The Evolving Narrative of Bitcoin: From Metrics to Culture

Introduction: A Shift in Perspective

The cryptocurrency landscape is witnessing a fascinating shift. Bitcoin, the pioneer of digital currencies, is no longer just a speculative asset or a technological marvel. It’s becoming a cultural phenomenon. Recent analyses suggest that community narratives are pivoting from pure metrics to a broader, more cultural embrace of crypto. This shift is not just about price movements or technical indicators; it’s about the role Bitcoin plays in society, finance, and even identity.

The Technical and Cultural Dynamics of Bitcoin

Technical Analysis: A Glimpse into the Future

Technical analysis remains a cornerstone of Bitcoin trading and investment strategies. Recent data shows Bitcoin’s price hovering around $118,000, with key resistance levels identified between $0.67 and $0.69. The asset has been following a small uptrend channel pattern, suggesting the potential for new higher highs soon. The Relative Strength Index (RSI) stands at 52.4, indicating a neutral to slightly bullish sentiment.

Glassnode’s analysis reveals that around 2% of network entities control approximately 71.5% of Bitcoin, excluding exchanges and miners. This concentration of wealth among a small group of entities raises questions about decentralization and market manipulation. Over 92% of wallets hold less than 0.1 BTC, highlighting the disparity between whale investors and retail participants.

Cultural Shift: Bitcoin as a Cultural Phenomenon

The narrative around Bitcoin is evolving. It’s no longer just about the technology or the price. It’s about the community, the culture, and the identity that surrounds it. This shift is evident in the way people talk about Bitcoin, the memes they share, and the way they integrate it into their daily lives.

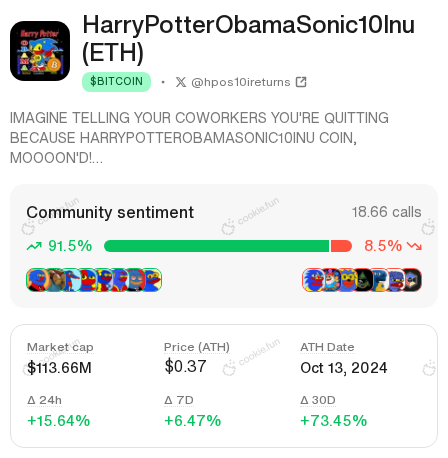

For instance, the recent surge in Bitcoin’s market capitalization has been tracked by Cookie Deep Research, which notes a growing emphasis on crypto-as-culture over pure metrics. This cultural aspect is crucial for understanding the long-term sustainability and adoption of Bitcoin. It’s not just about the numbers; it’s about the people and the stories they tell.

The Role of Whales and Retail Investors

Whales: The Big Players

Whales, or large holders of Bitcoin, play a significant role in the market. On-chain analysis shows that while retail investors are actively selling, large players are steadily increasing their positions. This trend suggests a growing confidence among institutional investors, who see Bitcoin as a long-term asset rather than a short-term speculative play.

Retail Investors: The Everyday Participants

Retail investors, on the other hand, are more volatile. They tend to react to short-term price movements and market sentiment. The fact that over 92% of Bitcoin wallet addresses hold less than 0.1 BTC indicates a broad but fragmented base of retail investors. This fragmentation can lead to increased volatility, as small holders are more likely to panic sell during market downturns.

The Future of Bitcoin: A Million-Dollar Question

Potential for Growth

The question on everyone’s mind is: Can Bitcoin reach $1,000,000? As of July 2025, Bitcoin has already updated its historical maximum of $123,166. Several factors could drive further growth:

– ETF Factor: The introduction of Bitcoin ETFs has made it easier for institutional investors to gain exposure to the asset. This increased liquidity and legitimacy could drive prices higher.

– Adoption: As more businesses and individuals adopt Bitcoin, its utility and value proposition grow. This increased adoption could lead to higher demand and, consequently, higher prices.

– Scarcity: Bitcoin’s fixed supply of 21 million coins makes it a deflationary asset. As demand increases and supply remains constant, the price is likely to rise.

Challenges and Risks

Despite the potential for growth, there are significant challenges and risks:

– Regulation: Governments around the world are grappling with how to regulate Bitcoin. Stricter regulations could limit its growth and adoption.

– Volatility: Bitcoin’s price is notoriously volatile. This volatility can deter institutional investors and make it difficult for retail investors to navigate the market.

– Competition: While Bitcoin remains the dominant cryptocurrency, it faces competition from other digital assets like Ethereum, Solana, and others. This competition could limit its growth potential.

Conclusion: A Balanced Perspective

Bitcoin’s journey is far from over. It’s a complex asset that straddles the line between technology, finance, and culture. While technical analysis provides valuable insights into its price movements, the cultural narrative around Bitcoin is equally important. Understanding both aspects is crucial for anyone looking to navigate the cryptocurrency landscape.

As we move forward, it’s essential to stay informed, remain disciplined, and focus on long-term strategies rather than short-term gains. Bitcoin’s potential is vast, but so are the challenges. By balancing technical analysis with a deeper understanding of the cultural and societal factors at play, we can make more informed decisions and better navigate the exciting world of cryptocurrency.