Exploring the Vibrant Intersection of NFTs, AI, and DeFi: Insights from Recent Developments

In the ever-evolving landscape of Web3, a fresh buzz centers on the fusion of art, artificial intelligence, decentralized finance (DeFi), and NFTs (non-fungible tokens). The latest updates from key players and platforms paint a multifaceted picture of innovation, risk management, and new utilities emerging within these interconnected ecosystems. This report will unpack these developments, highlighting their implications and potential trajectories.

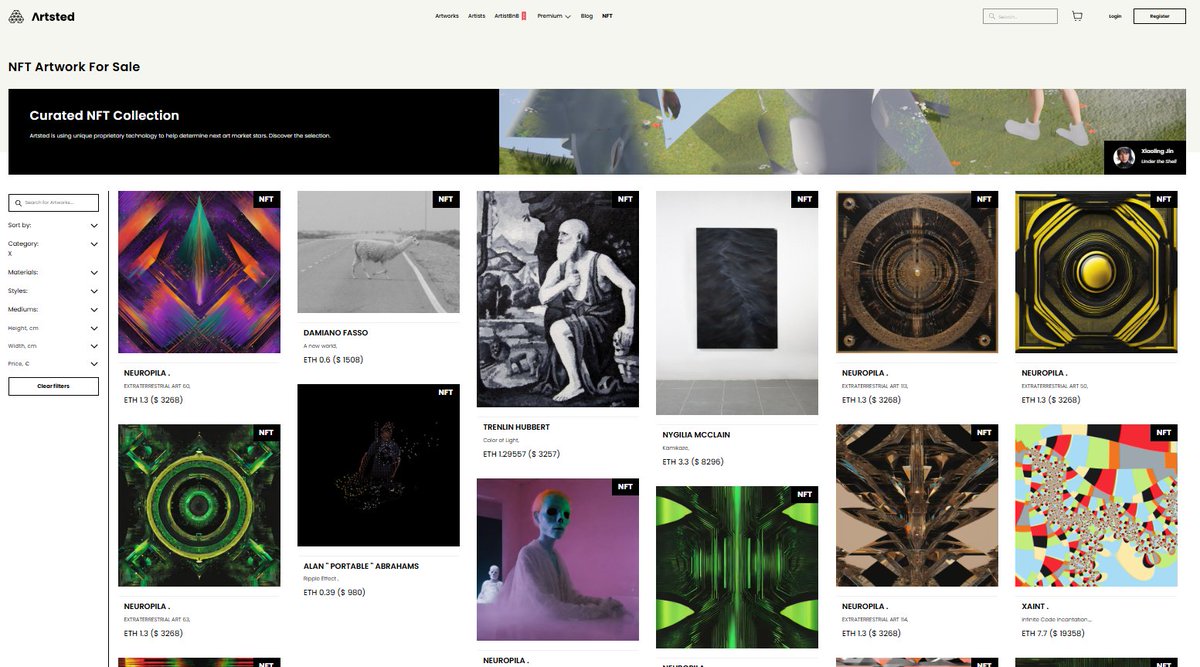

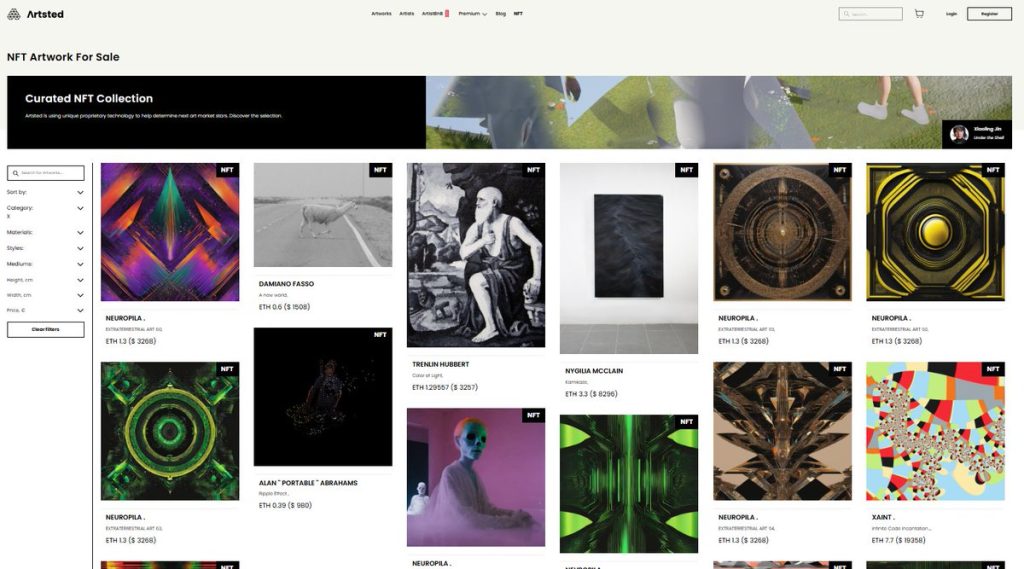

Art Meets Blockchain and AI: The Rise of Artsted and the Infinity Canvas Protocol

Emerging creators are finding a new playground with Artsted, a Web3-native art platform that uniquely merges NFT tools with AI-powered market analysis. What makes this particularly captivating is Artsted’s expansion into what they call the “Infinity Canvas”: an on-chain protocol where AI agents autonomously create and evolve digital artworks. This approach effectively turns art generation into a dynamic, living process encoded on the blockchain, opening up novel pathways for artists and collectors alike.

The Infinity Canvas concept leverages AI to not only automate creation but also to ensure that digital artworks continue developing over time, potentially increasing their uniqueness and value. By embedding these evolving pieces directly on-chain, Artsted strengthens provenance and immutability, a cornerstone of NFT value propositions. This integration could inspire a new wave of digital art that blurs the lines between creator, curator, and collector roles, transforming art from a static object into an ongoing narrative.

Enhancing DeFi Security with AI-Driven Risk Management: Magic Newton’s Innovation

