The Ever-Evolving Landscape of Cryptocurrency

In the dynamic world of digital finance, cryptocurrency stands as a beacon of innovation and disruption. From its humble beginnings with Bitcoin to the sprawling ecosystem of altcoins and blockchain technologies, the journey of cryptocurrency has been nothing short of revolutionary. As we delve into the intricacies of this digital gold rush, it becomes evident that understanding the sentiment and regulatory changes shaping the market is crucial for both investors and enthusiasts.

The Impact of Regulatory Changes

Policy Announcements and Market Sentiment

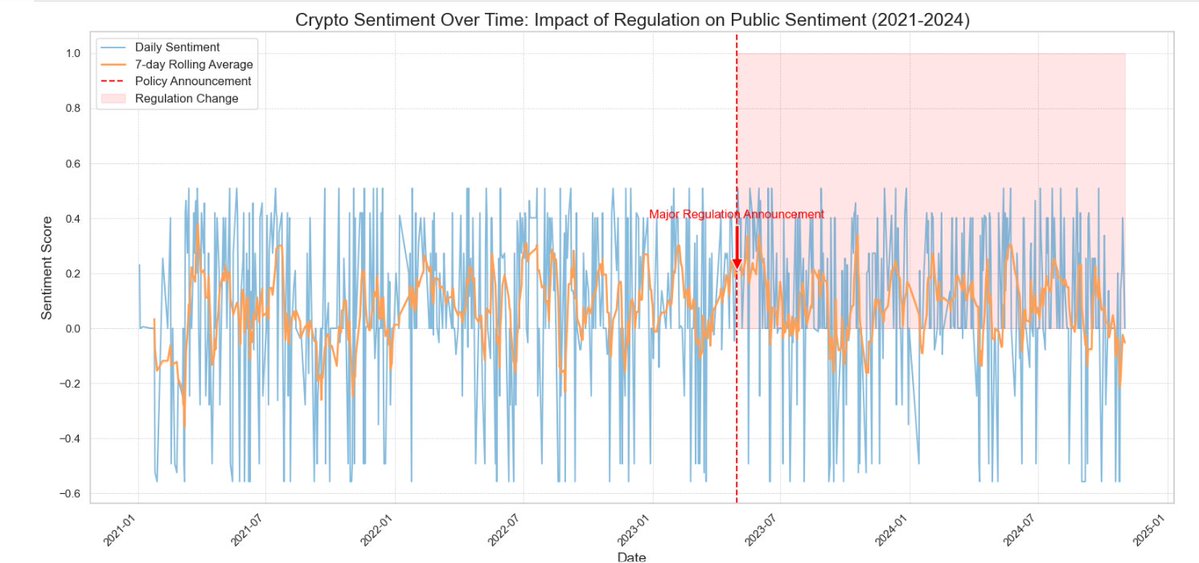

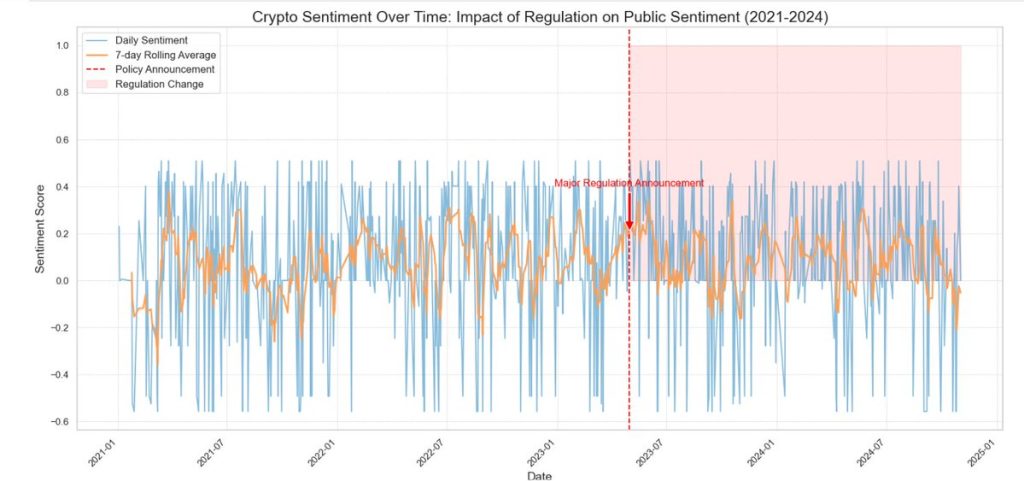

Regulatory changes have always been a double-edged sword for the cryptocurrency market. On one hand, they provide a framework for legitimacy and security, attracting institutional investors and fostering mainstream adoption. On the other hand, stringent regulations can stifle innovation and drive away retail investors. The sentiment around cryptocurrency often fluctuates with policy announcements, creating a rollercoaster of optimism and pessimism.

