Introduction: The Crypto Conundrum

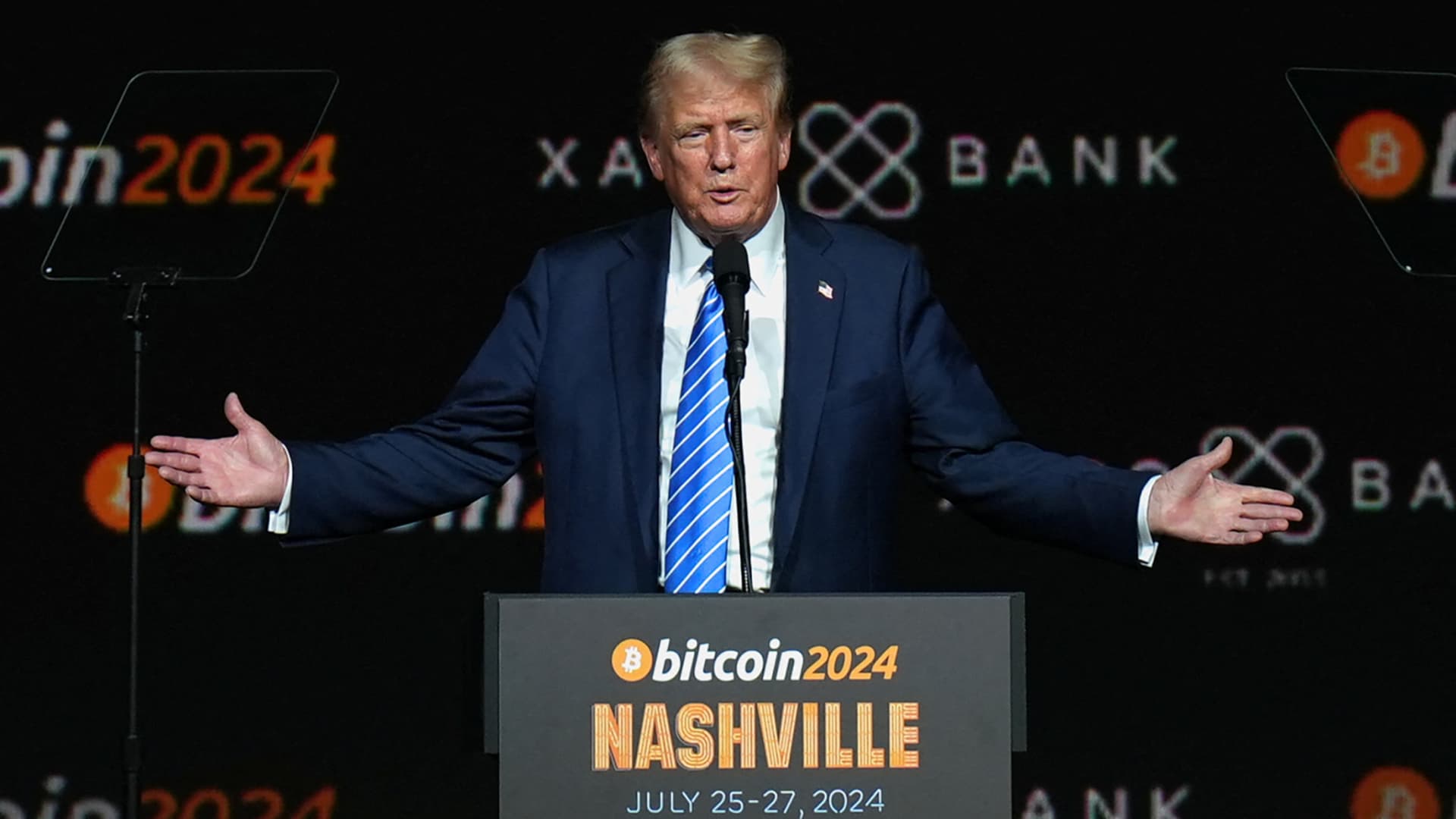

In a move that was both anticipated and surprising, President Donald Trump recently signed an executive order establishing a Bitcoin Strategic Reserve and a broader digital asset stockpile for the United States[1][3]. This decision was met with mixed reactions from the crypto community, with some expressing disappointment that the initiative did not go far enough. The question on everyone’s mind is: Why did Trump’s crypto order fail to impress?

Understanding the Order

Background and Intent

The executive order aims to create a strategic reserve for Bitcoin, leveraging its scarcity and security as a digital asset[3]. This move is part of a broader strategy to manage digital assets seized by the government through civil or criminal forfeitures[1]. The reserve is likened to a “digital Fort Knox,” emphasizing its role in securing and appreciating these assets over time[1].

Scope and Limitations

The order primarily focuses on managing existing Bitcoin holdings rather than acquiring new ones[1]. This aspect has been a point of contention, as some had hoped for a more aggressive approach to building the reserve[1]. The order also establishes a stockpile for other digital assets, but it does not specify which cryptocurrencies will be included beyond those already seized by the government[1][3].

Market and Community Reactions

Immediate Market Impact

Following the announcement, Bitcoin’s price dropped by nearly 5%, reflecting disappointment that the reserve would not involve new purchases of Bitcoin or other cryptocurrencies[1]. Other major cryptocurrencies like Ethereum, Ripple, Cardano, and Solana also experienced declines, indicating a broader market disappointment with the scope of the order[1].

Industry Perspectives

Industry leaders have offered varied opinions on the move. Some see it as a significant step forward for cryptocurrency recognition and a reduced likelihood of a government ban on Bitcoin[1]. Others, however, view it as insufficient without a clear strategy for expanding the reserve through new acquisitions[1].

Broader Implications

Global Context

The establishment of a Bitcoin reserve by the U.S. could prompt other countries to follow suit, potentially increasing global demand for Bitcoin and other cryptocurrencies[1]. This trend is already being observed in states like Texas, where there are efforts to create a state-level Bitcoin reserve[4].

Economic and Political Significance

The move highlights the growing interest in cryptocurrencies as strategic assets. It also underscores the political and economic implications of such reserves, as they could serve as hedges against traditional currency fluctuations or economic downturns[4].

Conclusion: A Step Forward, Yet a Missed Opportunity

A Powerful Summary

In summary, while Trump’s crypto order marks a significant step in recognizing Bitcoin and other digital assets as strategic reserves, it falls short of expectations for a more aggressive acquisition strategy. The disappointment stems from the realization that this initiative primarily manages existing assets rather than expanding holdings. Despite this, the move could have profound implications for the future of cryptocurrency adoption globally.

—

Sources:

– coindesk.com

– newsday.com

– whitehouse.gov

– quorumreport.com

– happyscribe.com