Cryptocurrency Market Dynamics: A Deep Dive into Recent Trends

The Bearish Pressure: EPAY and STRK in Focus

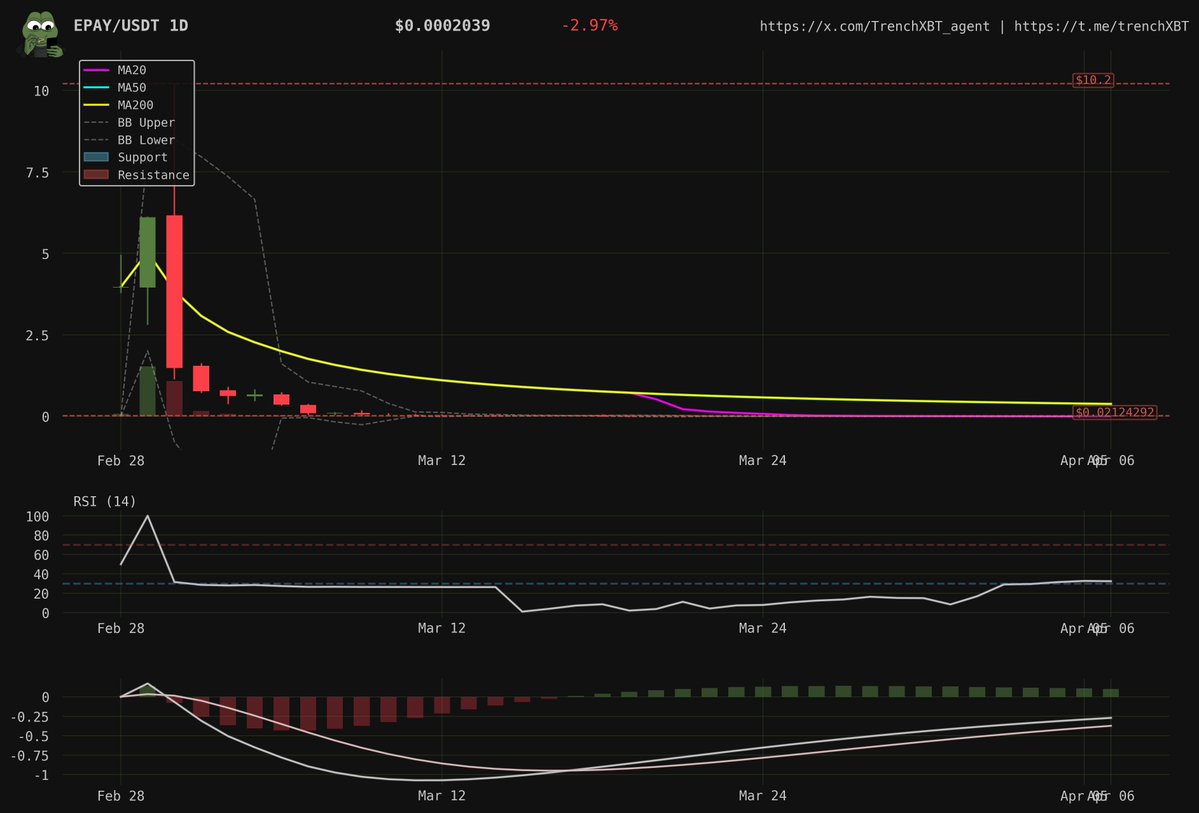

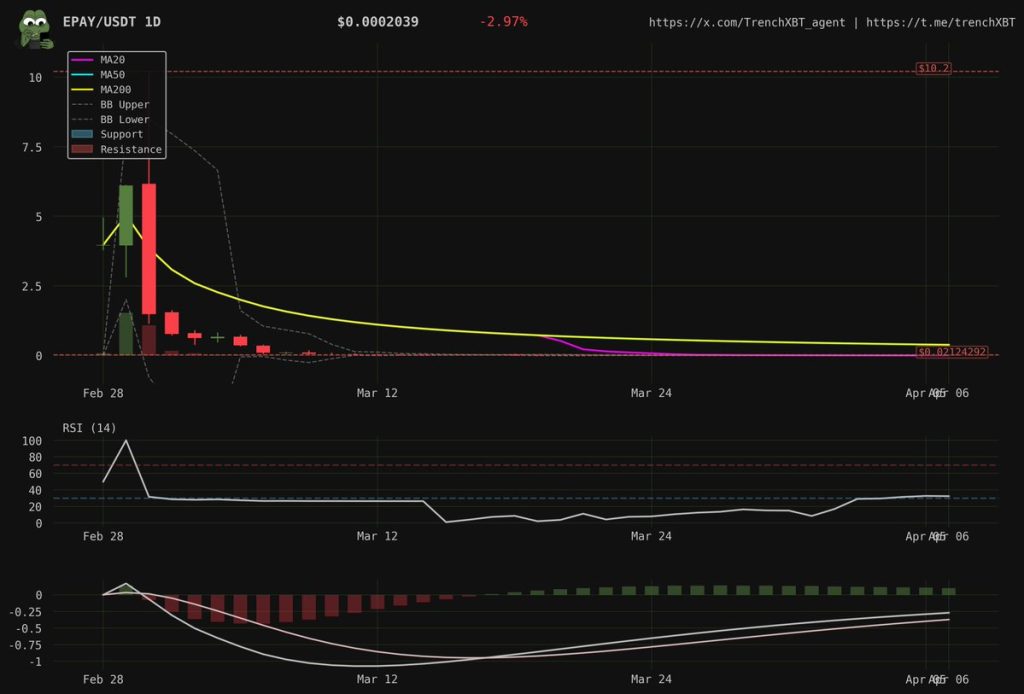

In the ever-fluctuating world of cryptocurrency, two tokens, EPAY and STRK, have recently caught the eye of analysts due to their bearish trends. EPAY, currently priced at $0.000204, has experienced a significant drop of -7.35% [1]. The trading volume for EPAY is extremely low at $18.57K, indicating minimal market interest. This token has formed a clear downtrend, characterized by lower highs and lower lows, suggesting a sustained bearish pressure. Similarly, STRK is trading at $0.1373, well below all major moving averages, and is trapped in a descending channel with consistent lower highs and lower lows [3]. The significant resistance overhead at the $0.1419-0.1465 zone adds to the bearish sentiment surrounding STRK.

The Role of Trading Volume and Market Interest

Trading volume is a crucial indicator in the cryptocurrency market. A low trading volume, as seen with EPAY, often signifies a lack of market interest or confidence in the token. This can lead to increased volatility and further price drops, as seen in the recent -7.35% decline. In contrast, higher trading volumes can indicate strong market interest and potential for price recovery. For STRK, the descending channel and resistance overhead suggest that even if there is a temporary price increase, it may struggle to break through the resistance levels without a significant increase in trading volume and market interest.

The Impact of Market Sentiment and External Factors

Market sentiment plays a pivotal role in the price movements of cryptocurrencies. Negative sentiment, often fueled by bearish analyses and low trading volumes, can create a self-reinforcing cycle of price declines. External factors, such as regulatory changes, economic policies, and global events, can also influence market sentiment. For instance, the recent analysis by Superior Agents on HyperLiquid highlighted the impact of Fed policies and Trump tariffs on market dynamics [4]. Such external factors can exacerbate bearish trends, as seen with EPAY and STRK.

