Bitcoin’s Resilience: Shrugging Off External Pressures

Introduction: The Unstoppable Force?

In the ever-evolving landscape of digital finance, Bitcoin has emerged as a formidable force, defying conventional market dynamics. Often labeled as a volatile asset, Bitcoin has recently demonstrated an uncanny ability to withstand external pressures that would typically send other assets into a tailspin. This resilience is not just a fleeting trend but a defining characteristic that challenges the traditional narrative surrounding cryptocurrencies. The question arises: What is driving this newfound strength, and what does it mean for the future of Bitcoin?

Decoding the “Shrug”: What Does it Mean?

The term “shrug” in the context of Bitcoin’s market behavior refers to the cryptocurrency’s ability to remain relatively unaffected by events that would typically cause significant price fluctuations. Unlike traditional assets, which often react dramatically to news such as interest rate changes, geopolitical tensions, or large sell-offs, Bitcoin has shown a remarkable capacity to absorb these shocks. This behavior suggests a growing maturity in the cryptocurrency market and a decoupling from traditional market dynamics.

Case Study 1: The Galaxy Digital Dump

One of the most striking examples of Bitcoin’s resilience is its reaction to Galaxy Digital’s massive Bitcoin sale. In a single transaction, the company offloaded over 80,000 Bitcoin, worth billions of dollars. Such a large-scale sell-off would typically trigger a significant price drop due to increased supply and panic selling. However, Bitcoin experienced “barely a blip,” demonstrating an impressive capacity to absorb the shock. This suggests a deep pool of buyers ready to step in and accumulate Bitcoin, even at relatively high prices.

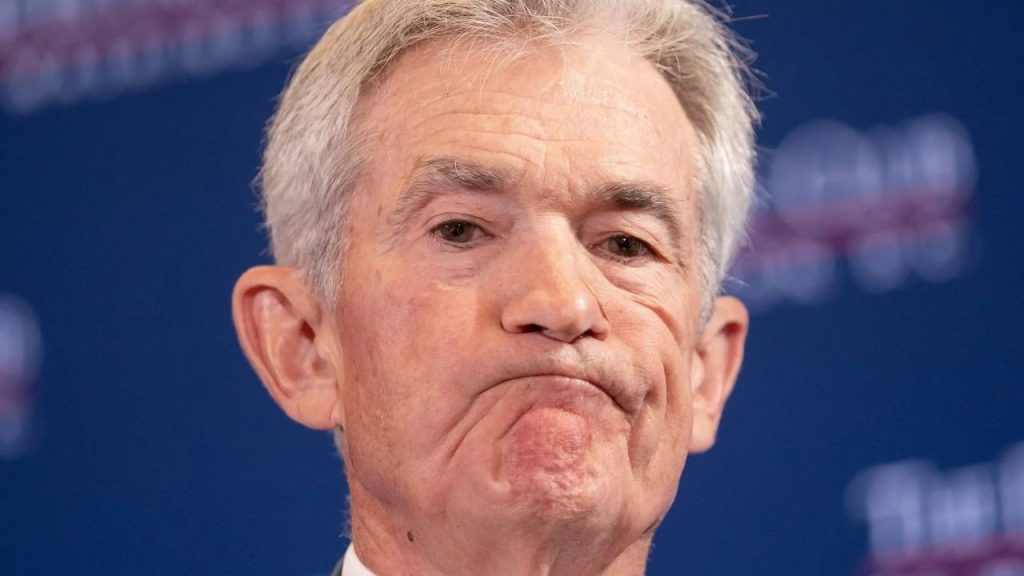

Case Study 2: Navigating the Fed’s Labyrinth

The U.S. Federal Reserve’s monetary policy decisions often send ripples through global markets. Bitcoin’s reactions to these decisions have been closely watched, and the cryptocurrency has often defied expectations. In several instances, Bitcoin has “shrugged off” Fed announcements, including rate hikes and pauses.

One report mentioned Bitcoin initially tumbling after the Fed maintained interest rates, but quickly recovering. Similarly, Bitcoin has been observed to rally following the release of the Federal Reserve’s fund rate decision. This counterintuitive behavior suggests that Bitcoin is not necessarily tied to the same factors influencing traditional markets.

Case Study 3: Geopolitical Turmoil

Geopolitical events, such as wars and trade disputes, often create uncertainty and volatility in financial markets. However, Bitcoin has shown a remarkable ability to withstand these pressures. One report noted that Bitcoin “shrugged off” the war, suggesting that investors are increasingly viewing the cryptocurrency as a safe haven asset, similar to gold, during times of global instability. This perception is fueled by Bitcoin’s decentralized nature and its resistance to government control.

The Drivers of Resilience: Why is Bitcoin So Unfazed?

Several factors contribute to Bitcoin’s increasing resilience:

Growing Institutional Adoption: Large institutional investors, such as hedge funds, asset managers, and corporations, are increasingly allocating capital to Bitcoin. This influx of institutional money provides a strong foundation of demand, helping to stabilize the price and absorb large sell-offs.

Increasing Retail Participation: The number of retail investors holding Bitcoin continues to grow. This broad base of support provides a buffer against panic selling and helps to maintain a steady level of demand.

Safe Haven Narrative: Bitcoin is increasingly being viewed as a safe haven asset, similar to gold. This perception is driven by its decentralized nature, its limited supply, and its resistance to government control. During times of economic uncertainty or geopolitical turmoil, investors may turn to Bitcoin as a store of value.

Decoupling from Traditional Markets: Bitcoin’s performance is becoming less correlated with traditional asset classes like stocks and bonds. This decoupling suggests that Bitcoin is developing its own unique dynamics, driven by factors specific to the cryptocurrency market.

Maturity of the Market: The Bitcoin market is maturing, with more sophisticated trading tools, infrastructure, and regulatory frameworks in place. This maturity reduces volatility and makes the market more efficient.

The Limits of Resilience: What Could Break the Shrug?

While Bitcoin has demonstrated remarkable resilience, it is not invincible. Certain events could still trigger significant price drops:

Regulatory Crackdowns: Governments could impose strict regulations on Bitcoin, such as banning its use or imposing heavy taxes. Such actions could significantly reduce demand and negatively impact the price.

Technological Flaws: The discovery of a critical flaw in Bitcoin’s code could undermine confidence in the cryptocurrency and lead to a sell-off.

Loss of Faith: A significant loss of faith in Bitcoin’s underlying technology or its long-term viability could trigger a mass exodus of investors.

Extreme Market Conditions: While Bitcoin has shown resilience, extreme market conditions, such as a global financial crisis, could still lead to a significant price decline.

Conclusion: A New Paradigm?

Bitcoin’s ability to shrug off negative news and events represents a significant shift in the cryptocurrency market. While volatility remains a characteristic of Bitcoin, the increasing resilience suggests a growing maturity and a decoupling from traditional market dynamics. Whether this trend continues remains to be seen, but it raises important questions about the future of Bitcoin and its role in the global financial system. The narrative has changed. No longer is Bitcoin a fragile experiment, easily toppled by a single event. It’s evolving into something more akin to a digital fortress, weathering storms and emerging stronger, forever altering the landscape of finance.