In DeFi, risk has always been a major concern. Here, Magic Newton has introduced risk filters within GPT agents—essentially melding AI with smart contract audits and liquidity analytics. These enhancements mean token analyses can now weigh DeFi-specific factors like the solidity of smart contracts and liquidity depth, giving users a clearer understanding of potential vulnerabilities.

This is akin to equipping ChatGPT-style conversational AI with a “DegenShield” — a nickname reflecting its ability to alert “farmers” (very active DeFi users) about risk before they dive headlong into investments. Such risk-aware AI agents could become indispensable tools for navigating the often-turbulent waters of decentralized finance. They empower users by providing real-time, in-depth insights, reducing the chances of falling victim to exploits or illiquid tokens.

Financial Forecasting in Crypto: Detailed Analysis of $CRCL and its Impact on EBITDA

On the financial analysis front, a detailed report on the crypto asset $CRCL highlights the sensitivity of its profit outlook to changes in regulatory reserve rates. According to an analysis by Coinage NFT holder Sean M. Farrell, every 25 basis points (bps) cut in the reserve rate could lower 2026 EBITDA estimates by approximately $100 million, assuming other variables stay constant.

This quantification helps investors understand the tight interplay between regulation, yield predictions, and token valuation. The projection of a $58.50 share price target for 2026 offers a concrete benchmark to track $CRCL’s performance amidst evolving monetary policy landscapes, providing a solid example of how traditional financial metrics and crypto assets can coexist in analysis frameworks.

Behavior of NFT Holders in Decentralized Exchanges: A Look at Bean DEX and Monad Ecosystem

Another intriguing dimension comes from the behavioral analysis of NFT holders in decentralized exchanges (DEX). Using Bean DEX, which holds a strong position within the Monad ecosystem, questions arise such as: Are NFT holders active participants in DEX trading? Do they trade manually or behave like bots by trading solely automated DeFi tokens?