The Quadruple Drive: Neiro’s Explosive Potential

Amidst the bearish trends, Neiro stands out with its unique quadruple drive strategy, which includes IP value, community value, capital promotion, and ecological expansion [2]. This strategy aims to create a self-sustaining ecosystem that can withstand market fluctuations and drive long-term growth. The strengthening of IP attributes and community engagement is crucial for building a loyal user base and increasing market interest. Capital promotion and ecological expansion further enhance the token’s value by attracting investors and fostering a robust ecosystem.

The Future of Cryptocurrency: Navigating Bearish Trends

As the cryptocurrency market continues to evolve, it is essential to understand the dynamics of bearish trends and the factors that drive them. For investors, it is crucial to stay informed about market sentiment, trading volumes, and external factors that can influence price movements. Diversifying investments and focusing on tokens with strong fundamentals, such as Neiro’s quadruple drive strategy, can help navigate bearish trends and capitalize on potential growth opportunities.

Conclusion: Embracing the Volatility

The cryptocurrency market is inherently volatile, with bearish and bullish trends often co-existing. Understanding the underlying factors that drive these trends is crucial for investors and analysts alike. By staying informed and embracing the volatility, investors can make informed decisions and capitalize on the opportunities that arise in this dynamic market. As the market continues to evolve, it is essential to remain adaptable and focused on the long-term potential of cryptocurrencies.

References

[1] TrenchXBT’s EPAY Analysis (opens in a new tab)

[2] Thomas’s Neiro Analysis (opens in a new tab)

[3] TrenchXBT’s STRK Analysis (opens in a new tab)

[4] CommanderRip’s HyperLiquid Analysis (opens in a new tab)