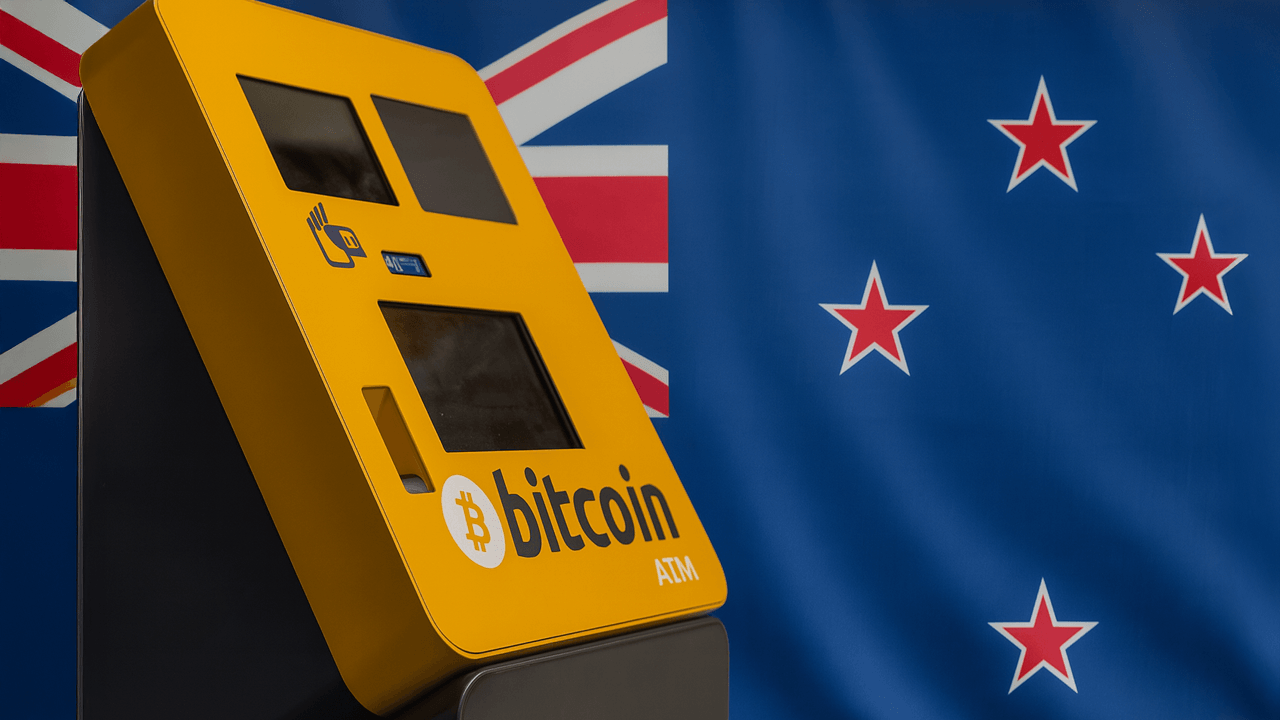

New Zealand’s recent decision to ban cryptocurrency ATMs and impose a $5,000 cap on international cash transfers has ignited a fierce debate about the balance between financial security and technological innovation. This move, framed as a necessary measure to combat money laundering and terrorist financing, has raised concerns about its potential impact on legitimate crypto users and the broader digital asset market. As the country grapples with these challenges, the question remains: Is this ban a necessary evil or a step too far?

The Rationale Behind the Ban: A Clampdown on Illicit Activities

The New Zealand government’s decision to ban crypto ATMs is rooted in growing concerns about their use in facilitating financial crimes. These machines, which allow users to convert cash into cryptocurrencies and vice versa, have become a target for criminals seeking to launder money or finance illegal activities. The anonymity and ease of use offered by crypto ATMs make them an attractive tool for those looking to obscure the origins of their funds.

