Navigating the Crypto Seas: A Mid-2025 Snapshot

The cryptocurrency market, a swirling ocean of opportunity and risk, continues its dynamic dance. As of early July 2025, we observe a fascinating interplay of factors shaping the digital asset landscape. From Bitcoin’s supply dynamics to emerging AI-driven trading tools and the burgeoning relationship between crypto and insurance, a comprehensive understanding of these trends is crucial for investors and enthusiasts alike. Let’s dive in and explore the key developments steering the crypto markets.

Bitcoin’s Balancing Act: Scarcity and Consolidation

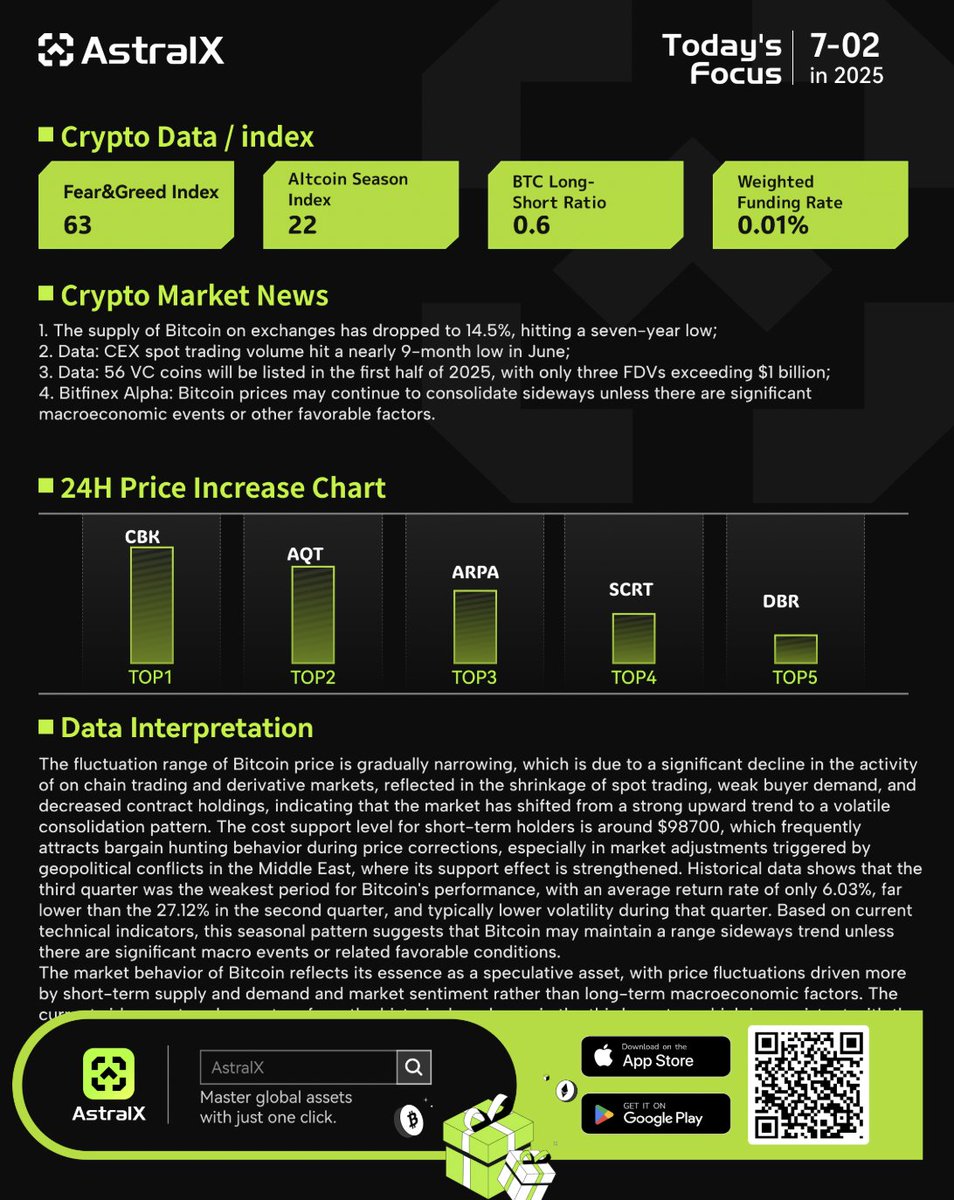

Bitcoin, the undisputed king of crypto, exhibits intriguing supply-side dynamics. The amount of Bitcoin held on exchanges has dwindled to a seven-year low, reaching just 14.5% [1]. This scarcity, driven by long-term holders transferring their Bitcoin to cold storage or decentralized finance (DeFi) platforms, theoretically supports higher prices. However, this supply squeeze is occurring concurrently with Bitcoin consolidating around the $100,000 mark, a price point that represents a significant psychological barrier [12]. This consolidation suggests a period of market indecision, a tug-of-war between bullish scarcity and bearish uncertainty. Furthermore, AstralX analysts suggest that the third quarter might bring seasonal pressures to bear on Bitcoin, adding another layer of complexity [12]. It is important to note that one analyst suggests a potential LONG entry point for Bitcoin at the $106,520-$105,250 range, with upside targets extending to $112,000, but this analysis carries an invalidation point at $103,950 [6]. This underscores the inherent volatility and the need for careful risk management.

Spot Trading Slowdown and VC Coin Activity

The broader cryptocurrency exchange landscape reveals a cooling trend in spot trading. June witnessed the lowest spot trading volume on centralized exchanges (CEXs) in nearly nine months [2]. This decline could be attributed to various factors, including increased regulatory scrutiny, market saturation, or a shift towards alternative trading venues like decentralized exchanges (DEXs). Conversely, the first half of 2025 saw a flurry of listings of venture capital (VC) backed coins, with 56 projects making their debut [3]. This injection of new assets brings both opportunity and risk. While VC-backed projects often boast strong teams and innovative technologies, they also carry the baggage of potential lock-up periods and concentrated ownership, factors that can influence price volatility.

