Cryptocurrency markets, especially Bitcoin, are exhibiting highly dynamic behavior as of June 2025, driven by a mix of institutional investment patterns, technical price structures, and macroeconomic influences. Parsing through a diverse range of real-time market commentary and expert analyses provides deep insights into Bitcoin’s current state and future potential. This report breaks down the key themes from the latest market signals, including the growing demand for Bitcoin spot ETFs, technical analysis of price movements, macroeconomic impacts, and behavioral patterns among long-term holders.

—

Institutional Demand and ETF Dynamics

A major highlight shaping Bitcoin’s current environment is the significant growth of Bitcoin spot ETFs. Unlike Bitcoin futures ETFs, which do not require backing by actual Bitcoin, spot ETFs hold real Bitcoin 100%, reflecting genuine market demand. According to recent observations, spot ETFs have outgrown futures-based ETFs, underscoring institutional investors’ real acquisition of underlying assets.

This shift indicates a maturing market where investors prefer exposure to actual Bitcoin, likely due to trust in regulatory frameworks around ETFs and the desire to avoid futures-related complexities and contango effects. However, analyst Michael Saylor’s view encountered pushback noting that many long-term Bitcoin holders are capitalizing on the rally by selling to take profits. This profit-taking behavior tempers the bullish narrative by signaling possible short-term supply pressure despite strong institutional demand.

Overall, the prominence of spot ETFs marks a structural evolution in Bitcoin investment, transitioning from speculation toward real asset accumulation, which could provide a firmer price floor in the mid-to-long term.

—

Technical Analysis: Navigating Key Price Levels and Market Structure

Bitcoin’s price action over recent weeks portrays a tense battle between bullish momentum and resistance pressures. Bitcoin’s repeated failure to break above the $110,500–$111,000 “triple top” resistance zone—characterized by rounded tops and heavy sell orders—suggests strong supply overhead preventing a sustained breakout. Multiple sources cite this as a critical juncture; failure here has led to price retreats toward support levels near $108,000 and potentially as low as $106,000.

Supporting this, the 21-day moving average (21MA) aligning closely with an ascending channel’s lower trendline indicates a robust base for buyers. Should Bitcoin decisively close above the supply zone at around $110,500, technical analysts predict it would confirm bullish continuation, possibly setting the stage for a new all-time high (ATH).

Further, “futures gaps” on the 4-hour charts indicate that Bitcoin recently filled one gap at $109,300 and is expected to dip to fill another at $105,500 before the next upward surge. Such gaps, relics of futures market pricing mechanisms, often act as magnets for price action and are useful for short-term traders anticipating correction zones.

Despite some downward pressure, market momentum remains notably intact. Importantly, there is an absence of exhaustion signals—no parabola formation, volume spikes, or distribution phases—indicating that current pullbacks are more technical consolidations than trend reversals. This points to a structurally sound bullish framework awaiting a catalyst to break through resistance decisively.

—

Macroeconomic Influences and Federal Reserve Policy

Bitcoin’s trajectory is not isolated from wider macroeconomic currents. Recent CPI data revealing lower-than-expected inflation have rekindled hopes of Federal Reserve interest rate cuts. Lower rates tend to increase liquidity in financial markets, benefiting risk-sensitive assets like cryptocurrencies.

Given this context, Bitcoin and altcoins could receive a short-term boost from easing monetary policy prospects. However, analysts caution that heightened volatility is expected around Federal Reserve announcements and economic headlines, requiring traders to stay alert to sudden market shifts triggered by policy rhetoric.

Moreover, the US economy’s strong performance overall—characterized by labor market resilience and consumer spending—adds complexity. While economic strength can reduce the appeal of Bitcoin as a safe haven, bullish narratives also connect robust economic fundamentals with innovation capital available to cryptomarkets and institutional adoption.