This line of inquiry is crucial because the activity patterns of NFT holders can significantly influence liquidity and market dynamics on DEXs. If holders act like bots focusing narrowly on DeFi tokens, the market may experience specific liquidity pockets and trading behaviors. Conversely, if they represent quality, diverse users, this could imply healthier ecosystem engagement. Such user behavior insights inform platform design, liquidity provisioning, and ultimately investor confidence.

Utility and Analytics in the $CITY Token Ecosystem: Real-Time Whale Alerts and Market Signals

The $CITY token ecosystem positions itself as a comprehensive financial utility on the $SUI blockchain, offering a suite of real-time tools targeted at “whale” traders—participants transacting large volumes. These tools include customizable volatility alerts, rare NFT sniping notifications, whale wallet updates, and new coin alerts.

This constellation of features equips traders and collectors with timely information to make strategic decisions, capitalize on market movements, and protect portfolios. More than just a token, $CITY serves as an intelligence hub within the SUI ecosystem, underscoring the growing trend of financial utilities tailored to niche trader segments rather than broad, generic tools.

Technical Market Analysis and Trade Planning with Crypto and Traditional Assets

A poignant example of technical trading strategy comes from a BTC/USD analysis focusing on potential buy zones identified through liquidity zones and price action signals like bullish Change of Character (CHoCH) and Fair Value Gaps (FVG) across timeframes. Such analyses, combining tools from both crypto and traditional financial markets, demonstrate the sophistication of current trading approaches and reinforce the crossover appeal of crypto assets.

SocialFi and Loyalty Programs: ZenFrogs Joins GiveRep Loyalty List

Finally, blending NFTs, social finance (SocialFi), and loyalty, projects such as ZenFrogs are creating new user engagement models. Recently joining the GiveRep loyalty list, ZenFrogs leverages its $3.5 million TVL to reward users who participate actively in farming REP points, linked to airdrops and possibly governance rewards. The recent 9.3% price boost over seven days illustrates how community-driven incentives can catalyze token appreciation and ecosystem vitality.

Conclusion: A Tapestry of Innovation on the Web3 Frontier

What emerges from these highlights is a vibrant tapestry of Web3 innovation, where art, AI, DeFi, NFTs, and financial analysis are no longer siloed but deeply interwoven. Art platforms like Artsted are pushing creative boundaries with autonomous AI agents, while DeFi tools like Magic Newton introduce risk-aware intelligence critical to maintaining user trust. Financial analyses rooted in traditional metrics now map clearly onto crypto tokens, guiding investment decisions with nuance and precision.

Moreover, the behavior of NFT holders within decentralized exchanges illuminates shifts in market dynamics, and token ecosystems such as $CITY provide tailored utilities for sophisticated traders. SocialFi projects like ZenFrogs remind us that community and incentive design remain the beating heart of the space.

As these elements continue evolving, the Web3 environment is not only expanding in technical capability but also maturing in sophistication and utility. In such a dynamic context, keeping abreast of these intersections offers a competitive edge and inspires a richer understanding of what the future of decentralized digital economies and culture might hold.

—

Sources

– Artsted Twitter Announcement: https://twitter.com/havelaw11/status/1666384123456781090

– Magic Newton Risk Filters: https://twitter.com/Vntry88nft/status/1666060728567652865

– Coinage Media’s $CRCL Analysis: https://twitter.com/coinage_media/status/1666140975248889344

– Bean DEX and Monad Ecosystem Analysis: https://twitter.com/_christian_obi/status/1666107032875644933

– Alpha City Utility Features: https://twitter.com/AlphaCity_AI/status/1666100029389656320

– BTC/USD Technical Analysis by Dua Fatima: https://twitter.com/fx_fatima1/status/1666110050070710275

– ZenFrogs Loyalty Program Update: https://twitter.com/longpham2730/status/1666058034564787200