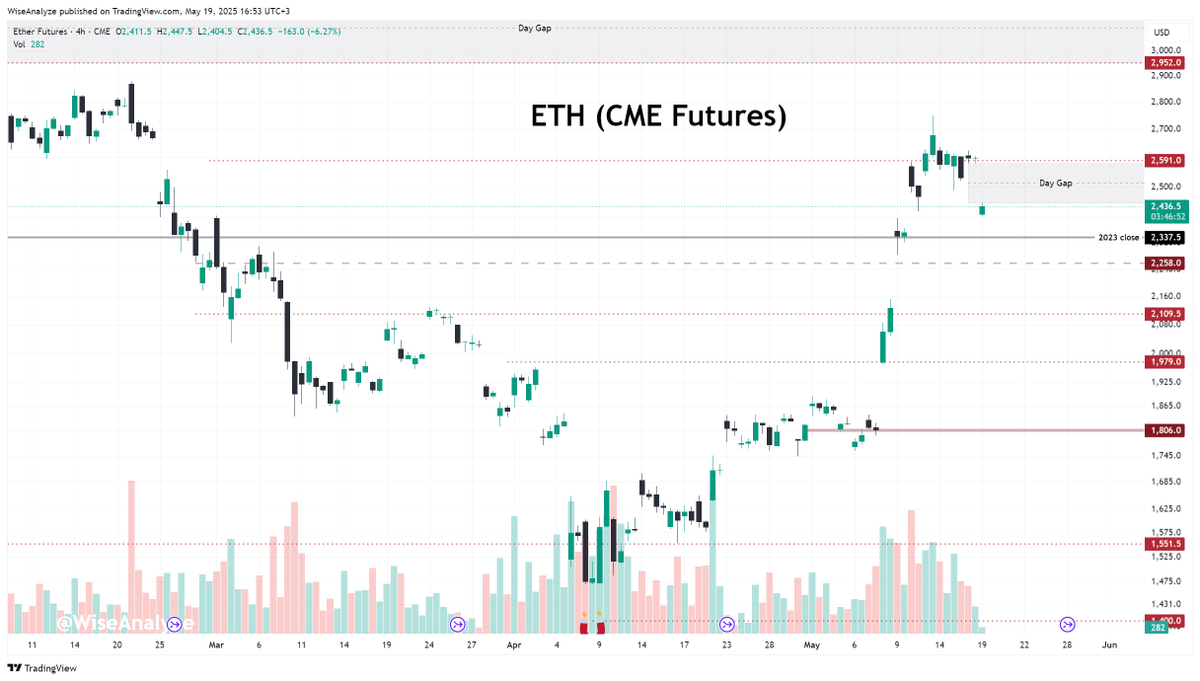

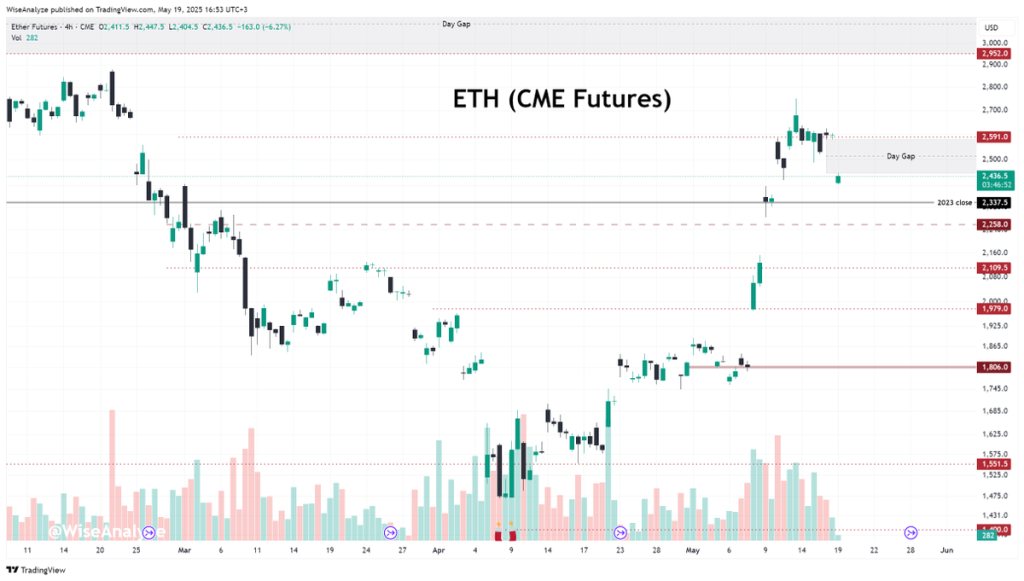

Recent analysis points to Ethereum having a few outstanding price gaps waiting to be filled. The closest one hovers around the $2,581 level, and another significant gap sits between roughly $2,952 and $3,278. What’s intriguing is that these price ranges could be filled either in the course of today’s trading or after a corrective move—a temporary pullback in price before continuing on any longer-term trajectory.

This kind of gap filling is an important concept: when an asset’s price moves back to “fill” a gap, it indicates a market attempt to retest previously skipped pricing levels, often confirming or exhausting momentum trends. Traders might interpret the filling of these gaps as signals to enter or exit positions, depending on the broader context.

The Nearest Gap at $2,581: What to Expect

The closest gap at $2,581 is tantalizingly near current price action, making it the most immediate level to monitor. Should Ethereum’s price retrace or rally to this point, the market could experience increased trading volume and volatility while testing this zone.

Filling this gap might mean Ethereum is resetting after some rapid moves, possibly absorbing selling or buying pressure left behind. For traders, observing how volume and momentum indicators behave around this level provides clues on whether Ethereum might rebound strongly or continue correcting further.

The Larger Gap Between $2,952 and $3,278

Looking beyond the immediate horizon, the larger gap between roughly $2,952 and $3,278 represents a broader area where Ethereum has significant untraded price zones. Such a wide gap could act as a real magnet for price over the medium term, especially if bullish catalysts return to the market.

This range spans nearly $326, which is huge in the context of crypto trading. Filling that gap would require sustained momentum and could be accompanied by substantial price swings. Traders and investors eyeing higher-price potential should watch this gap closely, as breaking through these levels could trigger momentum-driven rallies—or, conversely, strong resistance.

The Mechanics Behind Gap Filling: Market Psychology and Technical Factors

Why do gaps tend to get filled? It’s a well-documented market phenomenon tied to trader psychology and order flow mechanics. When the price leaps over a range without trading there, it suggests a temporary imbalance—either too little supply or too little demand occurred at that range during a rapid move.