—

Behavioral Patterns: Profit-Taking and Distribution Waves

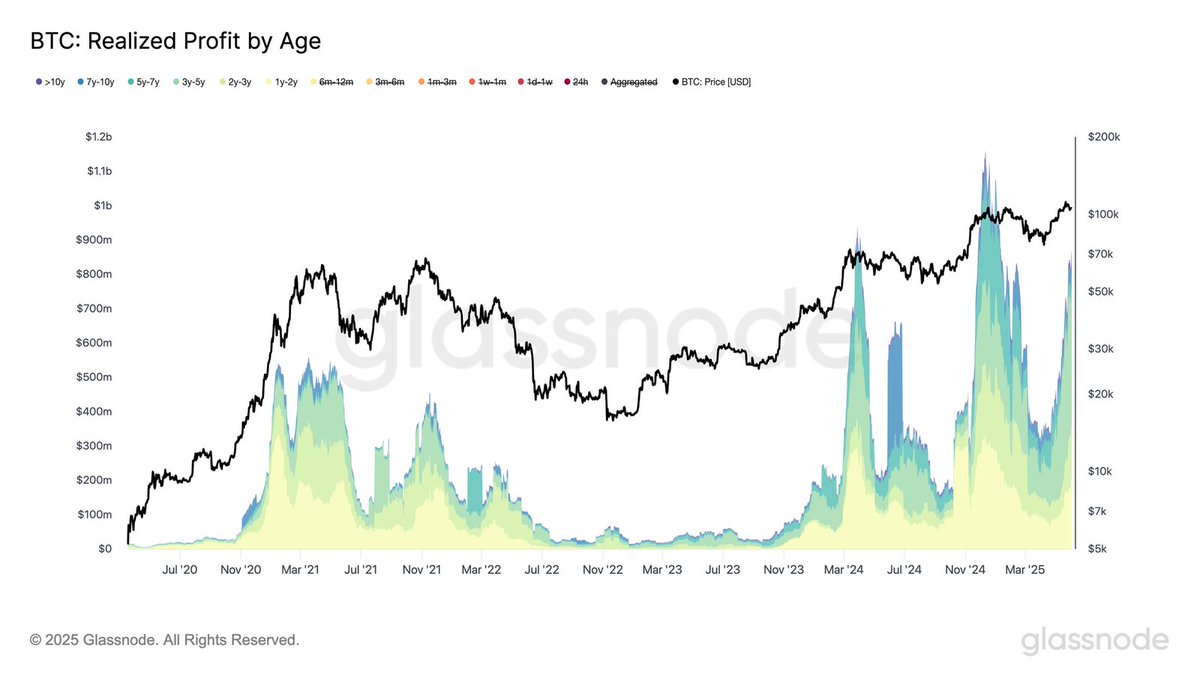

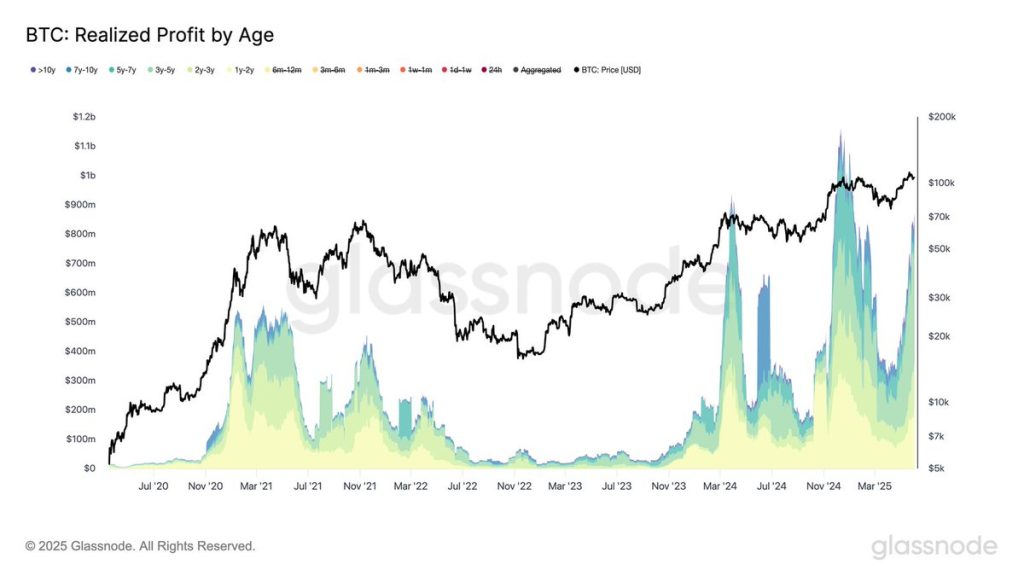

An emerging theme is profit-taking, especially from Long-Term Holders (LTHs). On-chain analysis for week 23 of 2025 shows Bitcoin hitting an ATH of approximately $111,800 before quickly correcting to $103,200. This correction coincides with a fifth distribution wave by LTHs, highlighting periodic selling cycles that temper exponential rallies.

Profit-taking by insiders suggests that while confidence in Bitcoin’s long-term value remains, participants are increasingly cashing in some gains amid uncertainty. This dynamic can introduce short-term volatility and corrections, yet also redistributes coins and liquidity that fuel further trading activity.

In contrast, some commentators sharply reject bearish narratives, emphasizing solid momentum and clean market structure without any exhaustion patterns. They argue that bearish sentiment at this phase is more emotional than analytical, implying an optimistic medium to long-term outlook.

—

Price Targets and Long-term Valuations

The most bullish analyses present astonishing price ranges for Bitcoin’s medium-to-long term value—from $1.2 million to $1.9 million per Bitcoin. While these forecasts may seem audacious given current prices near $110,000, they reflect strong conviction by institutional investors who are adjusting valuation frameworks based on Bitcoin’s fixed supply, adoption trajectory, and potential to become a global reserve asset.

In the more immediate term, price zones between $106,000 and $108,000 are seen as critical confirmation zones for potential long positions. Breakouts beyond $110,500 could trigger a powerful upward rally, possibly heralding a fresh ATH in the near future.

