The BITCOIN Act of 2025: A Detailed Analysis of the Proposed U.S. Strategic Bitcoin Reserve

Introduction: A Digital Asset Revolution

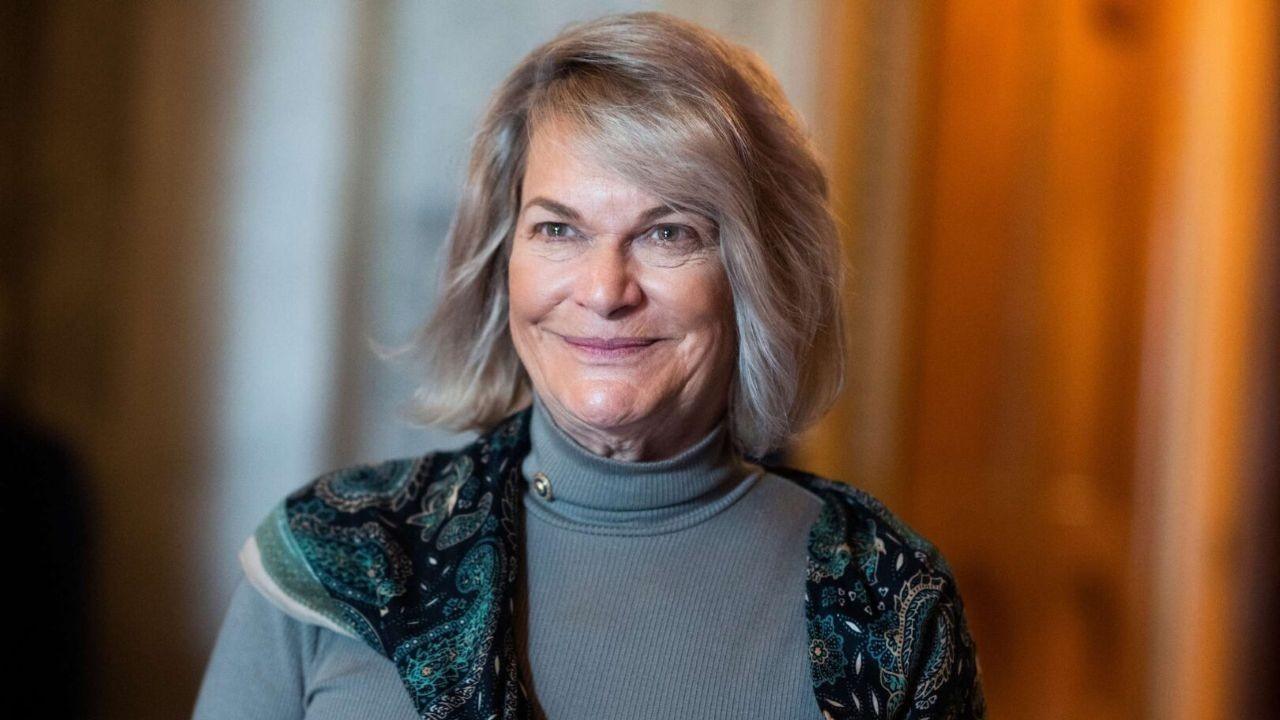

The financial landscape is undergoing a seismic shift, driven by the rise of cryptocurrencies. Among these digital assets, Bitcoin stands as a pioneer, challenging traditional financial systems and prompting governments worldwide to reconsider their economic strategies. In the United States, Senator Cynthia Lummis, a staunch advocate for cryptocurrency integration, has introduced the BITCOIN Act of 2025. This groundbreaking legislation proposes the establishment of a U.S. Strategic Bitcoin Reserve (SBR), a move that could redefine America’s financial future and solidify its position in the digital asset revolution.

The Genesis of the BITCOIN Act

The BITCOIN Act of 2025, introduced by Senator Cynthia Lummis and Congressman Nick Begich, marks a pivotal moment in U.S. cryptocurrency policy. Officially presented on March 11, 2025, the bill aims to create a national cryptocurrency policy centered around a Strategic Bitcoin Reserve. This reserve would serve as a strategic asset, enhancing America’s financial stability and global competitiveness.

Senator Lummis, often referred to as the “Crypto Queen,” has been a long-time advocate for Bitcoin. She recognizes its potential as a store of value and a hedge against inflation, envisioning the BITCOIN Act as a means to harness these properties for national benefit. Lummis has consistently emphasized the need for regulatory clarity in the crypto industry, arguing that the lack of clear rules pushes innovation overseas. Her leadership in Senate committees focused on digital assets underscores her commitment to this cause.

Key Provisions of the BITCOIN Act

The BITCOIN Act of 2025 encompasses several key provisions designed to integrate Bitcoin into the U.S. financial framework:

Establishment of a Strategic Bitcoin Reserve (SBR)

The centerpiece of the act is the creation of a national reserve of Bitcoin, similar to strategic reserves of other commodities like oil. The bill proposes that the U.S. government acquire up to 1 million Bitcoin for this reserve. This reserve would serve as a strategic asset, providing a hedge against inflation and currency devaluation.

