Cryptocurrency Market Analysis: Trends, Insights, and Future Outlook (August 2025)

Introduction: A Volatile but Promising Landscape

The cryptocurrency market remains one of the most dynamic and unpredictable financial arenas, where digital assets fluctuate based on macroeconomic factors, technological advancements, and investor sentiment. As of August 2025, Bitcoin (BTC) and Ethereum (ETH) continue to dominate discussions, while altcoins like Lista DAO (LISTA) and Polymesh (POLYX) showcase significant price movements. This report provides an in-depth analysis of recent market trends, key developments, and strategic insights for investors.

—

Bitcoin’s Historical Performance and Current Trends

Bitcoin’s August Historical Returns

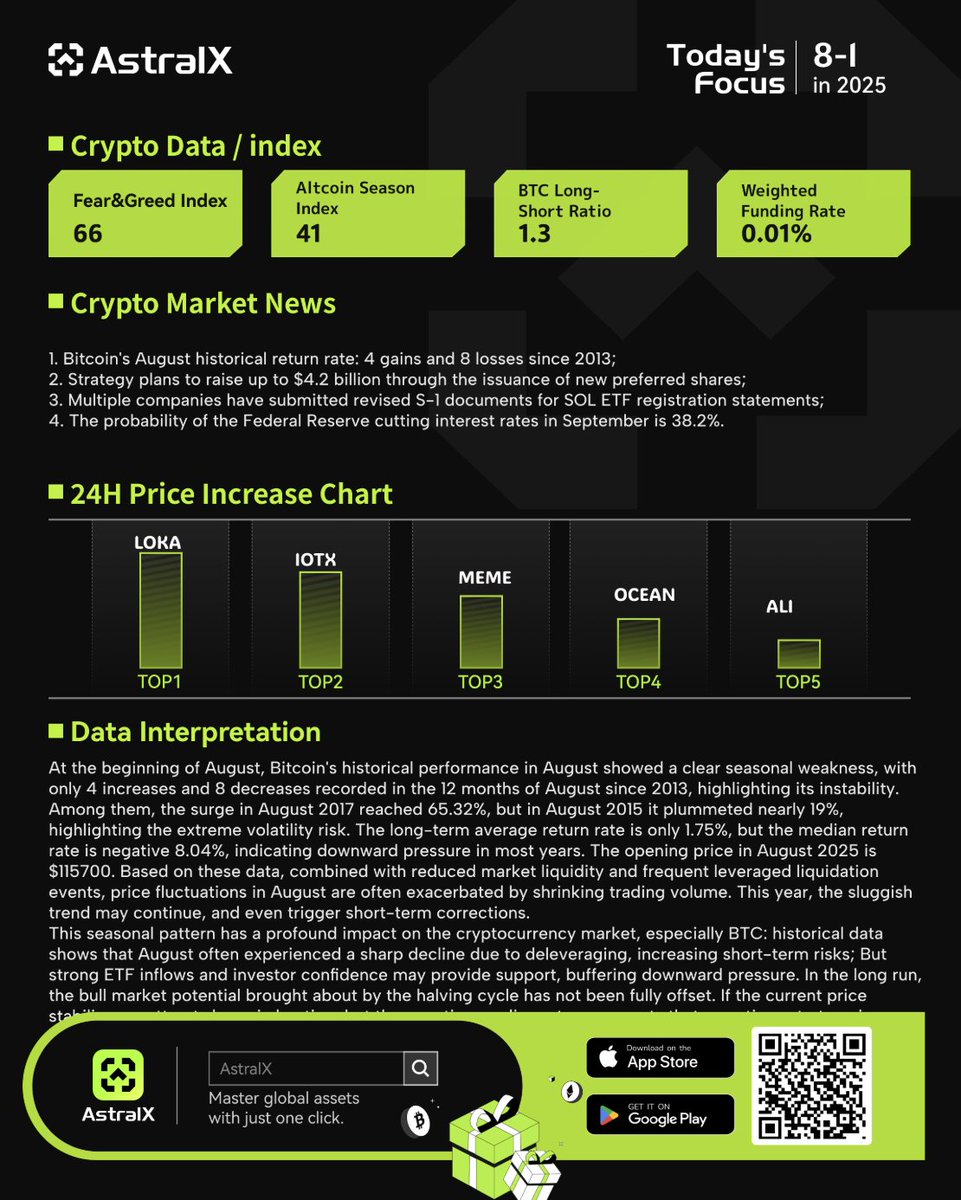

Bitcoin’s performance in August has been historically mixed, with a record of 4 gains and 8 losses since 2013. This volatility underscores the importance of strategic timing in crypto investments. Despite recent fluctuations, Bitcoin remains a cornerstone of the digital asset ecosystem, influencing broader market sentiment.