Associate Justice Minister Nicole McKee has emphasized the government’s commitment to strengthening the country’s Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) regime. The ban on crypto ATMs is seen as a direct response to the Financial Intelligence Unit’s (FIU) findings, which identified these machines as a “key laundering mechanism” and a “significant vulnerability.” The FIU’s report highlighted the challenges of tracking cash-to-crypto transactions, which can be difficult to monitor and trace. By eliminating these ATMs, the government aims to significantly reduce the risk of money laundering and terrorist financing.

The Scope of the Ban: A Significant Shift in the Crypto Landscape

With approximately 220 crypto ATMs operating across New Zealand, the ban represents a substantial shift in the regulatory landscape for digital assets. These machines, once a convenient gateway for individuals to access the crypto market, will now be phased out as regulators attempt to close the loopholes they represent. The ban is expected to have a direct impact on crypto users who rely on ATMs for their transactions, particularly those who may not have access to traditional banking services or prefer the anonymity offered by cash transactions.

The $5,000 cap on international cash transfers is another measure intended to restrict the movement of illicit funds across borders. This cap aims to close another avenue that criminals have used to move money offshore, making it more difficult for them to finance illegal activities. Together, the ban on crypto ATMs and the cap on international transfers represent a comprehensive effort to tighten the regulatory framework surrounding financial transactions in New Zealand.

Concerns and Criticisms: A Double-Edged Sword?

While the government’s intentions are clear, the ban has also drawn criticism from various quarters. Some argue that it unfairly penalizes legitimate crypto users who rely on ATMs for their transactions. They point out that the vast majority of crypto transactions are not linked to criminal activity, and that the ban may disproportionately affect those who are unbanked or prefer the privacy of cash transactions.

Others have raised concerns about the potential impact on the development of the crypto market in New Zealand. They argue that the ban could stifle innovation and discourage investment in the digital asset sector. By creating a more restrictive regulatory environment, New Zealand risks falling behind other countries that are actively embracing crypto and exploring its potential benefits.

Furthermore, some critics argue that the ban is unlikely to be a silver bullet in the fight against money laundering. They point out that criminals will always find new ways to circumvent regulations, and that the ban may simply drive illicit activity underground or to other jurisdictions with less stringent controls. A more effective approach, they argue, would be to focus on strengthening regulatory oversight and improving the detection of suspicious transactions, rather than imposing blanket bans that affect legitimate users.

Striking a Balance: Innovation vs. Regulation

The debate surrounding the crypto ATM ban highlights the ongoing tension between innovation and regulation in the digital asset space. On one hand, governments have a responsibility to protect their citizens from financial crime and ensure the integrity of the financial system. On the other hand, they must also foster innovation and create an environment that allows new technologies to flourish.

Finding the right balance between these competing objectives is a complex challenge. Overly restrictive regulations can stifle innovation and drive businesses to other jurisdictions, while lax regulations can create opportunities for criminal activity and undermine public trust in the financial system. The key is to adopt a risk-based approach that targets the most serious threats without unduly burdening legitimate users and businesses.

The Future of Crypto Regulation in New Zealand

The crypto ATM ban is just one piece of a larger puzzle when it comes to regulating digital assets in New Zealand. The government is currently working on a broader framework for regulating the crypto industry, which is expected to address issues such as licensing, consumer protection, and tax compliance. The goal is to create a regulatory environment that is both robust and flexible, allowing New Zealand to reap the benefits of crypto while mitigating the risks.

As the crypto market continues to evolve, it is likely that New Zealand will need to adapt its regulatory approach to keep pace with new developments. This will require ongoing dialogue between government, industry, and the crypto community to ensure that regulations are fit for purpose and do not stifle innovation.

A Necessary Step?

The ban on crypto ATMs in New Zealand is a bold move that reflects the government’s determination to combat financial crime and protect the integrity of the financial system. While the ban has sparked debate and raised concerns about its potential impact on legitimate crypto users, it is clear that authorities believe it is a necessary step to address the risks posed by money laundering and terrorist financing. Whether this ban will be effective in the long term remains to be seen, but it is a clear signal that New Zealand is taking a proactive approach to regulating the digital asset space. Ultimately, the success of this measure will depend on the government’s ability to strike a balance between security and innovation, and to create a regulatory environment that fosters responsible growth in the crypto market.