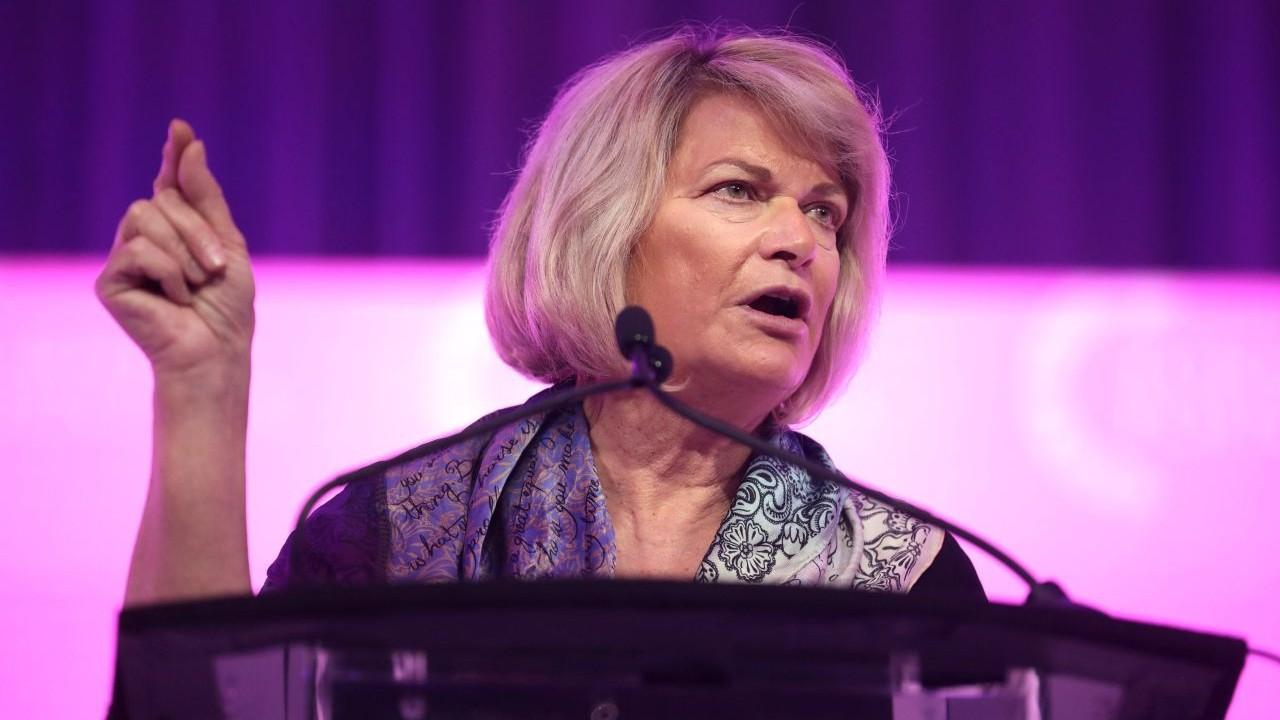

The Lummis Offensive: Unpacking the Senator’s Battle with the Federal Reserve

Introduction: A Clash of Institutions

The relationship between the legislative branch and the Federal Reserve has long been a delicate dance of oversight and independence. However, in recent years, this dynamic has been disrupted by Senator Cynthia Lummis, a Republican from Wyoming, who has emerged as a vocal critic of the Fed’s transparency and its approach to digital assets. Her persistent challenges to the central bank’s policies and practices have sparked a broader debate about accountability, innovation, and the future of finance.

The “Black Hole” Accusation: A Call for Transparency

Senator Lummis’s most striking critique of the Federal Reserve is her characterization of the institution as a “giant black hole of accountability.” This vivid analogy is not merely rhetorical flourish; it encapsulates a serious concern about the Fed’s lack of transparency, particularly in its interactions with Congress. Lummis argues that the Fed “consumes information, but never releases it,” creating a barrier to effective oversight.

The implications of this lack of transparency are significant. Without access to clear and unbiased information, Congress is hindered in its ability to hold the Fed accountable for its decisions. This opaqueness also makes it difficult to assess the impact of the Fed’s policies on the broader economy. Lummis’s accusation suggests a systemic issue within the Fed, where information is not just delayed or withheld, but potentially manipulated to serve the institution’s agenda.

Digital Asset Regulation: A Perceived Bias Against Innovation

One of the most contentious areas of Lummis’s critique is the Fed’s approach to digital assets. She has repeatedly expressed concerns about what she perceives as a bias against the cryptocurrency industry, particularly in the Fed’s handling of the Policy Statement on Section 9(13) of the Federal Reserve Act. This policy has been interpreted as creating significant hurdles for banks seeking to provide services to crypto-related businesses.