Bitcoin’s Price Dip Below $115,000

Bitcoin recently experienced a notable downturn, slipping below the $115,000 mark. This decline has sparked debates among analysts regarding whether this is a temporary correction or the beginning of a longer-term bearish trend. Some attribute this movement to macroeconomic factors, such as the Federal Reserve’s interest rate policies, while others point to profit-taking after a prolonged bull run.

—

Ethereum’s Resurgence and Altcoin Activity

Ethereum’s Rebound Near March 2024 Highs

Ethereum (ETH) has shown resilience, rebounding to levels near its March 2024 high of $3,980. This recovery suggests renewed investor confidence in Ethereum’s long-term potential, particularly as the network continues to evolve with upgrades like Ethereum 2.0 and increased adoption of decentralized finance (DeFi) applications.

Altcoin Market Dynamics

Altcoins have seen increased trading activity, with several tokens experiencing significant price movements. For instance:

– Lista DAO (LISTA) has surged by +41.05% in 60 days and +62.63% in 90 days, indicating strong bullish momentum.

– Polymesh (POLYX) has shown volatility but has rebounded positively in the past 60 days despite a -47.02% year-to-date decline.

These movements highlight the speculative nature of altcoins, where rapid gains and losses are common.

—

Key Market Developments and Strategic Moves

Strategy’s $4.2 Billion Fundraising Plan

Strategy, a prominent player in the crypto space, has announced plans to raise up to $4.2 billion through the issuance of new preferred shares. This move could inject significant liquidity into the market, potentially influencing Bitcoin and Ethereum prices.

Virtuals Protocol (VIRTUALS) and AI Integration

Virtuals Protocol (VIRTUALS) has gained attention for its innovative approach to integrating artificial intelligence (AI) with Metaverse technologies. This fusion of cutting-edge tech could position VIRTUALS as a key player in the evolving digital economy.

VAPE’s BNB Treasury Program

VAPE has launched the world’s largest BNB treasury program, creating structured arbitrage opportunities in the cryptocurrency market. This initiative could enhance liquidity and stability for BNB, benefiting traders and investors alike.

—

Technical Analysis and Trading Insights

Lista DAO (LISTA) Technical Outlook

Lista DAO (LISTA) is currently trading at approximately $0.2757, with strong upward momentum in recent months. Traders should monitor key resistance levels to determine potential entry and exit points.

Polymesh (POLYX) Volatility and Recovery

Polymesh (POLYX) has experienced significant volatility but has shown signs of recovery in the past 60 days. Investors should remain cautious due to its high risk-reward profile.

BNB’s Bullish Confirmation

BNB has retested a previous resistance level, providing a strong bullish confirmation. Analysts expect continued growth toward the $844 level, making it an attractive option for traders seeking short-term gains.

—

Crypto Trading Tools and Resources

Maximizing Profits with Trading Tools

The cryptocurrency market offers a variety of tools to streamline analysis, automate trades, and provide real-time market insights. Leveraging these tools can enhance trading efficiency and profitability.

Top Crypto Podcasts and Resources

For investors looking to stay informed, top podcasts and resources include:

– CoinDesk

– The Pomp Podcast

– Unchained

These platforms provide expert insights into the latest trends and developments in the crypto space.

—

Conclusion: Navigating the Crypto Market in 2025

The cryptocurrency market in August 2025 presents both opportunities and challenges. Bitcoin’s volatility, Ethereum’s resilience, and the rise of altcoins like Lista DAO and Polymesh highlight the sector’s dynamic nature. Strategic moves by major players, such as Strategy’s $4.2 billion fundraising plan and VAPE’s BNB treasury program, could further shape market trends.

For investors, staying informed through technical analysis, leveraging trading tools, and following expert insights will be crucial in navigating this ever-evolving landscape. As the crypto market continues to mature, those who adapt to its fluctuations will be best positioned for long-term success.

—

Sources