AI Takes the Helm: The Rise of Algorithmic Trading

The integration of artificial intelligence (AI) is rapidly transforming the crypto trading landscape. Companies like ATTN are pioneering AI-based trading technologies that promise to optimize investment strategies through powerful algorithms and real-time data analysis [4]. These AI systems can analyze vast datasets, identify patterns, and execute trades with speed and precision that human traders simply cannot match. While the promise of AI-driven profits is enticing, it’s crucial to acknowledge the potential risks. “Black swan” events, unforeseen market shocks, can overwhelm even the most sophisticated algorithms, leading to significant losses. Algorithmic bias, stemming from flawed training data, can also generate unintended and potentially harmful trading patterns.

Beyond Bitcoin: The Altcoin Arena and Technical Analysis

While Bitcoin dominates headlines, the altcoin market offers a diverse range of investment opportunities and technological innovation. However, navigating this space requires a keen understanding of technical analysis, the art of interpreting price charts and trading volumes to predict future price movements.

Technical analysis plays a crucial role in evaluating the potential of various altcoins. For example, one analysis suggests that Injective (INJUSDT) is currently trading below a descending trendline, indicating a potential for upward rebound if it breaks above the $15.50 price level [5]. Similarly, Solana (SOL) and Ethereum (ETH) are also subjects of ongoing technical analysis, with charts providing insights into potential support and resistance levels [8, 10]. These analyses, while not foolproof, provide valuable information for traders seeking to capitalize on short-term price fluctuations.

Furthermore, emerging blockchain platforms like Kaspa (KAS) are positioning themselves as potential challengers to Bitcoin’s dominance. Kaspa boasts significantly faster transaction speeds compared to Bitcoin, theoretically making it a more efficient electronic cash system [7]. However, Bitcoin’s first-mover advantage, network effect, and brand recognition remain formidable barriers to entry for any aspiring competitor.

