Trump-Linked Stocks: A Tumbling Trend

The stock market has been experiencing significant volatility, particularly with stocks linked to former President Donald Trump. Recent developments have led to a sharp decline in these stocks, leaving investors and analysts alike wondering about the future of these investments. In this report, we will delve into the reasons behind this trend and explore the broader implications for the market.

Introduction to the Decline

The stock market’s performance is often influenced by political and economic factors. Recently, Trump’s policies, especially his tariff announcements, have had a profound impact on the market. For instance, the imposition of 25% tariffs on goods from Canada and Mexico has been met with concern, as it could lead to increased costs for American consumers and potentially harm the economy[2]. This move has contributed to a decline in investor confidence, affecting stocks across various sectors.

Economic Impact of Tariffs

Tariffs are essentially taxes on imported goods, which can lead to higher prices for consumers. When Trump announced tariffs on Canada and Mexico, it was seen as a significant escalation in trade tensions with two of America’s closest trading partners[2]. This has raised fears of a trade war, which could further depress stock prices. The economic impact is twofold: not only do tariffs increase costs for consumers, but they also create uncertainty in the market, making investors more cautious about investing in stocks linked to Trump’s policies.

Market Reaction to Trump’s Policies

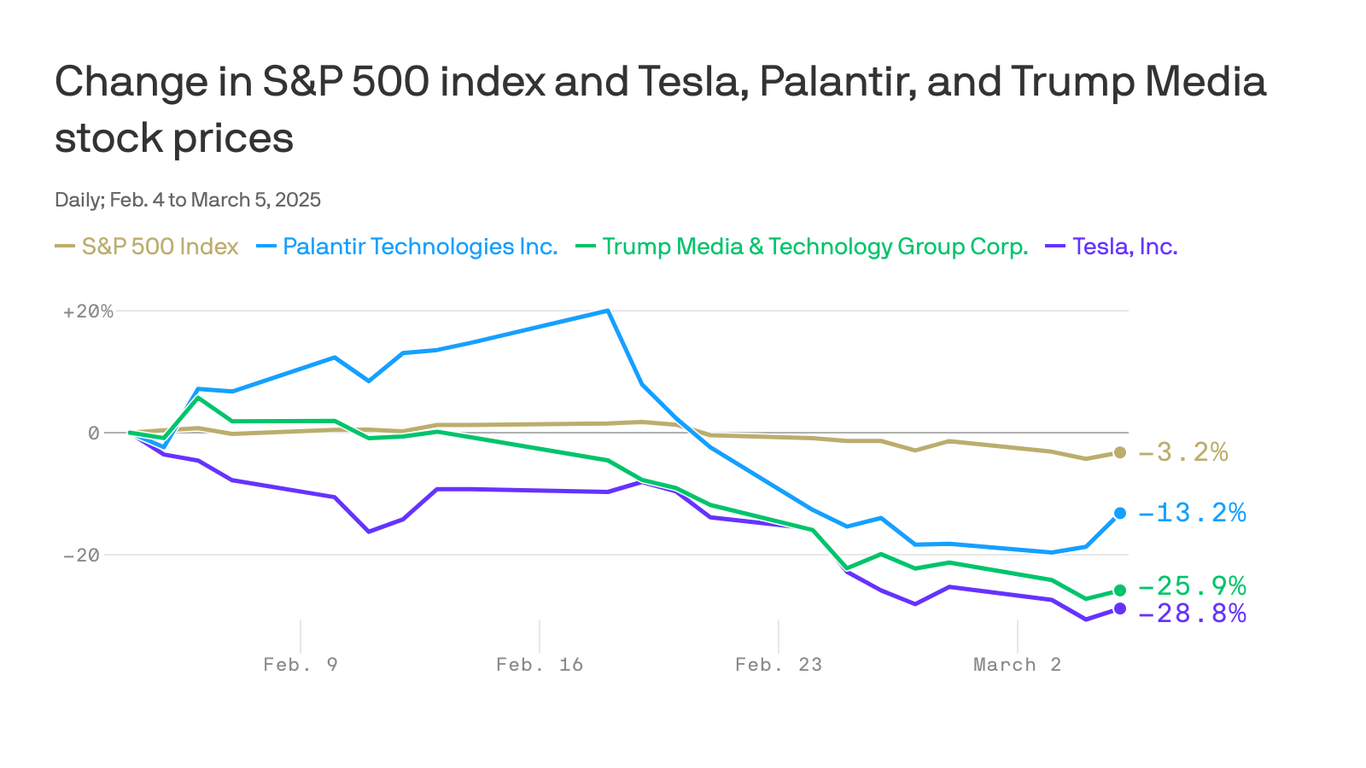

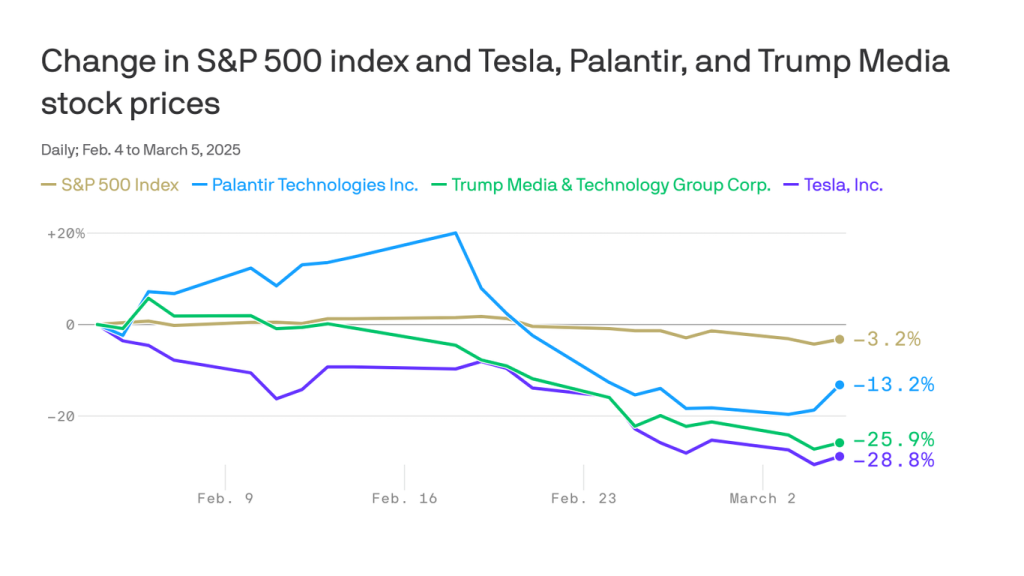