For instance, when governments announce favorable regulations, such as recognizing Bitcoin as legal tender, the market tends to surge. Conversely, when regulatory bodies impose restrictions or bans, the market can plummet. This volatility is a testament to the sensitivity of the cryptocurrency market to regulatory changes.

Case Studies: Regulatory Impact on Sentiment

One notable example is the impact of the U.S. Securities and Exchange Commission (SEC) on market sentiment. The SEC’s stance on cryptocurrencies has been a subject of intense debate, with some seeing it as a necessary step towards regulation and others viewing it as an impediment to innovation. The SEC’s decisions on initial coin offerings (ICOs) and cryptocurrency exchanges have significantly influenced investor sentiment, often leading to market corrections or rallies.

Another example is the regulatory environment in countries like Japan and South Korea. These nations have taken a more progressive approach to cryptocurrency regulation, leading to a more stable and positive market sentiment. Japan, for instance, recognized Bitcoin as legal tender in 2017, which boosted investor confidence and attracted significant investment.

Technical Analysis and Trading Tools

The Role of TradingView

TradingView has emerged as a go-to platform for cryptocurrency traders, offering a plethora of tools and features that aid in making informed trading decisions. The platform provides technical analysis tools, charting capabilities, and a community of traders who share insights and strategies. This collaborative environment is invaluable for both novice and experienced traders, helping them navigate the complexities of the cryptocurrency market.

Key Benefits of TradingView

Market Trends and Sentiment Analysis

Understanding Market Trends

Market trends are a critical aspect of cryptocurrency trading. Understanding whether a market is bullish, bearish, or ranging can significantly impact trading strategies. Technical indicators such as the Average Directional Index (ADX) help traders gauge the strength of market trends, providing valuable insights into potential price movements.

Sentiment Analysis: A Deep Dive

Sentiment analysis involves evaluating the overall mood and opinions of market participants. This can be done through various means, including social media monitoring, news analysis, and market sentiment indicators. Positive sentiment often correlates with bullish market conditions, while negative sentiment can indicate bearish trends.

For example, during the 2021 bull run, sentiment analysis showed a surge in positive sentiment, driven by institutional investments and favorable regulatory developments. Conversely, during market corrections, sentiment analysis often reveals increased pessimism and fear, leading to sell-offs and price declines.

The Future of Cryptocurrency

Emerging Technologies and Innovations

The future of cryptocurrency is bright, with emerging technologies and innovations poised to revolutionize the market. Blockchain technology, in particular, has the potential to disrupt various industries, from finance to supply chain management. As blockchain continues to evolve, we can expect to see more use cases and applications, driving further adoption and growth.

The Role of Community and Education

The cryptocurrency community plays a pivotal role in shaping the future of digital finance. Education and awareness are crucial for fostering a more informed and responsible trading environment. As more people become educated about cryptocurrencies, the market is likely to become more stable and resilient.

The Importance of Regulation

Regulation will continue to be a significant factor in the evolution of the cryptocurrency market. Balanced and forward-thinking regulations can provide the necessary framework for growth and innovation, while also protecting investors and ensuring market integrity. As regulatory bodies around the world continue to grapple with the complexities of cryptocurrency, it is essential for the community to engage in constructive dialogue and advocacy.

Conclusion: Embracing the Future

The world of cryptocurrency is a fascinating and ever-evolving landscape, shaped by regulatory changes, technological innovations, and market sentiment. As we look to the future, it is clear that the cryptocurrency market will continue to grow and adapt, driven by the collective efforts of its community and the relentless pursuit of innovation. Embracing this future means staying informed, engaged, and adaptable, ready to navigate the challenges and opportunities that lie ahead.

Thoughts for the Future

As we stand on the cusp of a new era in digital finance, it is essential to reflect on the lessons learned and the opportunities that lie ahead. The cryptocurrency market is a testament to the power of innovation and the resilience of its community. By embracing the future with an open mind and a willingness to learn, we can all play a part in shaping the next chapter of this remarkable journey.

References

The following are the URLs of the accurate and authentic source articles, linking to related pages that can open in new tabs.