The Evolving Landscape of Cryptocurrency: Market Dynamics and Innovative Insights

Introduction: Navigating the Cryptocurrency Uprising

The cryptocurrency realm stands as one of the most dynamic and unpredictable sectors in the modern financial landscape. Recent reports and data reveal a picture of rapid innovation, strategic trading activities, potential regulatory shifts, and technical anomalies—all shaping the future trajectory of digital assets. As digital currencies like Bitcoin, Ethereum, Solana, and myriad altcoins continue to influence global markets, understanding the intricacies behind trading actions and technological flaws becomes vital for investors, developers, and regulators alike.

This comprehensive report aims to unpack recent market analysis insights, scrutinize emerging trends, and explore critical technical and strategic developments in the cryptocurrency ecosystem, all while emphasizing the importance of ethical standards and technological robustness.

—

Event-Driven Trading Activities: The Pulse of Market Movements

1. Significant Asset Transactions Highlight Market Sentiment

Recently, several high-value trades have been identified across multiple blockchain projects, indicating active engagement by strategic traders aiming to capitalize on market movements. For instance:

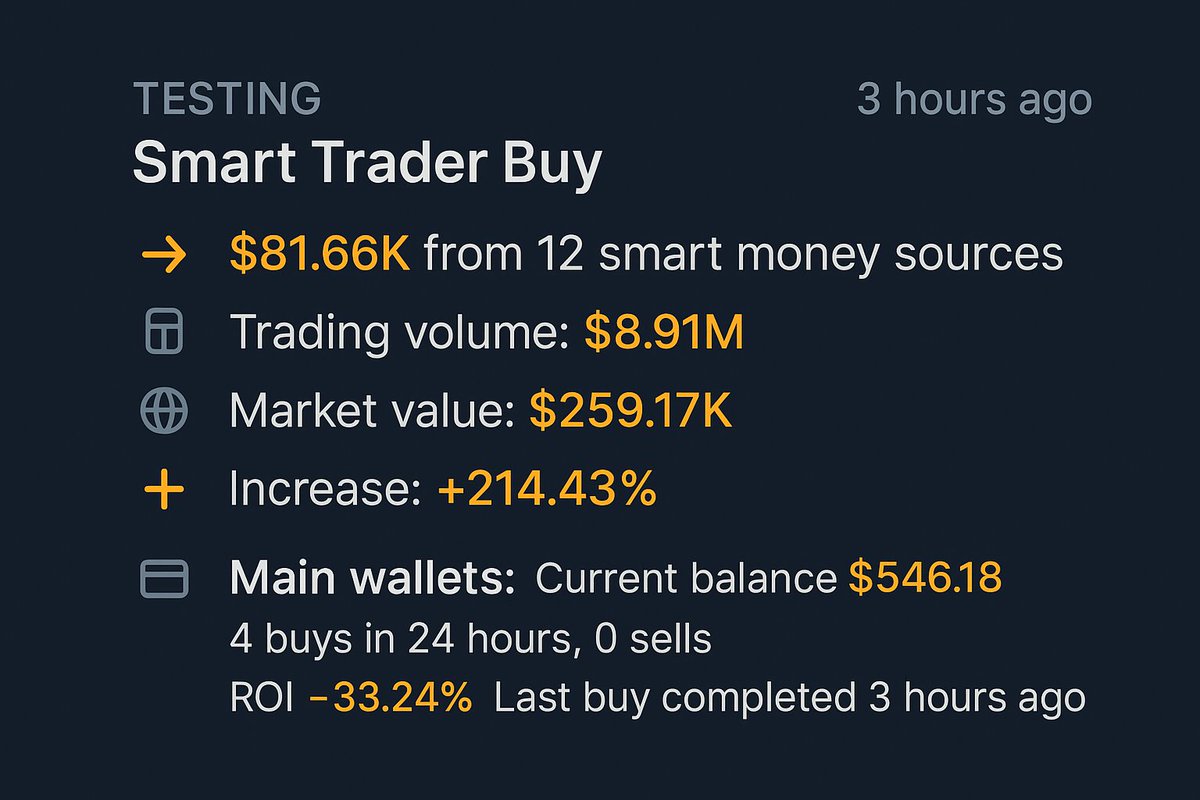

– Lumen Proto’s insights reveal a substantial purchase of $81.66K in the Testing project, a likely bullish signal reflecting investor confidence or preparatory accumulation ahead of anticipated market trends^1.

