The Gathering Storm: Analyzing Senator Lummis’s Call for Powell’s Resignation

Introduction: A Political Earthquake

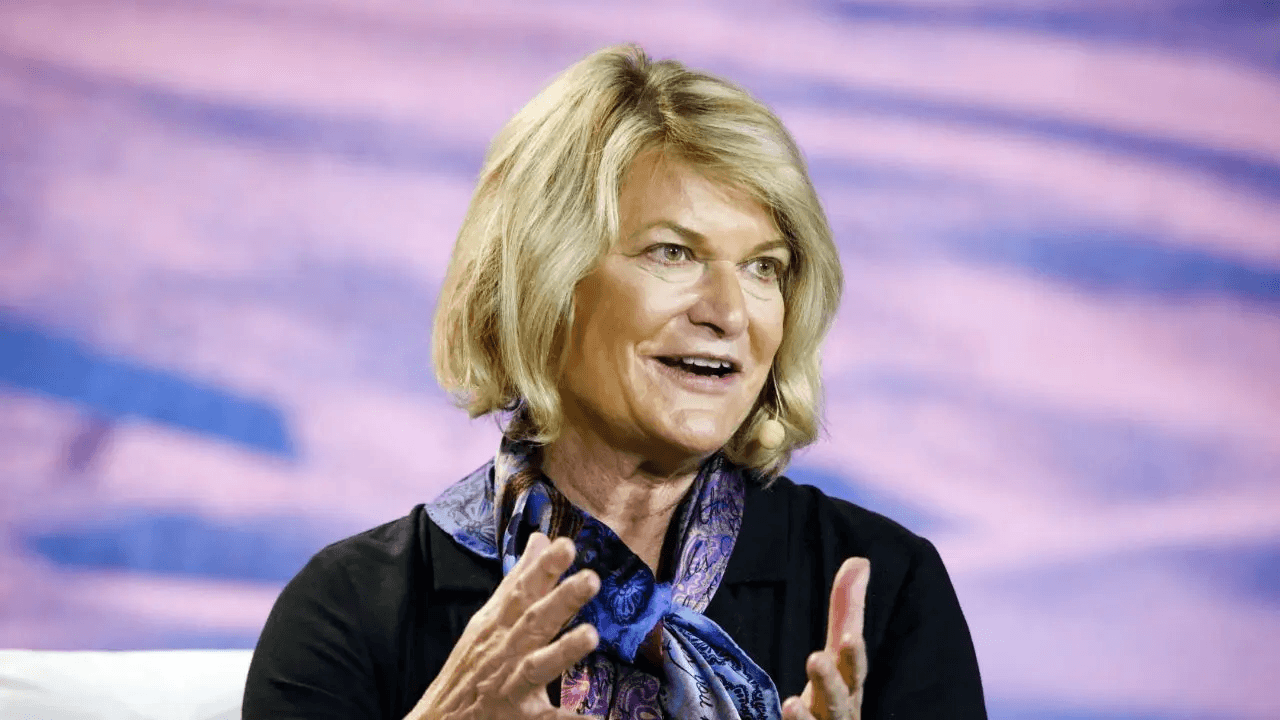

The call for the resignation of a Federal Reserve Chair by a sitting U.S. Senator is not a routine political maneuver. It is a seismic event that reverberates through the halls of power, the financial markets, and the broader economy. Senator Cynthia Lummis’s demand for Jerome Powell’s resignation is more than a personal grievance; it is a symptom of deeper fissures in the political and economic landscape. This report explores the motivations behind Lummis’s stance, the potential fallout from Powell’s departure, and the broader implications for the Federal Reserve’s independence and the digital asset industry.

The Catalyst: A Convergence of Grievances

Inflation and Monetary Policy

At the heart of Senator Lummis’s dissatisfaction lies a fundamental disagreement over monetary policy. As a fiscal conservative, Lummis has long advocated for a more restrained approach to government spending and monetary intervention. She views Powell’s handling of inflation as inadequate, arguing that the Fed’s policies have failed to curb rising prices effectively. This critique aligns with broader Republican concerns about the potential for excessive government spending and inflationary policies.

Lummis’s criticism of Powell’s inflation management is not merely academic. It reflects a growing frustration among conservatives who believe that the Fed’s policies have contributed to the erosion of purchasing power and economic stability. The senator’s call for Powell’s resignation is, in part, a demand for a more aggressive approach to inflation, one that prioritizes price stability over other economic objectives.

The Digital Asset Divide

Beyond general economic concerns, Lummis has accused Powell of enabling “Operation Chokepoint 2.0,” a policy that she argues is crippling the U.S. digital asset industry. This accusation suggests a belief that the Fed, under Powell’s leadership, is actively working to marginalize or suppress the growth of cryptocurrencies and related businesses. Given Lummis’s well-known advocacy for Bitcoin and digital assets, this issue represents a significant point of contention.

The digital asset industry has been a flashpoint in the broader debate over financial regulation and innovation. Lummis, a vocal proponent of cryptocurrencies, has argued that the Fed’s policies are stifling innovation and driving investment overseas. Her call for Powell’s resignation is, in part, a demand for a more supportive approach to digital assets, one that recognizes their potential to revolutionize the financial landscape.

Leadership and Communication

Lummis has also criticized Powell’s preparedness and accuracy during congressional testimony, suggesting a lack of attention to detail or a failure to fully grasp the implications of his policies. This criticism touches on Powell’s leadership capabilities and his ability to effectively communicate the Fed’s actions and intentions to Congress and the public.

