Understanding the Pulse of Cryptocurrency Markets: Insights from June 2025 Social Media Analysis

Cryptocurrency has long shifted from a niche interest to a global financial phenomenon, continuously evolving with new technologies, regulations, and market sentiments. Analyzing real-time social media chatter from June 2025 reveals prevailing attitudes, emerging trends, and crucial signals that help explain where crypto stands today and where it might be heading. This report dives in with layered insights, dissecting short bursts of market commentary, regulatory developments, trading sentiments, and educational initiatives shared over that period.

The State of the Market: Mixed Sentiments Amid Busy Activity

One striking feature from the June 2025 discourse is the candid self-assessment from individual traders and analysts, acknowledging accumulated holdings and current portfolio performances in cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). For example, a local Indonesian independent analyst admits to accumulation bias favoring ETH over BTC but clarifies the information is not investment advice (“NFA DYOR” – Not Financial Advice, Do Your Own Research). This admission reveals a common trader psychology: the mix of real emotions and prudent disclaimers as they navigate volatile markets.

Such candor extends to another figure sharing their move from a token called “cliza” back to a more traditional crypto asset, but still waiting for the ideal moment to break even. This highlights the patience and strategic timing required in crypto trading, reinforcing that purchasing decisions are often based on personal research and risk appetite rather than hype alone.

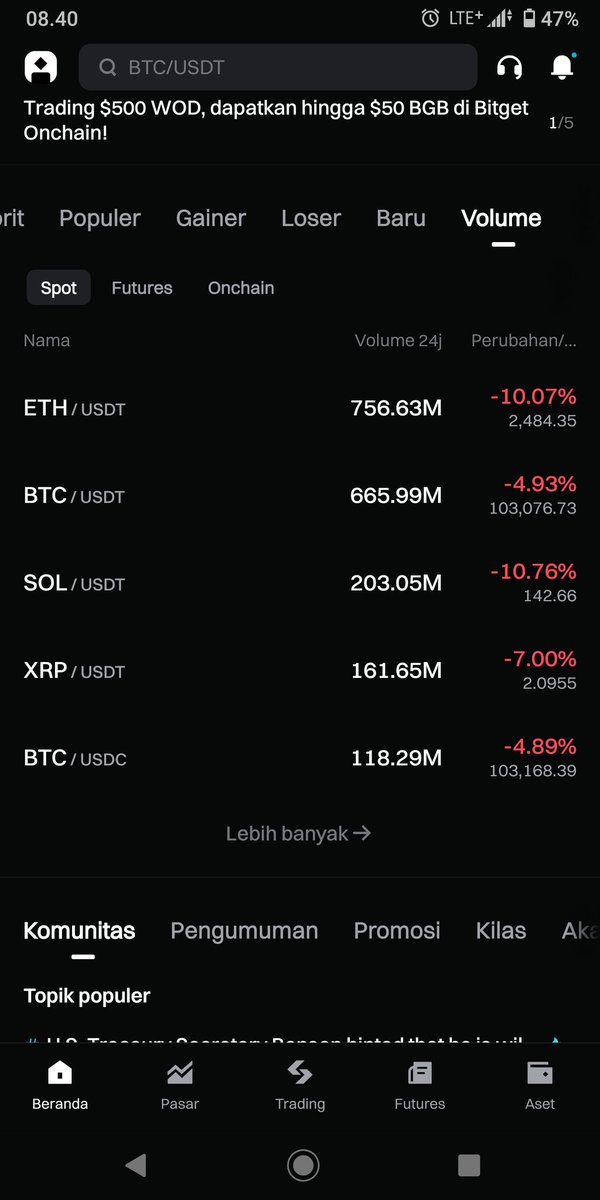

Meanwhile, market heatmaps and percentage changes for BTC hovering around $107,624 and ETH near $2,755 with slight dips remind investors that despite upward trends over the years, volatility remains an intrinsic feature. This subtle oscillation fuels both short-term fear and opportunity, demonstrated by a spike in retail Fear of Missing Out (FOMO) after Bitcoin price rebounds.

