Project Crypto: A New Era in US Financial Regulation

Introduction: Rekindling the American Crypto Dream

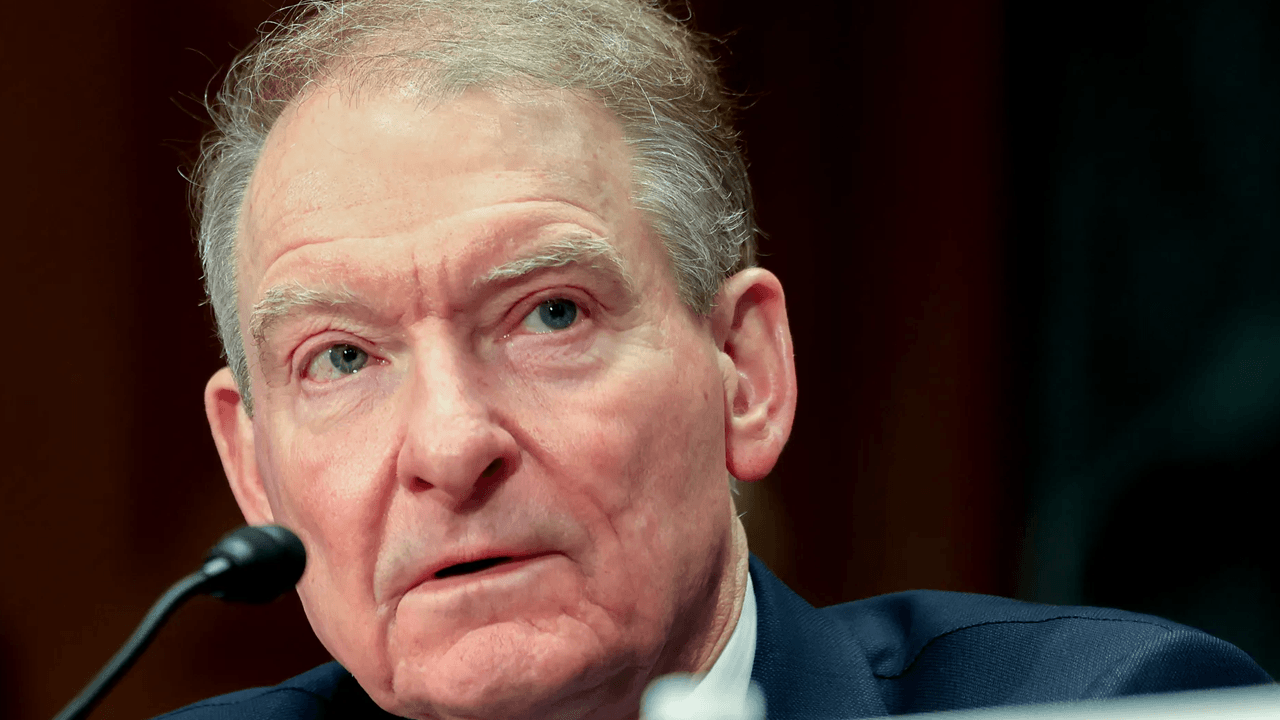

The United States has long been a global leader in financial innovation, but in recent years, it has lagged behind other nations in embracing the transformative potential of cryptocurrencies and blockchain technology. While countries like Switzerland, Singapore, and even smaller economies have established clear regulatory frameworks that foster crypto innovation, the U.S. has struggled with ambiguity and regulatory uncertainty. This has led many entrepreneurs and investors to seek opportunities abroad, fearing the lack of clarity and potential for harsh enforcement actions at home. However, a new initiative, “Project Crypto,” spearheaded by SEC Chairman Paul Atkins, aims to change this narrative. By modernizing securities regulations and fostering collaboration between regulators and the crypto industry, Project Crypto seeks to re-establish the U.S. as a dominant force in the digital finance revolution.

