Exploring Crypto Market Dynamics Through Social Media Insights: A Multi-Faceted Analysis

—

The cryptocurrency landscape is notoriously volatile, influenced by a complex interplay of market sentiment, technological innovation, geopolitical events, and regulatory developments. In recent times, the abundant conversations and updates shared across social media platforms present a goldmine of real-time data and sentiment indicators. By examining a selection of tweets and public posts from June 12–13, 2025, this report dissects key themes including technical analysis, sentiment tools, geopolitical impacts, market trends, and investor behavior. The goal is to provide a layered understanding of how these narratives shape crypto market movements and investor psychology.

—

Cryptocurrency Technical Analysis: A Window Into Market Behavior

Technical analysis (TA) has evolved into a core skill for crypto traders navigating this fast-moving market. As highlighted by user @Coco09114042539, who finds it “pretty fascinating,” TA involves using chart patterns, indicators, and statistical tools to anticipate future price movements. Several tweets with hashtags like #tradingtips, #cryptotraders, and #analysis reflect a community deeply engaged in dissecting price action (George Samaropoulos’s tweets).

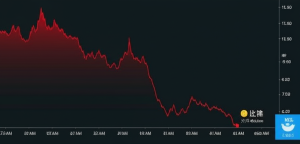

Central to TA discussions is the total market capitalization trend. Bitcoin Bayern points out that the entire crypto market cap is “consolidating within an ascending channel pattern” — an indication, from classical TA, of a “controlled upward trend.” Price action that holds above support trendlines signals potential bullish momentum, at least in the short term.

Such insights underscore how traders combine zoomed-in graphical analysis with broader market structures to frame their strategies. This scenario also reflects the degree to which TA has transcended traditional finance and adapted to crypto’s unique volatility and 24/7 trading cycles.

—

Sentiment Analysis Tools: Harnessing Social Media and News for Informed Decisions

One of the most innovative developments in crypto market analysis is the rise of sentiment analysis tools designed to gauge the mood of market participants based on social media chatter and news feeds. Paloma Naomi Diaz (@paolarosasnoem2) advocates for building such AI-powered systems, which could systematically track bullish or bearish sentiments, detect hype cycles, and map correlations with price swings.

Crypto Bulletin, with frequent updates peppered with disclaimers, exemplifies how market commentators micro-analyze sentiment spikes. For instance, an update on a Bitcoin price rebound triggered retail FOMO (Fear Of Missing Out), identified as “the second largest in two weeks,” demonstrates how fluctuations in sentiment translate into tangible market dynamics.

These sentiment-focused signals have grown indispensable for traders who want to stay ahead of market sentiment shifting abruptly, often prior to price movements reflected on charts. Integrating AI-driven sentiment gauges enriches technical analysis, reducing reliance on purely historical price data.

—

Geopolitical and Macroeconomic Factors: The Wider Ripple Effects

The volatile nexus between geopolitics and crypto markets is vividly illustrated in the tweets from AstralX and Sameera Al Hammadi. The Middle East conflict intensifying between Israel and Iran boosts traditional safe-haven assets like gold, triggering price surges. Since cryptocurrencies like Bitcoin are often discussed as “digital gold” or alternative stores of value, these developments spur cross-asset movements.

Sameera’s technical analysis of XAUUSD (gold prices) contextualizes how forex, crypto, and commodity markets intertwine amid economic shocks. The interrelation suggests investors dynamically allocate between assets based on perceived risk, inflation outlook, and geopolitical stability.

Further macroeconomic signals come from Crypto Bulletin’s posts referencing PPI (Producer Price Index) data releases and notable U.S. Senate moves with the GENIUS Act focused on stablecoin regulations. Regulatory clarity or uncertainty often catalyzes sharp price changes or market confidence fluctuations, underscoring the multi-layered risks crypto investors contend with.

—

Investor Behavior, Market Psychology, and Trading Narratives

A poignant aspect in the user posts revolves around personal reflections and behavioral patterns. The Indonesian trader @insiderforyou17 openly acknowledges strategic shifts from BTC to ETH accumulation and discusses position timings related to “the dip,” exemplifying common emotions like hesitation, patience, and decision-making complexity.

Such transparency is vital: it reflects the human element behind charts and algorithms—fear, hope, and sometimes a willingness to experiment with “memecoins” or emerging altcoins. The frequent phrase “NFA DYOR” (Not Financial Advice, Do Your Own Research) signals the caution and disclaimer culture prevalent in self-driven crypto investing.

Meanwhile, AI Analysis highlights a fascinating statistic: only 7% of the global population owns any cryptocurrency. This suggests an enormous untapped market and explains the ongoing drive for educational initiatives, sentiment tools, and technical analyses designed to attract and arm potential new entrants.

—

Crypto Analytics Tools: Empowering Data-Driven Investment Decisions

Geneva Evelyn’s tweet underscores the importance of analytics tools that monitor not just price movements but also trend strength, volume, and volatility. Such tools democratize trading insights, allowing retail and institutional investors alike to dissect complex data points in user-friendly dashboards.

Coupled with the aforementioned sentiment analysis and fundamental assessments, these analytical capabilities constitute an ecosystem helping participants make informed, timely, and risk-aware decisions. This trend represents crypto markets maturing toward greater transparency and systematic trading approaches.

—

Conclusion: The Cryptosphere’s Layered Dance of Analysis and Sentiment

This snapshot of social media activity reveals a vibrant, multifaceted ecosystem where mathematical rigor, AI sentiment tools, geopolitical undercurrents, and personal narratives intertwine to shape cryptocurrency markets. Technical analysis remains a vital toolkit, but its power is greatly enhanced by integrating social sentiment signals and understanding broader macro and geopolitical contexts.

Investor behavior is not a mere byproduct of charts and news—it is the engine driving market cycles, shaped by psychology, risk appetite, and global developments. Finally, the vast majority of the population yet to engage with cryptocurrency signifies enormous growth potential balanced by the imperative for better education and technological tools.

For those navigating this exciting yet unpredictable field, mastering a synthesis of technical skills, sentiment awareness, and geopolitical literacy will not just be advantageous; it will be indispensable.

—

Selected Sources for Further Reading:

– Understanding Cryptocurrency Technical Analysis

– Sentiment Analysis in Cryptocurrency Markets

– Geopolitical Risks and Crypto Correlations

– Crypto Analytics Tools Overview

– Cryptocurrency Adoption Statistics and Trends

—

Feel free to let me know if you want a deeper dive into any specific segment or more examples of trader insights!