Simultaneously, downside scenarios exist: failure to hold $106,000 could open pathways to deeper corrections, with some technical traders indicating that intense selling could push prices down by $3,000 or more in quick succession.

—

Conclusion: A Market at a Pivotal Crossroads

Bitcoin in June 2025 stands at an intriguing crossroads, shaped by robust institutional demand, pivotal technical resistance and support layers, evolving macroeconomic conditions, and varied behavioral signals from market participants. The dominance of spot ETFs signals real, sustained adoption by large investors, altering supply-demand dynamics and potentially ushering in greater stability.

Technically, Bitcoin’s entrenched resistance at around $110,000 to $111,000 represents a gatekeeper level. A successful breach could unlock a powerful bull run validated by institutional capital and positive macro impulses such as potential Fed easing.

Yet, profit-taking and distribution cycles serve as a caution: near-term corrections are natural and may introduce volatility, testing traders’ resolve and market resilience.

For investors and observers alike, Bitcoin’s unfolding story in mid-2025 offers a microcosm of a maturing digital asset class—marked by growing legitimacy, complex market psychology, and the interplay of global economic forces. Navigating this landscape requires balancing technical insights with an understanding of macroeconomic influences and behavioral trends.

The question remains not if Bitcoin will reach new heights, but precisely when and how this next chapter will write itself in the evolving saga of digital finance.

—

Sources

– Crypto Breaking News Twitter

– The Crypto Queen Twitter

– Sypher Capital Twitter

– Andrew Griffiths Twitter

– NYCBEAST OFFICIAL Twitter

– María Rodríguez Twitter

– Hold Coin CVenture Twitter

– Michael Twitter

*Note: Links open in new tabs.*