Deciphering the Howey Test: A Necessary Evolution

The regulatory uncertainty surrounding cryptocurrencies in the U.S. stems largely from the application of the Howey Test, a legal precedent established in 1946 to determine whether a transaction qualifies as an investment contract and is therefore subject to securities regulations. While the Howey Test has been a cornerstone of securities law for decades, its application to digital assets has been inconsistent and often contentious. The test, which evaluates whether an asset involves an investment of money in a common enterprise with an expectation of profits derived from the efforts of others, has been applied in varying ways to different crypto projects, creating a legal gray area that has stifled innovation.

Project Crypto aims to address this ambiguity by providing clearer guidelines for determining when a digital asset constitutes a security. By doing so, the SEC hopes to encourage entrepreneurs to innovate within the United States rather than seeking refuge in more regulatory-friendly jurisdictions. This clarification is essential for fostering a vibrant and compliant crypto ecosystem in the U.S., as it will provide businesses with the confidence they need to operate without fear of sudden regulatory crackdowns or enforcement actions.

The Pillars of Project Crypto: Modernization and Collaboration

Project Crypto is not merely a set of rules; it is a comprehensive initiative built on two key pillars: modernization and collaboration.

Modernization

The initiative aims to overhaul securities regulations to adapt to the unique characteristics of blockchain-based financial systems. This includes addressing issues such as the tokenization of assets, decentralized finance (DeFi), and the emergence of “super-apps” that combine various financial services into a single platform. The SEC recognizes that traditional regulations may not be suitable for these new technologies and that a more flexible and tailored approach is needed. By modernizing regulations, the SEC can ensure that they are both effective and conducive to innovation, allowing the U.S. to remain competitive in the global crypto landscape.

Collaboration

Project Crypto marks a significant departure from the SEC’s previous approach to crypto regulation, which has often been perceived as adversarial. The initiative emphasizes collaboration between the regulator and the crypto ecosystem, opening a new era for blockchain, asset tokenization, and decentralized finance. By working together, the SEC and the crypto industry can develop regulations that are both effective and conducive to innovation. This collaborative approach is crucial for building trust between regulators and the industry, as well as for ensuring that regulations are practical and enforceable.

Super-Apps and the Future of Finance

One of the most intriguing aspects of Project Crypto is its focus on “super-apps.” These all-in-one platforms, popular in Asia, combine a wide range of services, including payments, e-commerce, social media, and financial services. While super-apps have yet to gain widespread adoption in the United States, the SEC recognizes their potential to revolutionize the way people interact with finance. Super-apps can streamline financial services, reduce costs, and increase accessibility, making them an attractive option for consumers and businesses alike.

Project Crypto seeks to create a regulatory framework that allows super-apps to operate safely and efficiently in the U.S. This includes addressing issues such as data privacy, consumer protection, and systemic risk. By proactively regulating super-apps, the SEC hopes to foster innovation while ensuring that consumers are protected from potential harm. The goal is to strike a balance between encouraging innovation and maintaining the integrity of the financial system, ensuring that super-apps can thrive without compromising consumer trust or financial stability.

Tokenization: Unlocking New Possibilities

Asset tokenization, the process of representing real-world assets such as real estate, art, and commodities as digital tokens on a blockchain, is another key area of focus for Project Crypto. Tokenization has the potential to unlock new levels of liquidity, transparency, and accessibility in financial markets. By tokenizing assets, investors can gain fractional ownership of high-value assets, making them more accessible to a broader range of investors. Additionally, tokenization can streamline the process of transferring and managing assets, reducing costs and increasing efficiency.

Project Crypto aims to create a clear regulatory framework for the tokenization of assets, addressing issues such as custody, transfer restrictions, and reporting requirements. By providing clear guidance, the SEC hopes to encourage the adoption of tokenization and unlock its transformative potential. This will not only benefit investors but also open up new opportunities for businesses and entrepreneurs, fostering a more dynamic and inclusive financial ecosystem.

