Navigating the Cryptocurrency Market Landscape: Insights and Trends as of July 1, 2025

Cryptocurrency markets continuously evolve with a barrage of technical developments, regulatory shifts, and technological advances shaping their trajectories. As July 2025 kicks off, a deeper dive into recent market data, innovative analytical tools, and strategic movements reveals critical indicators about where this dynamic ecosystem might be headed. This detailed analysis synthesizes notable market signals, AI integration in trading, capital flow patterns, and emerging industry milestones that collectively paint a nuanced picture of the crypto space.

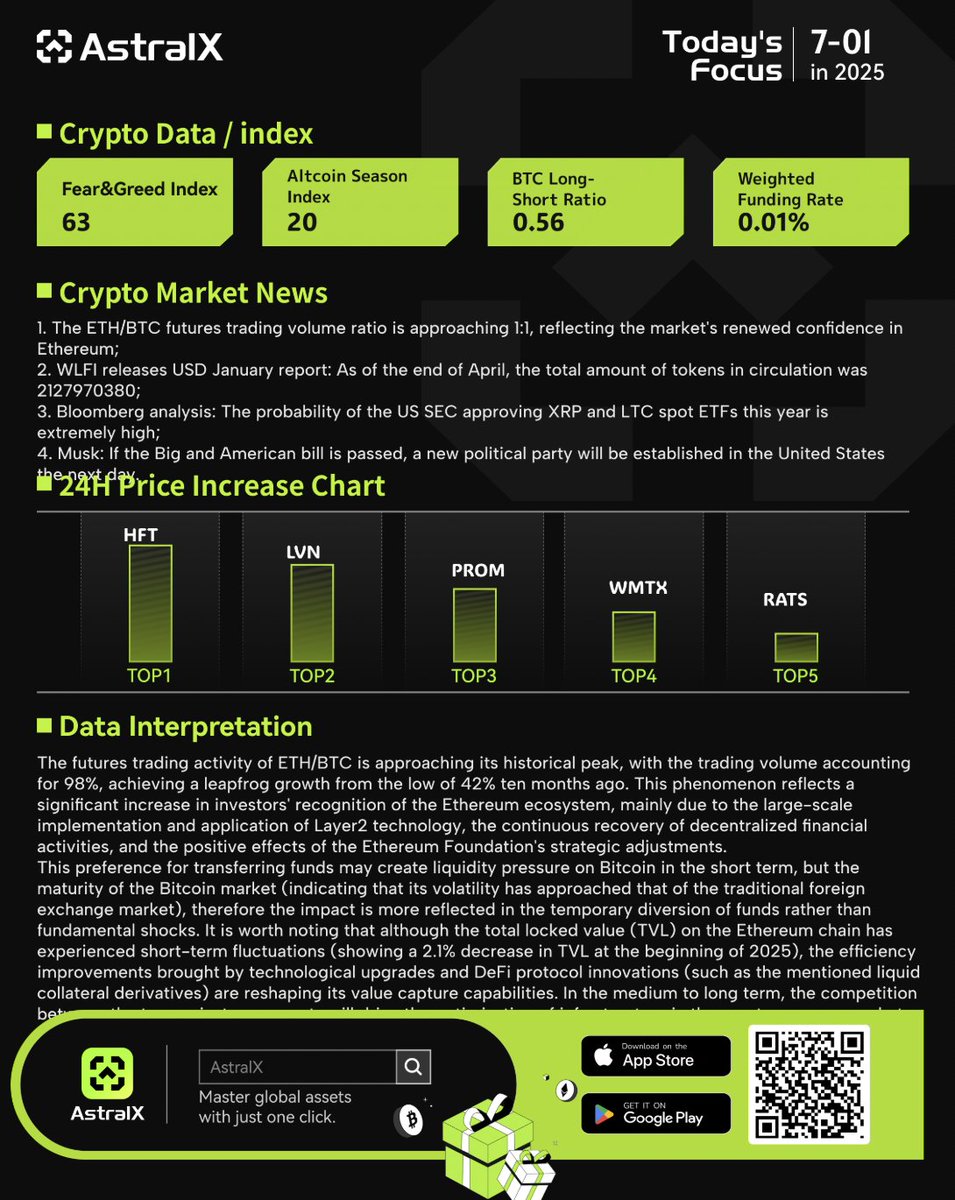

Signs of Renewed Confidence: Ethereum’s Futures Volume Approaches Parity with Bitcoin

One of the most striking developments is the trading volume ratio of Ethereum (ETH) futures relative to Bitcoin (BTC) futures approaching a 1:1 mark. Traditionally, BTC commands dominant dominance in futures markets due to its status as the pioneer and most widely adopted cryptocurrency. However, this near parity in futures trading volume suggests growing market confidence in Ethereum’s evolving role, driven by its ongoing upgrades and expanding decentralized finance (DeFi) ecosystem.

Futures trading reflects not just spot market interest but also speculative and hedging activity, meaning that derivatives traders increasingly view Ethereum as a key asset. This shift may underscore Ethereum’s broadening utility beyond simply ‘digital gold,’ venturing into smart contracts, NFTs, and institutional treasury diversification. The phenomenon also hints at an evolving narrative where ETH is increasingly competing head-to-head with BTC for investment capital and market influence.