Crypto and Insurance: An Evolving Relationship

The intersection of cryptocurrency and insurance is an intriguing and largely unexplored frontier. Despite the crypto market’s volatility, the applications of crypto within the insurance industry are not disappearing; instead, they are evolving [11]. One area of intersection involves using blockchain technology to streamline insurance processes, enhance transparency, and reduce fraud. Another involves offering insurance products specifically designed to protect crypto assets against theft, hacks, or smart contract vulnerabilities. As this space matures, actuarial analysis will play a crucial role in assessing the risks and pricing the policies associated with crypto-related insurance products.

Fundamental Analysis: The Key to Long-Term Success

While technical analysis focuses on short-term price movements, fundamental analysis is crucial for identifying cryptocurrencies with long-term potential [9]. Fundamental analysis involves evaluating a cryptocurrency’s underlying technology, team, use case, and market adoption. By understanding the core value proposition of a cryptocurrency, investors can make more informed decisions and weather the inevitable market fluctuations.

The Road Ahead: Navigating Uncertainty and Embracing Innovation

The cryptocurrency market remains a volatile and unpredictable landscape. As we move deeper into 2025, several key trends will shape the future of this dynamic ecosystem:

- Regulation: Increased regulatory scrutiny from governments around the world will continue to impact the crypto market, potentially leading to greater price stability but also limiting innovation.

- Institutional Adoption: The continued influx of institutional investors, such as hedge funds and pension funds, will bring greater liquidity and maturity to the market.

- Technological Innovation: The emergence of new technologies, such as layer-2 scaling solutions and privacy-enhancing protocols, will address some of the inherent limitations of existing cryptocurrencies.

- Real-World Applications: The expansion of crypto’s real-world applications, beyond speculative trading, will drive broader adoption and increase its long-term sustainability.

Ultimately, success in the crypto market requires a combination of informed analysis, disciplined risk management, and a willingness to embrace innovation. As the market continues to evolve, staying informed and adapting to changing conditions will be paramount. The future of crypto is not predetermined; it is being shaped by the choices we make today.

*

Source Articles:**

[1] AstralX Tweet – Bitcoin Exchange Supply: https://twitter.com/astralxcom/status/1808103228186038458

[2] AstralX Tweet – CEX Spot Trading Volume: https://twitter.com/astralxcom/status/1808103228186038458

[3] AstralX Tweet – VC Coin Listings: https://twitter.com/astralxcom/status/1808103228186038458

[4] MinhHoàng Tweet – ATTN AI Trading: https://twitter.com/MinhHoang17121/status/1808103304766531800

[5] criz santos Tweet – Crypto Trading Tools: https://twitter.com/promiscuous_boi/status/1807761336259973266

[6] Stock Market Charts Pro Tweet – INJUSDT Analysis: https://twitter.com/C7042224401/status/1807758347934167206

[7] Mamorez Tweet – Market & Crypto Update: https://twitter.com/Mamorez17243/status/1807750186099544337

[8] Barry | ChartMonkey Tweet – Bitcoin Analysis: https://twitter.com/ChartMonkeyBTC/status/1807746832043886693

[9] Cowboy Tweet – Bitcoin vs. Kaspa: https://twitter.com/CryptoCowboy_AU/status/1807728233709473806

[10] Stock Market Charts Pro Tweet – Solana Analysis: https://twitter.com/C7042224401/status/1807716376322461954

[11] Forex Training Group Tweet – Fundamental Analysis: https://twitter.com/FX_Training_Grp/status/1807713941830441361

[12] Stock Market Charts Pro Tweet – Ethereum Analysis: https://twitter.com/C7042224401/status/1807711130533712152

[13] David Kirk Tweet – Crypto x Insurance: https://twitter.com/DaveActuary/status/1807688176689471767

[14] AstralX Tweet – Bitcoin Consolidation: https://twitter.com/astralxcom/status/1807566588052930857