DeFi: Navigating the Decentralized Frontier

Decentralized finance (DeFi) is a rapidly growing sector of the crypto industry that seeks to replicate traditional financial services, such as lending, borrowing, and trading, on a decentralized blockchain. While DeFi offers many potential benefits, such as increased efficiency and transparency, it also poses new regulatory challenges. The decentralized nature of DeFi makes it difficult to apply traditional regulatory frameworks, as there is no central authority or intermediary to oversee transactions.

Project Crypto seeks to address these challenges by providing guidance on issues such as the registration of DeFi platforms, the regulation of stablecoins, and the prevention of money laundering. By creating a clear regulatory framework for DeFi, the SEC hopes to foster innovation while protecting investors from potential risks. This includes ensuring that DeFi platforms are transparent and secure, as well as that they comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. By striking the right balance between innovation and regulation, the SEC can help DeFi reach its full potential while minimizing risks to investors and the broader financial system.

From Skepticism to Strategy: A Change in Tone

The unveiling of Project Crypto represents a significant shift in tone from the SEC, particularly compared to the stance taken by its former Chair. While previous administrations were often seen as skeptical of cryptocurrencies and quick to pursue enforcement actions, Chairman Atkins has adopted a more collaborative and forward-looking approach. This change in tone is evident in the SEC’s emphasis on working with the crypto industry to develop regulations that are both effective and conducive to innovation. It also signals a recognition that cryptocurrencies and blockchain technology have the potential to transform the financial system and that the United States must adapt to this new reality.

This shift in approach is crucial for fostering a more positive relationship between regulators and the crypto industry. By adopting a more collaborative and proactive stance, the SEC can help build trust and encourage innovation, ensuring that the U.S. remains at the forefront of financial technology. Additionally, this change in tone reflects a broader recognition of the potential benefits of cryptocurrencies and blockchain technology, as well as a willingness to embrace new technologies and business models.

Potential Implications and Challenges

While Project Crypto holds great promise, it also faces several potential challenges:

Complexity

The crypto industry is constantly evolving, and creating regulations that are both comprehensive and adaptable will be a complex undertaking. The SEC will need to stay ahead of the curve and be prepared to adjust its regulations as new technologies and business models emerge. This requires a deep understanding of the crypto industry, as well as the ability to anticipate and address emerging risks and challenges.

Enforcement

Even with clear regulations in place, the SEC will need to effectively enforce those regulations to ensure that the crypto industry operates fairly and transparently. This will require significant resources and expertise, as well as a commitment to consistent and fair enforcement. The SEC must also be prepared to adapt its enforcement strategies as the industry evolves, ensuring that it remains effective in addressing new and emerging risks.

International Coordination

Cryptocurrencies are global in nature, and the SEC will need to coordinate with regulators in other countries to ensure that regulations are consistent and that there is no regulatory arbitrage. This requires a collaborative approach, as well as a willingness to work with international regulators to develop harmonized standards and best practices. By coordinating with other regulators, the SEC can help ensure that the U.S. remains competitive in the global crypto landscape, while also promoting a more stable and secure international financial system.

Despite these challenges, Project Crypto represents a significant step forward in the effort to regulate cryptocurrencies in the United States. By modernizing securities regulations and fostering collaboration between the regulator and the crypto industry, the SEC hopes to create a vibrant and compliant crypto ecosystem that benefits both investors and innovators. This initiative has the potential to not only re-establish the U.S. as a leader in financial innovation but also to unlock new opportunities for businesses, investors, and consumers alike.

Conclusion: Charting a Course for American Leadership

Project Crypto is more than just a regulatory initiative; it’s a statement of intent. It declares that the United States is committed to embracing the digital finance revolution and reclaiming its position as a global leader in innovation. The path ahead will undoubtedly be complex and require ongoing collaboration, but the potential rewards – a thriving crypto ecosystem, increased financial inclusion, and a more efficient financial system – are well worth the effort. Project Crypto offers a chance to not only regulate but also cultivate the transformative power of blockchain technology, ensuring that America remains at the forefront of financial innovation for generations to come. By embracing this initiative, the U.S. can set the standard for the future of finance, fostering a more dynamic, inclusive, and secure financial ecosystem that benefits all stakeholders.