Funding Mechanism

The Act intends to utilize existing funds across the Federal Reserve and the Treasury to amass this reserve, specifying that it would not be taxpayer-funded. This approach aims to alleviate concerns about the financial burden on U.S. citizens.

Regulatory Clarity

The bill seeks to provide a clear regulatory framework for digital assets. This includes defining the roles and responsibilities of various federal agencies in overseeing the crypto market, aiming to foster innovation while protecting consumers and investors.

Tax Policy Reform

Acknowledging the need for updated tax rules for cryptocurrencies, the Act proposes revisions to current tax policies that affect Bitcoin and other digital assets. These reforms aim to ease compliance burdens on miners, developers, and decentralized finance (DeFi) participants.

The Economic and Geopolitical Implications

The BITCOIN Act has far-reaching economic and geopolitical implications that extend beyond the immediate realm of cryptocurrency.

Economic Stability

By establishing a Strategic Bitcoin Reserve, the U.S. aims to diversify its financial assets and reduce its reliance on traditional reserve currencies. Bitcoin, with its decentralized nature and limited supply, could serve as a hedge against inflation and currency devaluation.

Global Competitiveness

The Act recognizes that the U.S. must embrace technological innovation to maintain its competitive edge in the global economy. By fostering a regulatory environment that supports the growth of the crypto industry, the U.S. can attract investment, create jobs, and become a leader in the digital asset space.

National Security

Integrating Bitcoin into the nation’s financial infrastructure has significant implications for national security. A strategic Bitcoin reserve can enhance the U.S.’s ability to conduct international transactions and bypass traditional financial systems, which may be subject to sanctions or political pressure.

Energy Policy

Given the energy-intensive nature of Bitcoin mining, the Act could also influence U.S. energy policy. By encouraging the use of renewable energy sources for mining operations, the U.S. can mitigate the environmental impact of Bitcoin and promote sustainable practices.

Challenges and Obstacles

Despite its potential benefits, the BITCOIN Act faces several challenges and obstacles.

Congressional Opposition

Securing bipartisan support for the Act is a significant hurdle. Lawmakers have varying degrees of understanding and acceptance of cryptocurrencies. Overcoming skepticism and educating members of Congress about the benefits of Bitcoin will be crucial.

Regulatory Uncertainty

Establishing a clear and comprehensive regulatory framework for digital assets is a complex task. Different federal agencies may have conflicting views on how to regulate the crypto market, leading to uncertainty and confusion.

Market Volatility

The volatility of Bitcoin’s price poses a challenge for managing the Strategic Bitcoin Reserve. Fluctuations in value could affect the perceived stability and credibility of the reserve.

Technical Implementation

Acquiring and securing a large quantity of Bitcoin requires sophisticated technical expertise. Ensuring the safety and security of the reserve from hacking and theft is paramount.

Public Perception

Shaping public perception of Bitcoin and addressing concerns about its use in illicit activities is essential for building support for the Act.

Lummis’s Vision and Leadership

Senator Cynthia Lummis has emerged as a central figure in the push for crypto legislation in the U.S. Her deep understanding of Bitcoin and her ability to articulate its potential benefits have earned her the moniker “Crypto Queen.” As the chair of the Senate Banking Committee’s digital assets panel, Lummis is in a unique position to shape the future of crypto policy.

Lummis has been a vocal advocate for regulatory clarity. She argues that the SEC’s current approach to crypto regulation, which relies heavily on enforcement actions, is inadequate and stifles innovation. Instead, she proposes a comprehensive framework that empowers the CFTC to regulate Bitcoin and Ethereum as commodities. Lummis is also pushing for reforms to U.S. crypto tax rules, which she believes unfairly burden miners, developers, and DeFi participants.

The Path Forward: Future Prospects and Considerations

The BITCOIN Act of 2025 represents a significant step towards integrating digital assets into the U.S. financial system. While the Act faces numerous challenges, the potential benefits are substantial. By establishing a Strategic Bitcoin Reserve, the U.S. can enhance its economic stability, promote global competitiveness, and strengthen national security.

To ensure the success of the BITCOIN Act, policymakers must address the challenges outlined above. This includes building bipartisan support, establishing a clear regulatory framework, managing market volatility, and securing the reserve from cyber threats. Furthermore, ongoing education and outreach efforts are needed to shape public perception and build confidence in Bitcoin.

Conclusion: Embracing the Future of Finance

The BITCOIN Act of 2025 is more than just a piece of legislation; it is a statement of intent. It signifies that the United States is taking the prospect of digital assets seriously and is willing to explore innovative ways to leverage their potential. As the world moves towards an increasingly digital future, embracing technologies like Bitcoin is not just an option; it’s a necessity. The BITCOIN Act, with its vision of a Strategic Bitcoin Reserve, offers a glimpse into a future where digital assets play a central role in the global financial landscape, and where the U.S. remains at the forefront of innovation and leadership.