Total Market Capitalization and Technical Patterns: Consolidation and Bullish Signals

The total cryptocurrency market capitalization is currently treading a fine line within complex technical configurations. Observers note that market cap is consolidating inside a descending broadening wedge pattern, trading within an Ichimoku cloud—a technical indicator signaling equilibrium between bullish and bearish forces.

A breakout above the cloud and the wedge pattern would generally signify a bullish uptrend, potentially triggering fresh capital inflows and rally momentum. Yet, prevailing conditions point to further sideways movement before a decisive breakout unfolds. This type of measured consolidation often preludes significant volatility events, reflecting markets digesting prior gains amid macroeconomic uncertainties such as interest rate expectations.

The anticipation for interest rate cuts globally is a fundamental driver behind optimistic market outlooks. Lower borrowing costs tend to enhance liquidity, encouraging investment in risk assets including cryptocurrencies. Thus, underlying macroeconomic sentiment acts as a potent catalyst for cryptocurrency price dynamics and investor appetite.

The Growing Role of Artificial Intelligence in Market Analysis and Trading

Artificial intelligence (AI) is no longer merely a futuristic concept in crypto trading—it has cemented itself as a transformative tool. Platforms like BingXAI offer users quick, comprehensive market reads, devouring vast datasets to generate actionable insights like 24-hour price outlooks and detailed chart breakdowns.

While AI enhances rapid decision-making and nuanced pattern recognition, experts caution against relying solely on automated signals. The optimal strategy combines AI-generated data with manual analysis, where human intuition and contextual understanding mediate algorithmic outputs. This hybrid approach balances machine speed with critical thinking, mitigating risks from blind algorithmic confidence.

Moreover, AI extends beyond price prediction to innovations such as DOM Heatmap History tools, which visualize order book depth and trade flow, totaling a new dimension of futures market analysis. These technological leaps empower traders and institutions to dissect liquidity and market sentiment with unprecedented granularity.

Notable Industry Developments: Mining Advances and Token Entrants

Industry milestones continue to unfold, evidencing maturation and expansion. For example, Hut 8’s activation of the Vega Bitcoin mining facility represents a significant step forward in Bitcoin infrastructure, emphasizing scaling and efficiency. Mining remains a backbone of the crypto network security model, so advances in this area wield substantial influence over supply-side dynamics and network vitality.

Meanwhile, emerging tokens such as Thirstcoin attract attention from investors seeking entry points into smaller-cap projects. With its current modest market cap and trading volume, Thirstcoin illustrates how micro-market niches persist within the crypto ecosystem, often serving as incubators for future growth or innovation.

Blockchain Forensics: Tracking Fraud through Transparent Ledgers

The incident involving stolen cryptocurrencies traced back to an insider exemplifies blockchain’s dual role as both an enabler and watchdog. Blockchain forensics utilize transaction tracing across wallets and exchanges to unmask fraudulent activities, showcasing the digital trail’s power in dispute resolution and regulatory enforcement.

This forensic capability adds a layer of security and accountability to an otherwise pseudonymous environment, reassuring institutional stakeholders and regulators. It reflects the maturation of the crypto space not just as a speculative playground but as a serious financial ecosystem demanding compliance and risk management sophistication.

Market Sentiment and Future Outlook

Overall, the cryptocurrency market is at a pivotal juncture, balanced between consolidation and potential breakout. Optimism is buoyed by technological integration (AI tools, new mining facilities), macroeconomic prospects (anticipated interest rate cuts), and expanding breadth of market participants, exemplified by Ethereum’s rising futures volume.

However, inherent volatility and pattern-based caution signal that patient observation and robust analytical frameworks remain indispensable. Traders and investors benefit from integrating traditional charting methods with next-gen technologies, maintaining agility amid a landscape defined by rapid innovation and shifting narratives.

Conclusion: Embracing Complexity to Navigate the Crypto Frontier

The crypto market’s mosaic of shifting volumes, evolving technical patterns, AI-enhanced analytics, and infrastructural developments demands a multifaceted approach to understanding and participation. As Ethereum approaches futures parity with Bitcoin and total market capitalization teeters within key technical zones, the space reflects both cautious consolidation and latent bullish potential.

Incorporating technology like AI for insightful, real-time market analysis while retaining critical human judgment may well define successful strategies going forward. Meanwhile, developments in mining infrastructure and blockchain forensics add tangible dimensions that underpin confidence and institutionalization.

Cryptocurrency’s journey remains one of balancing innovation with regulation, speculation with foundational advancements, and volatility with strategic patience. Engaged observers and participants can seize opportunities and mitigate risks by staying attuned to these evolving dynamics, ensuring they navigate the frontier not just with excitement, but with informed insight.

—

Sources

– AstralX Twitter Market Data

– Chainalysis Co-founder Profile

– BingXAI Insights

– Crypto Catalyst Market Cap Analysis

– Stock Market Charts Pro Technical Analysis

– Global FinTech Series on DOM Heatmap

– Mamorez on Hut 8 Mining Facility

– Henry Caldwell on Blockchain Forensics

– Dynamite Trader Market Cap Commentary