A Week in Review: NFT and Token Loan Trends

The digital asset landscape is ever-evolving, with new trends and data emerging daily. Last week was no exception, with significant activity in the NFT and token loan sectors. Let’s dive into the numbers and analyze the trends that shaped the week.

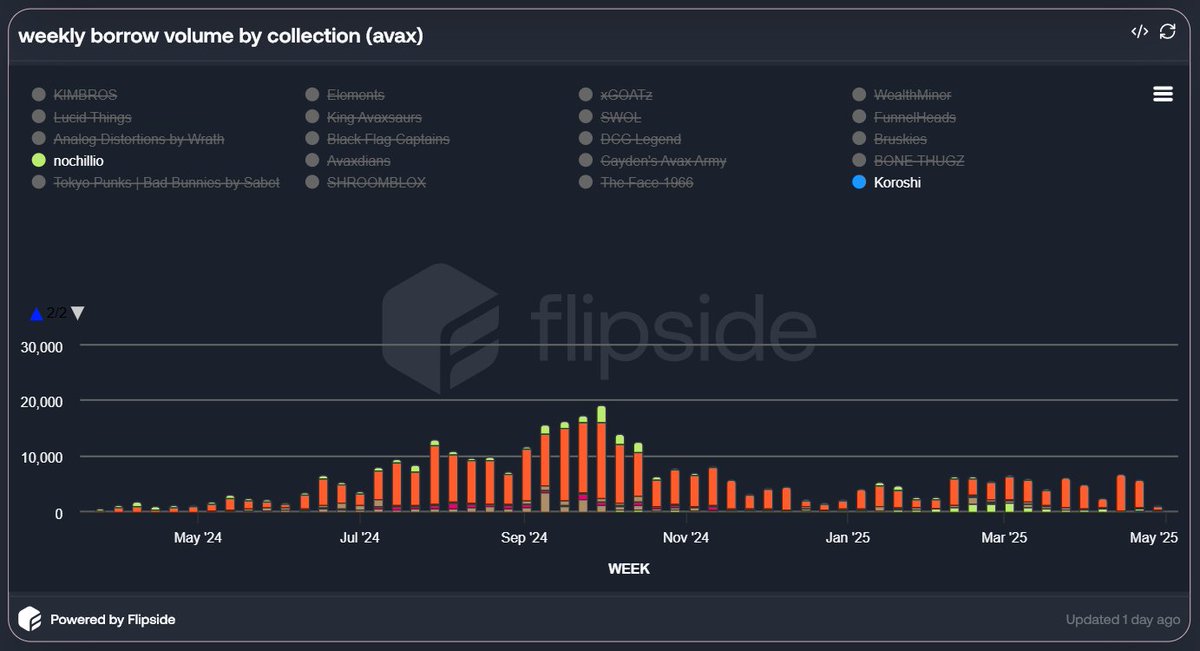

NFT and Token Loan Activity

Loan Offers and Deposits

Last week saw a substantial amount of activity in the NFT and token loan markets. Over $1.1 million in loan offers were made using NFTs as collateral. This indicates a growing trust and liquidity in the NFT-backed loan sector. Additionally, there were deposits of more than $550,000 in $KET tokens to receive loans, showcasing the increasing interest in token-based lending[1].

NFT Lending Dynamics

NFT lending has been gaining traction, with lenders and borrowers finding innovative ways to utilize digital assets. The process typically involves a lender providing a loan to a borrower, with the borrower’s NFT serving as collateral. If the borrower defaults, the lender can seize the NFT. This system allows NFT holders to access liquidity without selling their assets, while lenders can earn interest on their loans.

The Ronen Coin Project

Gaining Attention on Ronin Network

The Ronen Coin project has been making waves on the Ronin Network. This project has garnered significant attention, with its Pro Miner NFT Collection launched on April 28, 2025. The collection consists of 555 NFTs, and trading activity has been robust, indicating a strong market interest[2].

Market Performance

The Pro Miner NFT Collection has seen the largest trading volume among similar projects, suggesting a high demand and liquidity. This performance can be attributed to several factors, including the unique utility of the NFTs, the project’s marketing efforts, and the overall bullish sentiment in the NFT market.

Market Analysis and Tools

Tools for Tracking and Analysis

In the fast-paced world of cryptocurrencies and NFTs, having the right tools for tracking and analysis is crucial. Several platforms offer comprehensive market tracking and analysis features:

– CoinMarketCap: Provides data on over 13,000 coins, including market cap rankings and price movements.

– CoinGecko: Offers in-depth NFT and DeFi analysis, along with heatmaps to visualize market trends.

– TokenTerminal: Focuses on fundamental metrics for various protocols, helping investors make informed decisions.

The Role of AI in Market Analysis

AI-driven tools like IQ Index AI are becoming increasingly popular for their ability to provide autonomous market analysis. These tools can track whale wallet movements, protect against sniper bots, and analyze NFT minting and DeFi trends. By leveraging AI, investors can stay ahead of the curve and make smarter trading decisions[6].

The Shutdown of Reservoir’s NFT Services

Understanding the Shutdown

Reservoir, a prominent NFT marketplace, recently shut down its NFT services. The reasons behind this decision are multifaceted and include market saturation, regulatory challenges, and shifts in user preferences. The shutdown highlights the volatile nature of the NFT market and the need for continuous adaptation and innovation[5].

Impact on the Market

The shutdown of Reservoir’s NFT services has had a ripple effect on the market. Other NFT platforms may see an influx of users, and the overall market dynamics could shift as a result. This event serves as a reminder of the importance of diversification and resilience in the digital asset space.

Conclusion: The Future of NFTs and Token Loans

Looking Ahead

The digital asset landscape is poised for continued growth and innovation. As NFTs and token loans become more mainstream, we can expect to see new trends and technologies emerge. The key to success in this space will be adaptability, informed decision-making, and a keen eye on market trends.

The Power of Data and Analysis

Data and analysis are the backbone of successful investing in the digital asset space. By leveraging the right tools and staying informed, investors can navigate the complexities of the market and capitalize on emerging opportunities. The week’s trends and developments serve as a testament to the dynamic and ever-evolving nature of the digital asset landscape.

Embracing the Future

As we move forward, it is essential to embrace the future of digital assets with an open mind and a willingness to adapt. The trends and data from last week provide valuable insights into the current state of the market and offer a glimpse into what lies ahead. By staying informed and leveraging the power of data and analysis, investors can position themselves for success in the exciting world of NFTs and token loans.

—

Sources