The United States has imposed new sanctions on several North Korean bankers and financial entities, accusing them of laundering stolen cryptocurrency to fund the country’s nuclear weapons and missile programs. The Treasury Department’s Office of Foreign Assets Control (OFAC) announced the measures on November 4, targeting eight individuals and two organizations linked to North Korea’s illicit financial activities. Among those sanctioned are key figures associated with First Credit Bank, an IT outsourcing company called KMCTC, and several North Korean bank representatives operating in China and Russia.

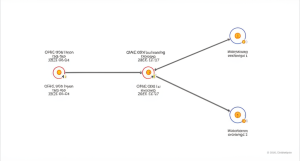

The U.S. government alleges that these individuals and entities have played a central role in helping North Korea launder funds obtained through cyberattacks and cryptocurrency theft. According to Treasury officials, North Korean hackers have stolen more than $3 billion in digital assets over the past three years, making Pyongyang the world’s most prolific state-sponsored cybercriminal actor. The sanctioned bankers are accused of managing funds for First Credit Bank, including approximately $5.3 million in cryptocurrency, and facilitating the movement of these illicit proceeds through shell companies and proxy accounts.

The Treasury Department emphasized that North Korea relies on a network of overseas bank representatives, shell companies, and financial institutions to launder money, evade sanctions, and finance its weapons programs. The U.S. has previously warned businesses to be vigilant against North Korean IT workers who may infiltrate financial systems under false identities to conduct illegal activities. The latest sanctions are part of a broader effort to disrupt North Korea’s ability to generate revenue through cybercrime and to prevent the country from accessing the global financial system.

In addition to targeting North Korean actors, the U.S. has also taken action against third-party entities that have facilitated the laundering of North Korean cybercrime proceeds. For example, the Financial Crimes Enforcement Network (FinCEN) recently issued a final rule under Section 311 of the USA PATRIOT Act, prohibiting U.S. financial institutions from maintaining or opening correspondent accounts for Huione Group, a financial services company accused of laundering at least $4 billion in illicit funds, including millions stolen by North Korean hackers. This move effectively cuts off Huione Group from the U.S. financial system and aims to prevent North Korea from indirectly accessing American markets.

The sanctions highlight the growing threat posed by North Korea’s use of cryptocurrency and cybercrime to circumvent international sanctions and fund its military ambitions. As North Korea faces increasing economic pressure from global sanctions, the country has turned to high-tech methods to generate revenue, with cyberattacks on cryptocurrency exchanges and financial institutions becoming a key source of income. Reports indicate that North Korean hackers, particularly the Lazarus Group, have been responsible for a series of major attacks on global exchanges, stealing billions of dollars in digital assets.

The U.S. government’s actions underscore the importance of international cooperation in combating cybercrime and financial crime. By targeting both North Korean actors and their foreign facilitators, the U.S. aims to disrupt the networks that enable Pyongyang to launder stolen funds and finance its weapons programs. The sanctions also serve as a warning to financial institutions and businesses worldwide to remain vigilant against the risks posed by North Korea’s cybercrime activities and to implement robust anti-money laundering measures to prevent the flow of illicit funds through their systems.

資料來源:

[2] news.cnyes.com

[3] www.binance.com

[4] www.163.com

[5] www.rfi.fr

[6] www.163.com

Powered By YOHO AI