Navigating the Crypto and NFT Landscape: A Deep Dive into Recent Trends and Insights

The cryptocurrency and NFT markets continue to evolve, presenting both opportunities and challenges for investors, traders, and creators. Recent discussions on platforms like Twitter have highlighted key developments, from reward structures to market cycles and emerging projects. Below, we break down the latest trends, analyze their implications, and explore what they mean for the broader ecosystem.

—

1. Reward Distribution in the Kaito Ecosystem: A Closer Look

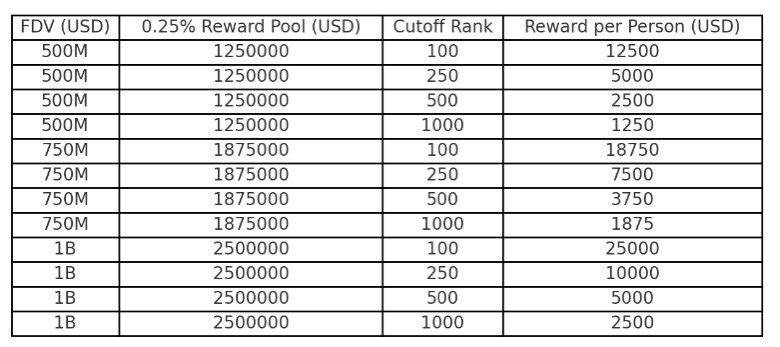

The announcement by @boundless_xyz regarding a 0.25% reward for creators through Kaito has sparked discussions about how incentives are structured within blockchain ecosystems. While the reward rate itself is reasonable, the real question lies in how these rewards are distributed.

Why Distribution Matters More Than the Rate

– Fairness and Incentive Alignment: A well-distributed reward system ensures that creators, stakeholders, and early adopters are fairly compensated, fostering long-term engagement.

– Economic Sustainability: If rewards are concentrated among a few, it may lead to short-term gains but long-term disillusionment among the broader community.

According to @soonlidaero’s analysis, the valuation potential of Kaito depends heavily on how these rewards are allocated. If the distribution is transparent and equitable, it could drive sustained growth and adoption.

—

2. NFT Market Cycles: A Potential Turning Point

The NFT market has been volatile, but recent analysis suggests a potential bullish reversal. @dj_david943 highlights that $NFT has completed its bearish cycle, with 15 million in open edition (OE) sales, indicating a possible shift in momentum.

Key Indicators of a Bullish Reversal

– Low-Timeframe (LTF) Buildup: For a sustained uptrend, smaller price movements (LTF) must align with higher-timeframe (HTF) trends.

– Breaking Resistance Levels: If key resistance levels are breached, it could signal a shift from bearish to bullish sentiment.

– New All-Time Highs (ATHs): If LTF accumulation leads to HTF confirmation, we may see new ATHs, reinforcing bullish momentum.

This analysis underscores the importance of technical indicators in predicting market movements, especially in the highly speculative NFT space.

—

3. The Rise of Anoma’s Yapping: A Testnet Success Story

@OOPS_NFT shares insights from participating in Anoma’s Yapping testnet, accumulating 150,000 points over five days. The engagement levels suggest strong community interest, with top participants remaining active.

Why Testnet Participation Matters

– Community Engagement: High participation indicates strong developer and user interest, which is crucial for a project’s long-term success.

– Network Effects: Early adopters who accumulate points or rewards are more likely to stay invested, creating a self-reinforcing cycle of growth.

If Anoma continues to foster this level of engagement, it could position itself as a key player in the Aptos DeFi ecosystem.

—

4. AI-Powered Trading and Market Insights

@trade365days emphasizes the role of AI-driven trading strategies in navigating volatile markets. With real-time insights across stocks, crypto, forex, and commodities, traders can make more informed decisions.

The Role of AI in Trading

– Predictive Analytics: AI models can identify patterns that human traders might miss, improving decision-making.

– Risk Management: Automated tools help mitigate risks by executing trades based on predefined strategies.

– Market Sentiment Analysis: AI can gauge market sentiment by analyzing social media, news, and trading volumes, providing a more holistic view.

As markets become more data-driven, AI will play an increasingly critical role in trading strategies.

—

5. $AMI: A Rising Star in Aptos DeFi

@nft_pokeworld highlights $AMI as a project with strong fundamentals, real traction, and community support. If this momentum continues, it could become a core asset in Aptos DeFi.

What Makes $AMI Stand Out?

– Community-Driven Growth: Strong community engagement often correlates with long-term success.

– Real-World Utility: Projects that solve real problems tend to outperform meme coins in the long run.

– Market Positioning: If $AMI can establish itself as a key player in Aptos DeFi, it could see significant appreciation.

Investors should keep a close eye on $AMI’s development, as it may represent a high-potential opportunity in the evolving DeFi landscape.

—

6. The Importance of Discipline in Trading

@YoCryptoclub reminds traders that discipline beats emotion in the markets. Whether trading Bitcoin, altcoins, or NFTs, sticking to a strategy is crucial for long-term success.

Key Takeaways for Traders

– Risk Management: Never risk more than you can afford to lose.

– Emotional Control: Avoid impulsive decisions driven by FOMO (Fear of Missing Out) or panic.

– Continuous Learning: Markets evolve, and staying informed is essential for adapting strategies.

—

7. UMA Alpha: Analyzing $CORRUPTED

@umaonsol provides an in-depth analysis of $CORRUPTED, a meme-themed NFT project that leverages internet culture for engagement. With a CMC tier of C and a market cap of $3,223, it remains a niche but intriguing project.

What to Watch For

– Meme Coin Volatility: Meme coins often experience extreme price swings, making them high-risk, high-reward investments.

– Community Hype: Projects like $CORRUPTED thrive on viral trends, so monitoring social media sentiment is key.

– Long-Term Viability: While meme coins can generate short-term gains, their long-term sustainability depends on utility and adoption.

—

8. Sonic NFT Market Health Check

@GangstaLions provides a real-time health check of the Sonic NFT market, highlighting trends in volume, trades, and market sentiment via the PaintSwap dashboard.

Key Metrics to Monitor

– Trading Volume: High volume indicates strong liquidity and market interest.

– Market Sentiment: Positive sentiment can drive price appreciation, while negative sentiment may signal a downturn.

– Summary Metrics: Tools like PaintSwap provide a consolidated view of market performance, helping traders make data-driven decisions.

—

Conclusion: The Future of Crypto and NFTs

The crypto and NFT markets remain dynamic, with reward structures, market cycles, AI trading, and community-driven projects shaping the landscape. As we move forward, investors must:

– Stay Informed: Keep up with the latest trends and analyses.

– Diversify Strategies: Combine technical analysis, AI insights, and disciplined trading.

– Focus on Long-Term Value: While short-term gains are tempting, sustainable projects with real utility tend to outperform in the long run.

The future of crypto and NFTs is bright, but success will depend on adaptability, discipline, and a deep understanding of market dynamics.

—

Sources