The stock market has reacted negatively to Trump’s recent announcements. For example, the S&P 500 experienced its largest one-day decline of 2025 after Trump mentioned tariffs, falling by 1.8%[1]. Similarly, the Nasdaq Composite and Dow Jones Industrial Average also saw significant drops, with the Nasdaq plunging 2.6% and the Dow sliding 1.5%[1]. This reaction indicates that investors are wary of the potential economic consequences of Trump’s policies.

Cryptocurrency and Trump’s Influence

Interestingly, Trump’s influence extends beyond traditional stocks. His recent announcement about creating a “Crypto Strategic Reserve” led to a surge in cryptocurrency prices, including Bitcoin, which rose from below $80,000 to around $93,000[1][4]. This move highlights Trump’s ability to impact different sectors of the market, even those as volatile as cryptocurrencies.

Conclusion: A Turbulent Future

In summary, Trump-linked stocks have been falling due to a combination of economic uncertainty and policy announcements. The imposition of tariffs on key trading partners has increased concerns about inflation and trade wars, leading to a decline in investor confidence. While Trump’s influence can still move markets, particularly in areas like cryptocurrencies, the overall trend for stocks linked to his policies remains uncertain.

As the market continues to navigate these challenges, investors will be closely watching for any signs of stability or further disruptions. The future of these stocks will depend on how effectively Trump’s policies are implemented and received by the global economy.

—

Sources:

– Investopedia

– GovInfo

– U.S. Bank

– Newsday