Effective communication is a critical aspect of the Fed Chair’s role. The Fed’s policies have far-reaching implications, and clear, transparent communication is essential for maintaining public trust and confidence. Lummis’s criticism of Powell’s communication skills suggests a belief that the Fed Chair has failed to adequately explain or justify his policies, leading to a lack of understanding and support among lawmakers and the public.

The Ripple Effect: Potential Consequences of Powell’s Departure

Political Interference and Fed Independence

The resignation of a Federal Reserve Chair is a momentous event with far-reaching consequences. Powell’s departure, particularly under pressure from a sitting senator, could trigger a cascade of effects, impacting the Fed’s credibility, monetary policy, and the overall economic climate.

One of the most immediate concerns would be the potential for increased political interference in the Fed’s operations. The Fed is designed to be an independent body, insulated from short-term political pressures, allowing it to make decisions based on long-term economic considerations. If Powell were to resign under pressure, it could set a precedent for future administrations or lawmakers to exert undue influence on the central bank, potentially compromising its independence and credibility.

Monetary Policy Shifts

A change in leadership at the Fed could also lead to a shift in monetary policy. A new Chair might have different priorities and approaches to managing inflation, unemployment, and economic growth. This could result in changes to interest rates, quantitative easing policies, and other key tools used by the Fed to influence the economy. Such policy shifts could have significant implications for businesses, consumers, and investors.

For example, a new Fed Chair might prioritize price stability over employment, leading to a more aggressive approach to inflation. Alternatively, a new Chair might focus more on employment and social equity, leading to a more accommodative monetary policy. The direction of monetary policy under a new Chair would depend on their economic philosophy and priorities, as well as the broader political and economic context.

Market Volatility and Uncertainty

Powell’s resignation could create uncertainty in financial markets. The Fed’s actions are closely watched by investors around the world, and any sudden change in leadership could trigger volatility and instability. Investors might become more cautious, leading to a decline in stock prices and other asset values.

Market volatility could have broader economic implications, affecting consumer confidence, business investment, and overall economic growth. In a worst-case scenario, a sudden change in Fed leadership could contribute to a broader economic downturn, exacerbating existing economic challenges.

The Digital Asset Industry

Finally, Powell’s departure could have a chilling effect on the digital asset industry. If Lummis’s accusations of “Operation Chokepoint 2.0” are accurate, a new Chair might be more receptive to the concerns of the cryptocurrency community and less inclined to pursue policies that stifle innovation in this space. Conversely, a new Chair could also take an even more cautious or restrictive approach to digital assets, depending on their views and priorities.

The digital asset industry is still in its early stages, and its future trajectory will be shaped by regulatory and policy decisions. A change in Fed leadership could have a significant impact on the industry’s growth and development, with potential implications for financial innovation, investment, and economic growth.

The Broader Context: Political Pressures and the Future of the Fed

The Politicization of the Fed

Senator Lummis’s call for Powell’s resignation is not an isolated incident but part of a broader trend of increasing political scrutiny and pressure on the Federal Reserve. In recent years, the Fed has faced criticism from both sides of the political spectrum, with Republicans often accusing it of being too dovish on inflation and Democrats pushing for policies that prioritize employment and social equity.

The increasing politicization of the Fed reflects a growing recognition of the central bank’s immense power and influence over the economy. As the Fed’s role has expanded in the wake of financial crises and economic downturns, lawmakers and the public have become more aware of its ability to shape economic outcomes and impact people’s lives.

Calls for Reform

The increasing awareness of the Fed’s power has led to calls for greater accountability and transparency at the central bank. Some lawmakers have proposed reforms to the Fed’s governance structure, seeking to make it more representative and responsive to the needs of the public. Others have called for greater transparency in the Fed’s decision-making process, arguing that the public has a right to know how the central bank is using its power.

The future of the Federal Reserve will likely depend on how it navigates these competing pressures. The Fed must maintain its independence and credibility while also being responsive to the needs of the economy and the concerns of the public. This will require strong leadership, clear communication, and a willingness to engage in dialogue with lawmakers and other stakeholders.

The Role of Digital Assets

The rise of digital assets has added a new dimension to the debate over the Fed’s role and responsibilities. Cryptocurrencies and other digital assets have the potential to revolutionize the financial landscape, offering new opportunities for investment, innovation, and economic growth. However, they also pose significant challenges for regulators and policymakers, who must balance the need for innovation with the need for consumer protection and financial stability.

The Fed’s approach to digital assets will be a critical factor in shaping the future of the industry. A supportive approach could foster innovation and growth, while a restrictive approach could stifle the industry and drive investment overseas. The Fed’s policies in this area will have significant implications for the broader economy, as well as for the future of finance and technology.

A Fork in the Road: Navigating Economic and Political Turbulence

Senator Lummis’s challenge to Jerome Powell represents more than just a personal disagreement. It highlights the deep-seated tensions surrounding monetary policy, the rise of digital assets, and the appropriate role of the Federal Reserve in a rapidly changing world. Whether Powell ultimately resigns or weathers this storm, the episode serves as a stark reminder of the political pressures facing the Fed and the need for a thoughtful and balanced approach to navigating the complex economic challenges ahead.

The coming months will undoubtedly be a period of intense scrutiny and debate, with the future of the Fed, and perhaps the broader economy, hanging in the balance. The Fed’s ability to navigate these challenges will depend on its leadership, its commitment to independence and transparency, and its willingness to engage with the broader economic and political landscape. The stakes are high, and the decisions made in the coming months could have far-reaching implications for the economy and the financial system.