Cryptocurrency Market Analysis: Trends, Challenges, and Opportunities

Introduction: A Volatile Week in Crypto

The cryptocurrency market has been a rollercoaster in recent days, with Bitcoin (BTC) showing mixed signals, meme coins facing declines, and altcoins experiencing varying levels of volatility. This report analyzes key trends, technical indicators, and market sentiment to provide a comprehensive overview of the current state of digital assets.

—

Bitcoin: Stalled Rally and Technical Challenges

Bitcoin’s Price Action and Resistance Levels

Bitcoin has been struggling to break past key resistance levels, particularly around $118,600. A recent 5.7% decline in Pepe (PEPE), a popular meme coin, highlights the broader weakness in altcoins amid Bitcoin’s stalled rally. The failure to surpass $0.000013 resistance has triggered bearish signals, with $1.92 million in whale inflows suggesting potential distribution.

Technical Indicators and Market Sentiment

– 1H Chart: Bitcoin shows signs of weakening bullish momentum, with key support at $116,911 and resistance at $121,700.

– RSI and MACD: The Relative Strength Index (RSI) indicates potential exhaustion, while the Moving Average Convergence Divergence (MACD) suggests a bearish crossover.

– Hashrate Milestone: Bitcoin’s network hashrate hit 1,000 exahashes per second (EH/s), a new all-time high, indicating strong miner participation. However, concerns arise over centralization, with Foundry USA and Antpool controlling ~50% of the hashrate.

Long-Term Potential and Price Targets

Despite short-term volatility, Bitcoin’s long-term upside remains significant:

– TopCap Model: Predicts a potential 366% upside to $550,409.

– DeltaTop Model: Suggests a 109% upside to $247,752.

– Terminal Price Model: Estimates a 106% upside to $243,489.

—

Altcoins: Mixed Performance and Key Developments

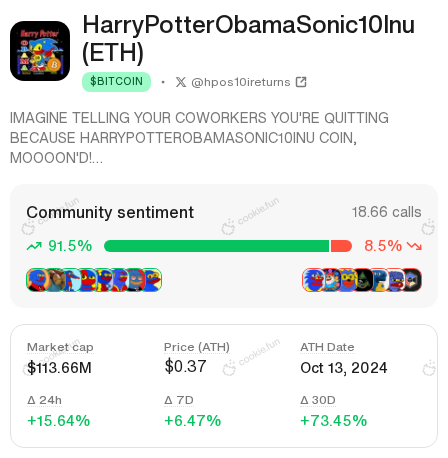

Meme Coins Under Pressure

– Pepe (PEPE): A 5.7% decline reflects broader weakness in meme coins, with whales potentially distributing holdings.

– Dogecoin (DOGE), Shiba Inu (SHIB), and Others: Many meme coins are facing downward pressure as investors shift focus to more stable assets.

Polygon (MATIC) and the Shift to POL

– MATIC’s Decline: Once trading at 800 satoshis (sats) on POL/BTC, it has dropped to 200 sats, raising concerns about its long-term viability.

– Migration to POL: The transition from MATIC to POL is only 85% complete, with users frustrated by delays and lack of clarity.

Other Altcoins: Ethereum, Solana, and More

– Ethereum (ETH): Faces selling pressure, with the MACD below the signal line and price below key moving averages.

– Solana (SOL), Cardano (ADA), and XRP: Show mixed signals, with some altcoins struggling to maintain upward momentum.

—

Trading Strategies and Market Psychology

The Battle Between Analysis and Instinct

Many traders face a dilemma between technical analysis and market instinct. For example, one trader noted:

> *”My trading plan says enter… My instinct says another. The battle of ideas and analysis delays and slows the decision.”*

This highlights the importance of balancing discipline with adaptability in trading.

Whale Activity and Market Manipulation

– Whale Inflows: Significant inflows into Pepe (PEPE) suggest potential distribution, which could lead to further downside.

– Market Manipulation Risks: Large holders can influence prices, making it crucial for traders to monitor on-chain data and exchange flows.

—

Conclusion: Navigating a Complex Market

The cryptocurrency market remains highly dynamic, with Bitcoin facing resistance while altcoins experience mixed performance. Key takeaways include:

As the market evolves, staying informed and adaptable will be crucial for investors and traders alike.

—

Sources