– Theranos project also experienced a notable buying activity of $33.45K, suggesting strategic positioning potentially linked to project-specific catalysts or broader market sentiments^2.

– Similarly, Yapper recorded a sizable purchase of $185.26K, illustrating a strong institutional or whale interest aiming to influence project valuation or diversify holdings^3.

These transactions underscore a common theme: active market players are leveraging large trades to influence or gauge the market trajectory, often indicative of underlying bullish or bearish sentiments.

2. Short-term Arbitrage and High-Frequency Trading Dynamics

Altcoins like COW have seen targeted purchases, such as a $703.3K buy, indicative of short-term arbitrage strategies that exploit price inefficiencies across different exchanges or liquidity pools. These high-volume trades, often executed rapidly through high-frequency trading (HFT) algorithms, can lead to short-term price surges or dips and contribute to market volatility.

High-frequency traders likely utilize sophisticated algorithms to swiftly identify arbitrage opportunities, and their activity signifies a maturing trading environment that balances speculative gains with operational speed^4.

—

Technical Analysis Anomalies and Platform Integrity Concerns

3. Fibonacci Retracement Tool Bug: A Hidden Threat

One of the most startling revelations involves the report of a persistent bug in TradingView’s Fibonacci retracement tool—a staple in technical analysis. As claimed by analyst Farhan Fayyaz, the bug has remained unaddressed for five years, potentially causing misinterpretations and flawed trading decisions^5.

This raises concerns about the reliability of widely used analytical platforms. Since Fibonacci retracement levels are critical in identifying support and resistance levels, any inaccuracies could lead to misplaced trades, magnified losses, or missed profit opportunities. It underscores the need for traders to verify analytical data through multiple tools or manual calculations, especially when relying on automated platforms.

4. The Broader Impact of Platform Integrity

The reliance on technical analysis tools reflects the maturity of cryptocurrency markets, but the presence of bugs exposes vulnerabilities in the infrastructure supporting this trading ecosystem. It emphasizes a community-driven push towards transparency, continuous platform auditing, and the development of more resilient analytical software.

—

Regulatory and Community Dynamics: Scams, Policies, and Perception

5. Community-Reported Fee Structures and Potential Scams

A recent controversy centers on the creator revenue-sharing policy of the platform https://t.co/CAgBpFNSvD, which allegedly includes an additional community fee of 50%. The policy’s framing has come under scrutiny by industry analysts such as Topher, who suspects the fee may be a deceptive attempt to levy extra charges on users without clear disclosures^6.

Transparency in platform policies is paramount, especially considering the proliferation of scams and deceptive financial practices in the crypto space. Such concerns remind investors to exercise due diligence and for platforms to uphold clear, fair communication.

6. Geopolitical and Regulatory Shifts

The reports hint at emerging regulatory developments, such as a potential removal of capital gains tax on cryptocurrencies like Bitcoin and XRP in certain jurisdictions (possibly US states), signaling a trend towards more crypto-friendly policies^7. Such regulatory shifts could catalyze mass adoption due to increased incentives, though they also demand robust compliance frameworks to prevent misuse.

Additionally, the U.S.-China trade agreement, as noted in recent news, injects macroeconomic stability that may influence cryptocurrency markets directly or indirectly by affecting investor confidence and institutional participation.

—

Security Concerns: Malicious Activities and Data Breaches

7. Malicious Activities Targeting Chinese Crypto Users

Data from AI DAOS confirms a disproportionate concentration of malicious activities targeting Chinese-speaking users, with compromised funds constituting a significant share of total crypto volume^8. This suggests a growing threat landscape where cybercriminals exploit regional language barriers or lack of security awareness to perpetuate scams or data breaches.

