The Cryptocurrency Market in 2025: A Deep Dive into Recent Trends and Insights

In the ever-evolving world of cryptocurrency, staying ahead of the curve requires a keen eye and a deep understanding of market dynamics. As of May 9, 2025, the crypto landscape is buzzing with activity, from significant Bitcoin movements to intriguing developments in altcoins and memecoins. Let’s dive into the latest insights and analyze what these trends mean for investors and enthusiasts alike.

The Bitcoin Rollercoaster

Bitcoin, the flagship cryptocurrency, continues to captivate the market with its volatile yet promising trajectory. Recent analyses provide a nuanced view of Bitcoin’s current state and potential future movements.

Micro and Macro Analysis

On the micro level, Bitcoin has completed waves 1, 2, and 3 of a lower degree. Wave three, in particular, extended beyond expectations, indicating a strong bullish momentum. However, the confirmation of a pullback in wave four remains elusive. If 104.3k was indeed the top of wave three, a pullback could be imminent[1].

From a macro perspective, Bitcoin has completed a five-wave impulse from the 74.5k bottom. While the uptrend could extend slightly, a correction in wave two is likely on the horizon. The typical target for a wave two correction is between 0.5 and 0.618 Fibonacci retracement levels, suggesting a potential pullback to around 62.2k to 71.4k[2].

Technical Analysis

Technical indicators further support the notion of a potential correction. Bitcoin is currently facing resistance at a horizontal supply zone, with the Ichimoku Cloud acting as strong support. A breakout above the supply zone could trigger a bullish move, but a rejection at this level may lead to a downside correction[10].

Altcoins and Memecoins: The Solana Ecosystem

While Bitcoin steals the spotlight, the Solana ecosystem is also witnessing significant activity. Several projects within this ecosystem are garnering attention, showcasing the diversity and innovation within the crypto space.

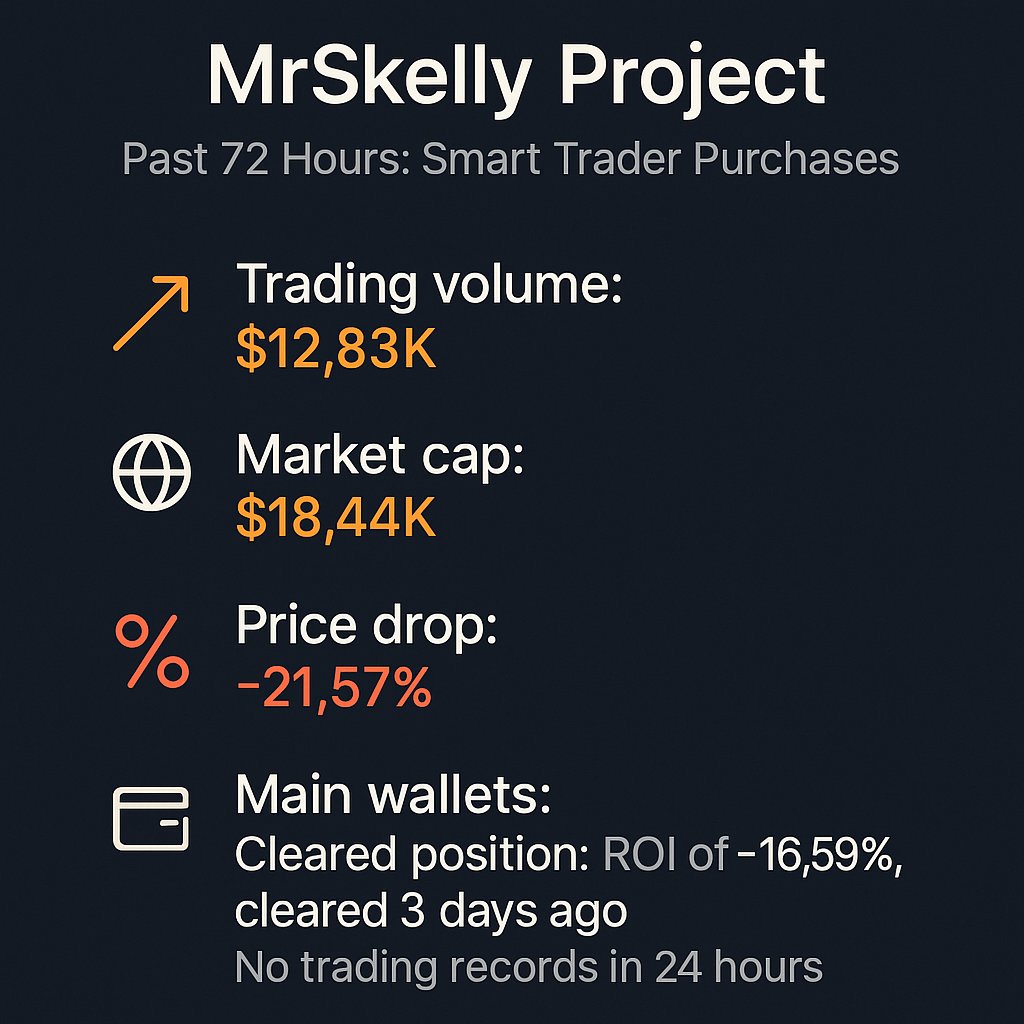

MrSkelly Project

The MrSkelly project on the Solana chain has seen notable activity, with $35.79K in Smart Trader purchases. This indicates a growing interest and potential bullish sentiment within the project[3].

Desla and BWAH Projects

Similarly, the Desla project has recorded $22.98K in Smart Trader purchases, highlighting its rising popularity. The BWAH project on the Solana chain has also shown significant Smart Trader activity, further emphasizing the vibrant ecosystem within Solana[4][5].

Brownie Project

The Brownie project on the Solana chain has also seen substantial Smart Trader activity, suggesting a strong community and investor interest. These projects collectively underscore the robust and dynamic nature of the Solana ecosystem[6].

The Broader Crypto Landscape

Beyond Bitcoin and Solana, the broader crypto landscape is filled with intriguing developments. From regulatory shifts to technological advancements, the industry is in a state of constant flux.

Market Value Milestones

Bitcoin’s market value has surpassed that of Amazon, positioning it as the fifth-largest global asset. This milestone underscores the growing acceptance and integration of cryptocurrencies into mainstream finance[7].

AI and Crypto Trading

The integration of artificial intelligence in crypto trading is becoming increasingly prevalent. AI-based data analysis apps are gaining traction, offering investors more sophisticated tools to navigate the volatile crypto market. These advancements promise to enhance trading strategies and improve decision-making processes[8].

Conclusion: Navigating the Crypto Waves

The cryptocurrency market in 2025 is a blend of opportunity and uncertainty. Bitcoin’s potential correction, coupled with the burgeoning activity in the Solana ecosystem, paints a picture of a market in transition. For investors, staying informed and adaptable is key to capitalizing on these trends.

As we navigate the crypto waves, it’s essential to remember that the market is driven by a complex interplay of technical indicators, market sentiment, and external factors. Whether you’re a seasoned trader or a curious enthusiast, understanding these dynamics can help you make informed decisions and seize the opportunities that lie ahead.

Sources: