Artificial Intelligence and Cryptocurrency Trading: Unfolding the New Paradigm

The world of cryptocurrency trading is nothing short of turbulent seas—volatile, unpredictable, yet laden with opportunity. Recently, a transformative force has been making waves in this dynamic landscape: Artificial Intelligence (AI). Far from being a mere buzzword, AI is beginning to fundamentally shift how traders interpret data, predict market movements, and execute transactions. This report takes a deep dive into the AI-driven revolution in cryptocurrency trading, exploring its practical applications, benefits, and caveats, while contextualizing insights from recent market activities.

Harnessing AI for Market Insights

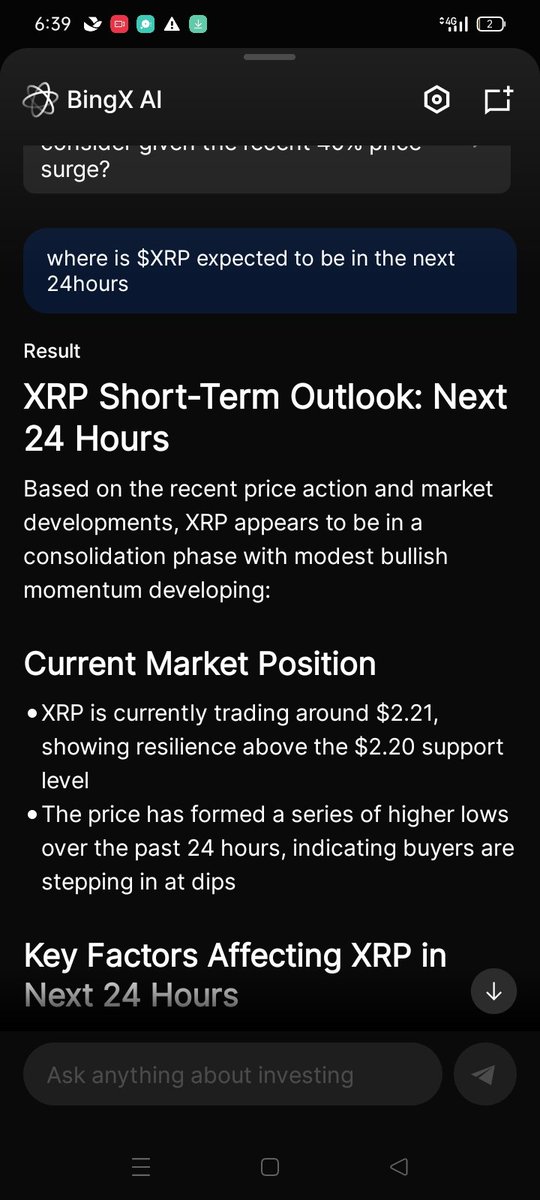

AI’s emergence in cryptocurrency trading is marked by its ability to digest and analyze vast swathes of market data swiftly and with precision. A vivid example emerges from users of BingXAI, an AI-powered tool designed for rapid market reads. One trader reported generating a 24-hour outlook on XRP ($XRP) that went beyond mere numerical summaries—it provided a nuanced breakdown of price charts, helping demystify complex patterns that traditional analysis might overlook. This kind of AI application turns raw market data into actionable insights, allowing traders to comprehend trends without getting lost in the chaos of fluctuating prices.

The AI advantage here lies in pattern recognition. For instance, the total cryptocurrency market capitalization has recently been consolidating within a descending broadening wedge pattern while trading inside an Ichimoku cloud. These are technical indicators that often foreshadow future market movements. AI tools can analyze such patterns in real-time across numerous assets, signaling potential breakout points that could lead to bullish trends. Human traders, constrained by time and cognitive limits, benefit immensely from these automated signal detections, which enhance decision-making accuracy.

Balancing Automation with Manual Analysis

While AI accelerates and refines market analysis, experts advise caution against blind reliance. The cryptocurrency market is influenced by an intricate blend of technological, economic, and sociopolitical factors that may elude purely algorithmic assessment. Thus, the current best practice recommends coupling AI-generated signals with manual, human-driven analysis to contextualize and validate findings.