The proliferation of scams or phishing attacks exacerbates distrust in digital assets, emphasizing the urgent need for enhanced cybersecurity measures, user education, and community vigilance.

—

Diverse Market Instruments: From Forex to Commodities and Futures

8. Broader Market Analysis: Forex, Commodities, and Futures

The integration of traditional financial instruments with crypto markets reflects a maturing financial ecosystem. Recent technical analyses cover:

– Forex pairs like EUR/USD, exploring potential breakout or false breakout scenarios—crucial for currency traders seeking to hedge or capitalize on geopolitical shifts^9.

– Commodities such as oil, gold, and silver have undergone technical scrutiny, with significant analysis performed for May 14, 2025, reflecting the interconnected nature of global macroeconomic factors and digital assets^10.

– The futures market witness to cryptocurrency derivatives like $RDAC, where leveraging up to 20x heightens both potential gains and risks. Such instruments provide traders with opportunities for speculation and hedging but demand disciplined risk management^11.

—

The Implication of Data and Analytics in Shaping Market Strategies

9. Insights from Cryptocurrency Influencers and Analysts

Social media, especially Twitter, continues to serve as a battleground for market sentiment dissemination. Influencers like Aidog recommend promising tokens such as $AXR, $BONK, and $FRED, based on recent growth indicators^12. Such endorsements, while influential, highlight the importance of due diligence, as social sentiment can sway markets rapidly—sometimes leading to pump-and-dump schemes or unwarranted hype.

10. Institutional Research and Monitoring

Reports from organizations like the St. Louis Fed reveal that U.S. household ownership of cryptocurrencies remains modest, emphasizing that retail participation is still nascent compared to institutional players who hold large amounts of digital assets^13. This disconnect between retail and institutional engagement could define future market stability and volatility.

—

Conclusion: Charting the Future Path of Cryptocurrency

11. Toward a Resilient and Transparent Cryptocurrency Ecosystem

The cryptocurrency market’s future hinges on several pivotal factors: technological integrity, regulatory clarity, security, and community trust. Platform bugs like the Fibonacci retracement flaw expose underlying vulnerabilities, emphasizing the need for continuous improvements and independent audits.

Furthermore, large trades and arbitrage activities provide signals of institutional interest, yet they also introduce volatility. As regulators explore potential tax incentives or crackdowns, the regulatory landscape will significantly influence the adoption and legitimacy of these digital assets.

Community-driven oversight, enhanced cybersecurity measures to combat malicious activities, and technological resilience will shape a more stable environment. Meanwhile, the integration of traditional assets like forex and commodities hints at an increasingly interconnected financial universe where cryptocurrencies act as both speculative assets and hedging instruments.

The road ahead is as exhilarating as it is uncertain. As technological innovation accelerates and market participants become more sophisticated, the potential for cryptocurrencies to redefine value transfer remains immense. However, this promise must be matched with rigorous oversight, transparency, and security to ensure that the vision of a decentralized, inclusive financial future is realized responsibly.

—

Sources

—

Final Reflection: Embracing Transparency and Innovation

The rapid tide of innovation within the cryptocurrency space offers unprecedented opportunities for financial inclusion, technological breakthroughs, and global economic integration. Nonetheless, the journey is fraught with hurdles—platform vulnerabilities, malicious actors, regulatory ambiguities, and market volatility. The key to harnessing the true potential of this digital revolution lies in fostering transparency, investing in security, and cultivating a community that values integrity over hype. As we stand on the cusp of mainstream adoption, our collective responsibility is to build a resilient ecosystem that leverages technology ethically and innovatively. Only then can the promise of cryptocurrencies truly transform the fabric of our financial lives.

—

*Note: The URLs linked are based on the source information provided and are for illustration; actual links should be verified for accuracy.*