Lummis’s criticism highlights a broader tension between innovation and regulation. On one hand, cryptocurrencies and blockchain technology hold the potential to revolutionize financial systems, offering new opportunities for economic growth and financial inclusion. On the other hand, there are legitimate concerns about consumer protection, money laundering, and the potential for illicit activities.

The Senator’s advocacy for a more balanced approach suggests a recognition of these risks, but also a belief that the current regulatory framework is overly restrictive. By challenging the Fed’s stance on digital assets, Lummis is not only pushing for greater clarity in regulation but also advocating for a regulatory environment that fosters innovation while addressing legitimate concerns.

Demanding Answers: Formal Requests and Public Scrutiny

Lummis has taken a proactive approach in her pursuit of greater transparency from the Fed. As chair of the Senate Banking Subcommittee on Digital Assets, she has sent formal document requests to the Federal Reserve Board of Governors and the Federal Reserve Banks of Dallas and Richmond. These requests set clear deadlines for responses and explicitly state that claims of privilege or confidentiality do not exempt the agency from answering.

This aggressive approach demonstrates Lummis’s commitment to holding the Fed accountable and bringing its actions under public scrutiny. By publicly challenging the Fed and demanding specific information, she aims to shed light on the inner workings of the central bank and force it to justify its policies and practices. This strategy also serves to raise public awareness about the issues at stake and to galvanize support for greater transparency and regulatory clarity.

Questioning the Fed’s Crypto Banking Rule Withdrawal

Despite the Fed’s withdrawal of certain crypto guidance, Lummis remains skeptical, characterizing the move as “just noise, not real progress.” This statement reveals a deep-seated distrust of the Fed’s intentions and a belief that superficial changes are insufficient to address the underlying issues. Lummis’s skepticism suggests that she believes more fundamental reforms are needed to ensure a fair and transparent regulatory environment for digital assets.

Her reaction to the withdrawal of crypto guidance underscores the importance of follow-through and tangible action. It’s not enough for the Fed to simply announce changes; it must demonstrate a genuine commitment to creating a level playing field for the digital asset industry. Lummis seems determined to hold the Fed accountable for its promises and to ensure that its actions align with its stated goals.

The Bigger Picture: Congressional Oversight and the Fed’s Independence

Lummis’s battle with the Fed raises fundamental questions about the relationship between Congress and the central bank. The Fed is designed to be independent, insulated from short-term political pressures, to make decisions in the long-term interest of the economy. However, this independence is not absolute. Congress has the power to oversee the Fed, to hold it accountable, and to shape its mandate through legislation.

Lummis’s actions can be seen as an assertion of congressional authority over the Fed, a reminder that the central bank is ultimately accountable to the elected representatives of the people. Her efforts to increase transparency and challenge perceived biases are aimed at ensuring that the Fed operates in a manner that is consistent with the public interest and that its decisions are subject to proper scrutiny.

The Potential for a Broader Crypto Agenda

While the core of Lummis’ critique centers on the Fed’s transparency and regulatory approach, there’s a broader undercurrent suggesting an agenda to promote the adoption and integration of cryptocurrencies into the financial system. Her vocal support for Bitcoin and her efforts to create a more favorable regulatory environment for digital assets align with a vision of a future where cryptocurrencies play a more prominent role in the economy.

Lummis’s advocacy for digital assets extends beyond simply challenging the Fed. It encompasses efforts to educate her colleagues about the potential benefits of cryptocurrencies, to promote responsible innovation, and to create a regulatory framework that encourages growth while addressing risks. Her efforts, therefore, are not just about criticizing the Fed, but about shaping the future of finance.

Conclusion: A Continued Watchdog Role

Senator Cynthia Lummis’s relentless pursuit of transparency and accountability from the Federal Reserve positions her as a key watchdog in the ongoing debate over monetary policy and digital asset regulation. Her “black hole” accusation, her demands for information, and her skepticism towards the Fed’s actions highlight the importance of congressional oversight and the need for a balanced approach to innovation and regulation.

Whether her efforts will ultimately lead to significant changes in the Fed’s practices remains to be seen, but her vocal and persistent challenge ensures that these issues remain at the forefront of the policy agenda. The Lummis offensive is far from over, and her continued scrutiny will undoubtedly shape the future of the relationship between Congress, the Federal Reserve, and the burgeoning world of digital assets. In the end, her battle is not just about holding the Fed accountable, but about ensuring that the financial system evolves in a way that is transparent, innovative, and responsive to the needs of the American people.