Ethereum: Buy, Sell, or Hold?

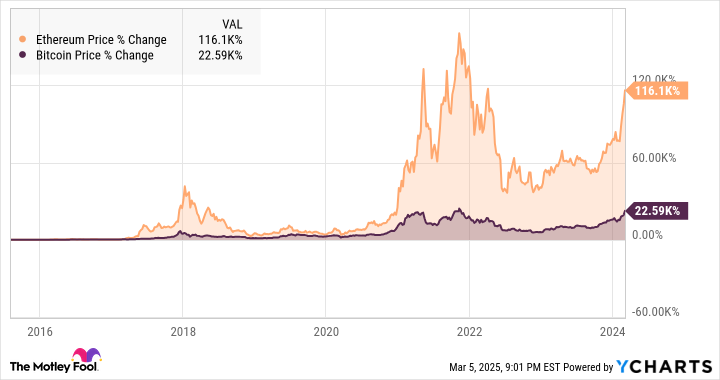

In the ever-volatile world of cryptocurrencies, Ethereum (ETH) has been a focal point for investors and traders alike. As we navigate through the complexities of the crypto market, understanding the current trends and future prospects of Ethereum is crucial for making informed decisions. In this analysis, we will delve into the current state of Ethereum, its recent price movements, and what this means for potential investors.

Introduction to Ethereum’s Current State

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced significant fluctuations in recent months. Its price has been oscillating between key support and resistance levels, leaving many wondering whether it’s the right time to buy, sell, or hold onto their ETH holdings.

Recent Price Movements

As of early March 2025, Ethereum’s price has been trading below a critical resistance level of $2,550, following a rally that saw it dip to around $2,000[1]. This dip was met with a recovery, pushing the price up to approximately $2,220[3]. The price action indicates a bearish trend, with ETH trading below its 50-day and 200-day Exponential Moving Averages (EMAs), suggesting potential selling pressure[1].

Key Factors Influencing Ethereum’s Price

Several factors are influencing Ethereum’s price movements:

– Technical Analysis: Ethereum needs to break above $3,000 to resume a bullish trend. Failure to do so could lead to a drop towards $1,500, which is seen as a strong demand zone[1].

– Market Sentiment: The recent price decline after a brief rally indicates a bearish sentiment among investors. This could be exacerbated if Ethereum fails to protect its support zone around $2,000[1].

– Market Volatility: Ethereum’s price is highly volatile, with recent movements showing a range-bound behavior. This volatility makes it challenging for traders to predict long-term trends[3].

Future Prospects and Investment Strategies

Given the current market conditions, here are some strategies investors might consider:

– Buy: If you believe in Ethereum’s long-term potential, particularly with its upcoming developments and the broader crypto market trends, buying during dips could be a viable strategy. However, it’s crucial to set stop-losses to mitigate potential losses.

– Sell: If you’re holding ETH and are risk-averse, selling during brief rallies might be a safer option. This approach allows you to lock in profits or minimize losses if the price continues to decline.

– Hold: For long-term investors, holding onto ETH might be the best strategy. Ethereum’s potential for growth, especially if it breaks above key resistance levels, could lead to significant gains in the future.

Conclusion: Navigating Ethereum’s Uncertainty

In conclusion, Ethereum’s current market situation presents both opportunities and challenges. While its price volatility and bearish trends might deter some investors, others see potential for long-term growth. Ultimately, the decision to buy, sell, or hold Ethereum depends on your investment goals, risk tolerance, and market outlook.

As the crypto market continues to evolve, staying informed about Ethereum’s developments and market trends will be essential for making successful investment decisions.

—

Sources:

– usethebitcoin.com

– coinfomania.com