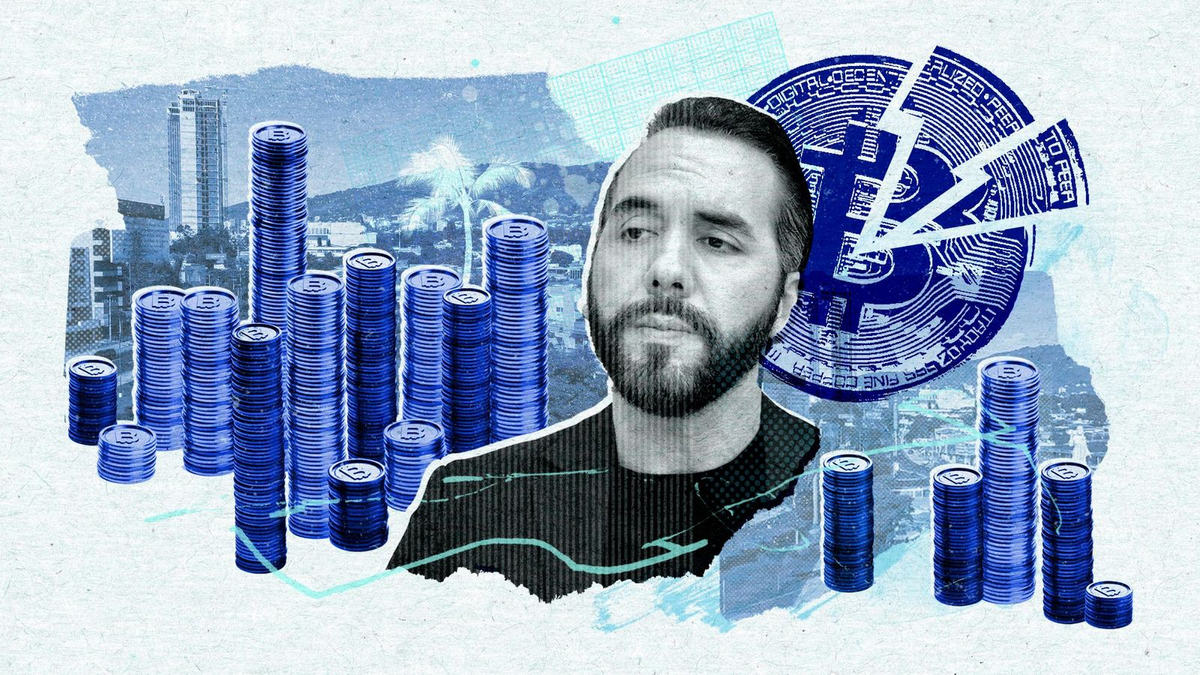

The Collapse of El Salvador’s Bitcoin Dream: A Cautionary Tale

In 2021, El Salvador made history by becoming the first country to adopt Bitcoin as legal tender, a move that was hailed as revolutionary and bold. However, this experiment has faced significant challenges, leading to a reevaluation of its viability. Let’s delve into the story of how El Salvador’s Bitcoin dream began to unravel.

Introduction to the Experiment

El Salvador’s decision to embrace Bitcoin was driven by the hope of stimulating economic growth and attracting foreign investment. President Nayib Bukele envisioned Bitcoin as a tool to bypass traditional financial systems and empower citizens financially[1]. However, this ambitious plan encountered numerous obstacles from the outset.

Challenges and Setbacks

Public Rejection and Technological Issues

Despite government incentives, the adoption of Bitcoin remained minimal among the general public. Security issues with the Chivo wallet, a government-backed digital wallet for Bitcoin transactions, further eroded trust in the system[1]. The wallet’s technical problems and the lack of widespread acceptance hindered the cryptocurrency’s integration into daily life.

Market Volatility and Economic Vulnerability

The collapse of cryptocurrency markets in 2022 exposed El Salvador’s economic vulnerability. The volatility of Bitcoin’s value made it an unreliable store of value and medium of exchange, undermining its potential as a legal tender[1]. This instability, combined with the country’s existing economic struggles, led to increased pressure from international financial institutions.

International Pressure and IMF Conditions

The International Monetary Fund (IMF) played a crucial role in shaping El Salvador’s Bitcoin policy. As part of a $1.4 billion loan agreement, the IMF required El Salvador to halt public sector Bitcoin purchases and phase out support for the Chivo wallet by July 2025[3]. This move effectively scaled back the country’s Bitcoin strategy, signaling a significant shift away from its initial ambitions.

The Current State and Future Implications

Economic Struggles and Debt Concerns

El Salvador’s economic challenges, including a widening fiscal deficit and rising debt, have been exacerbated by the failure of its Bitcoin strategy. The country’s GDP growth has been inconsistent, and the limited use of Bitcoin has not achieved the anticipated economic benefits[3]. As a result, El Salvador now ranks high among countries likely to default on its debt[3].

Lessons Learned

The collapse of El Salvador’s Bitcoin dream offers valuable lessons for other nations considering similar policies. It highlights the importance of robust financial infrastructure, regulatory clarity, and phased implementation of cryptocurrency integration[1]. The experiment also underscores the need for alternative digital currency models, such as central bank digital currencies (CBDCs), which might offer more stability and control.

Conclusion: A Cautionary Tale

Summary and Reflection

El Salvador’s Bitcoin experiment, though innovative, ultimately faced insurmountable challenges. The combination of public skepticism, technological issues, market volatility, and international pressure led to a significant retreat from its initial ambitions. As the world watches this experiment unfold, it serves as a reminder of the complexities involved in integrating cryptocurrencies into national economies. The story of El Salvador’s Bitcoin dream is a cautionary tale about the importance of careful planning and the need for robust financial systems before embracing such radical changes.

—

Sources:

– papers.ssrn.com

– tradingview.com

– youtube.com