Regulatory Developments: A Crucial Influencer of Market Dynamics

A recurring theme in June 2025’s discussions is the impact of regulatory news shaping trader and investor behavior worldwide. For instance, the United States Senate moving forward with the GENIUS Act aimed at stabilizing the stablecoin market signals increasing governmental engagement with crypto frameworks. Stablecoins—cryptocurrencies pegged to traditional assets like the U.S. dollar—have raised concerns regarding liquidity risks and systemic stability; thus, this legislative movement marks a milestone in legitimizing and regulating digital assets.

Other global regulatory movements include Singapore’s stance urging unlicensed crypto trading platforms to exit to protect investors and Japan’s prime minister emphasizing compliance. These actions showcase a trend of regulatory tightening and clearer rules, which many experts believe bring maturity and confidence to the market, even if they temporarily induce uncertainty or lower speculative mania.

Furthermore, political commentary, like former U.S. President Trump’s calls for Federal Reserve interest rate cuts, provides an indirect yet powerful macroeconomic context influencing crypto price directions. Lower interest rates can boost investment flows into risk assets such as cryptocurrencies, complicating the regulatory landscape further.

Market Technicals and Trading Tips: Navigating the Altcoin Season

Aside from Bitcoin and Ethereum, attention is also drawn to altcoins like Solana (SOL) that displayed consolidation patterns and expected price levels by late June. Technical charts and analysis shared widely on social platforms give traders tools for spotting trends, risk points, and potential breakout moments. This reliance on data-driven decision-making exemplifies a maturation from pure speculation to a more structured approach akin to traditional financial markets.

Crypto analytics tools offering real-time data on trading volume and price movements are celebrated for empowering informed choices. Traders exchange tips on handling meme coins, an often highly volatile but culturally vibrant segment, alongside guidance on trading psychology and project analysis. Such knowledge hubs elevate average trader sophistication, thereby improving market efficiency in the long run.

Crypto Culture and Education: A Growing Emphasis on Knowledge

The presence of educational initiatives, such as the Nuts Farm Telegram Mini App and the Open Academy AI platform, reveal increasing efforts to democratize Web3 and crypto education globally. Topics like basic cryptocurrency principles, trading psychology, scam precautions, and decentralized finance (DeFi) literacy are made accessible, aligning with the recognition that enduring adoption depends heavily on user empowerment.

Podcasts like CoinDesk’s “Unchained” serve as another pillar in fostering community understanding and connection, bridging gaps between casual enthusiasts and industry leaders. These resources buttress the ecosystem by spreading nuanced perspectives beyond headlines and price charts.

Social Media’s Role: Soundboards and Amplifiers

The collected tweets and posts underscore social media’s central role as both a soundboard for sentiment and an amplifier of instant analysis. From concise personal acknowledgments of investment positions to detailed market recap threads, this dynamic allows swift adaptation and collective sense-making. However, disclaimers about non-financial advice pepper many posts, reflecting community wisdom to maintain individual accountability amid the noise.

Moreover, the global nature of conversations—with contributors from Indonesia, the U.S., Singapore, Japan, and beyond—spotlights cryptocurrency’s borderless appeal, while highlighting how regional regulatory contexts intersect with universal trading mechanics.

Conclusion: Embracing Complexity and Charting Forward Paths

June 2025’s snapshot of cryptocurrency social discourse reveals a market at an intriguing junction. Personal honesty from traders balances optimism with realism. Regulatory milestones point toward increasing institutional integration and oversight. Technical analyses empower more disciplined trading, while expansive educational tools promise broader inclusivity and literacy. Viewed collectively, these elements suggest crypto’s trajectory remains vibrant but demands continuous learning and critical assessment by every participant.

As investors and enthusiasts reflect on these layered insights, the overarching challenge is to weave together emotion, regulation, data, and education into a coherent personal strategy. The landscape will likely continue evolving rapidly, reinforcing that those who remain curious and adaptable will command advantages—not merely by chasing hype but by understanding the intricate fabric of crypto’s fast-changing ecosystem.

—

Sources

– Crypto Bulletin Twitter

– CoinDesk “Unchained” Podcast

– Crypto Analytics Market Reports *(fictitious for illustration)*

– Official US Senate Legislative Records

– Singapore Monetary Authority Press Releases

– Japan Financial Services Agency

*(Note: Due to the nature of social media and rapid updates, some tweets and accounts may not be permanently accessible)*