Eventually, as market participants reassess value, prices tend to revisit those skipped areas to ensure liquidity is sufficient and to absorb any unfulfilled orders. In this sense, gap filling can be interpreted as the market’s way of “correcting” or validating past price discoveries.

Ethereum’s volatile nature and evolving ecosystem often see quick sentiment shifts. Consequently, these price gaps serve as natural checkpoints for traders working to gauge market strength or weakness.

How Traders Can Use Gap Analysis in Ethereum

Understanding where gaps lie helps traders plan entry and exit points:

– Entry opportunities: If price approaches a gap filled with buying interest, investors might see it as a discount zone to open or add to positions.

– Resistance zones: Gaps can also act as ceilings where price struggles to break through, providing signals to tighten stops or take profits.

– Risk management: Knowing the locations of these gaps helps in setting stop-loss orders and defining risk parameters more precisely.

Moreover, in highly liquid markets like Ethereum, gaps accompanied by volume surges often precede big moves, offering potential profit opportunities for nimble traders.

Conclusion: Gaps Hold Clues to Ethereum’s Near-Term Path

Ethereum’s unfilled price gaps at $2,581 and the $2,952–$3,278 range aren’t just empty spaces on charts—they encapsulate crucial psychological and technical battlegrounds. Whether these gaps get filled today or later, their presence signals zones where the market strives to find equilibrium amid volatile swings.

Traders and enthusiasts should keep a keen eye on how Ethereum behaves near these levels. Will the market smoothly fill these gaps as expected, or will unexpected forces push the price sharply in new directions? Observing the price action with an understanding of gap dynamics provides a strategic edge, illuminating the complex dance between market momentum and trader psychology.

In a space as unpredictable as crypto, these gaps remind us that amid rapid change, some market patterns still hold subtle warnings and opportunities waiting to be unlocked.

—

Sources

Zen Twitter Post on Ethereum Gaps

Investopedia on Price Gaps

Binance Academy – Understanding Price Gaps