This hybrid approach is exemplified in technical analyses shared for tokens like SUI/USDT, DOGS/USDT, and others, where strategic patience combined with AI’s data processing capability informs profitable trading moves. AI provides the what and when; traders provide the why and how, injecting experience and intuition into the methodology.

Innovations Beyond Trading: Market Infrastructure and Security

AI’s influence extends beyond price forecasting. Market infrastructure developments, like the launch of DOM Heatmap History tools by dxFeed and ATAS, usher in a new era of futures market analysis, enriching traders’ visual comprehension of order flows and liquidity. AI supports these tools by dynamically rendering complex datasets, enabling traders to anticipate shifts in supply-demand dynamics with greater precision.

Moreover, blockchain forensics powered by AI have become invaluable in investigating illicit activities. A recent case involved the disappearance of a trader’s cryptocurrency and subsequent tracing of stolen tokens through various wallets and exchanges, uncovering the theft’s origin at the business partner level. AI’s ability to analyze transaction trails on an immense scale and identify anomalies offers potent deterrence and redress mechanisms in an ecosystem often criticized for anonymity-based risks.

Market Sentiment and Industry Dynamics

Strategic analysts and market commentators are closely watching how AI fits into broader market trends. For example, the cryptocurrency market is currently displaying moderate consolidation, awaiting decisive moves influenced by factors such as anticipated interest rate cuts and on-chain support mechanisms that could spur Bitcoin’s (BTC) breakthrough. AI-infused platforms frequently integrate these macroeconomic and blockchain data points, yielding more holistic market perspectives.

Investor engagement is also evolving. Emerging tokens like Thirstcoin ($THIRSTCOIN), despite being nascent with modest market caps, benefit from AI-powered volume and trend analyses that help investors assess entry points credibly. The data transparency and rapid analytics AI provides reduce information asymmetry for smaller players, enhancing overall market efficiency.

Beyond trading, the ecosystem is enriched by educational resources. Top cryptocurrency podcasts and analytic platforms curated through AI facilitate ongoing learning, equipping traders to navigate complexity with confidence.

Challenges and Ethical Considerations

Despite its promise, AI’s growing role invites critical reflection. Market actors must grapple with ensuring that AI tools do not foster overdependence, reducing diversity in trading strategies and potentially amplifying systemic risks. Furthermore, as AI algorithms become more sophisticated, regulatory frameworks must evolve to address new risks related to algorithm-driven market manipulation or errors.

Transparency in AI decision-making processes is another pressing concern. Black-box models can generate valuable signals but may lack explainability, complicating accountability when trades go awry. Ongoing research and development aim to improve interpretability alongside performance.

Conclusion: Embracing AI as an Empowering Ally in Crypto Trading

The integration of AI into cryptocurrency trading heralds a transformative epoch—one in which data-driven precision and human judgment coalesce to unlock new potential. From enhancing technical analyses and detecting security breaches to fostering informed investment decisions, AI is proving indispensable. Yet, prudence demands a balanced approach that leverages AI’s strengths while maintaining critical oversight. The future of cryptocurrency trading is not AI versus human, but AI empowered by human wisdom.

As the digital asset market matures, embracing AI’s capabilities with strategic patience will enable traders, investors, and institutions to navigate volatility more confidently, realize profits more consistently, and contribute to a more robust and transparent ecosystem.

—

Sources:

– Recent market outlooks and technical analyses shared on June 30, 2025, via social media by traders and analysts familiar with BingXAI, Crypto Catalyst, Dynamite trader, and others.

– Announcements on new market analysis tools, such as the dxFeed and ATAS DOM Heatmap History launch.

– Blockchain forensic cases exemplified by investigation threads from Henry Caldwell (@heismacha).

– Industry-wide market sentiment insights from AstralX and Solana CT Scanner.

– Public disclosures from Hut 8’s Vega Bitcoin mining facility energization reports.

*Note: Content derived from aggregated social media and industry reports dated June 30, 2025.*