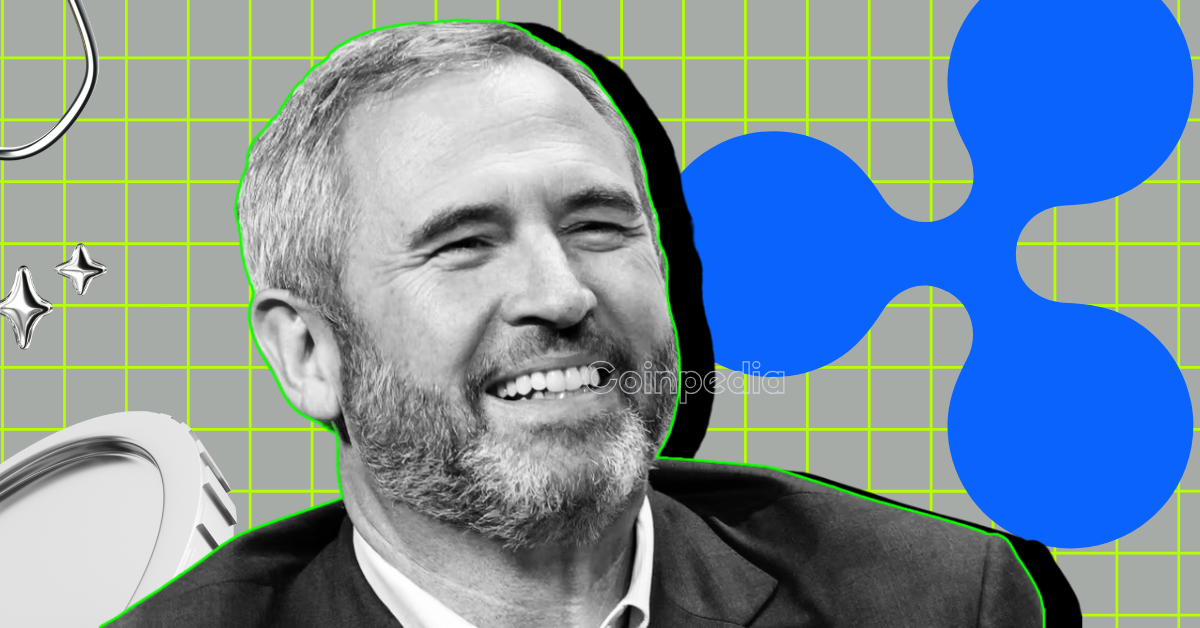

The cryptocurrency world, a realm often associated with innovation and disruption, is no stranger to controversy. The latest tempest centers around Ripple, the company behind the digital currency XRP, and Linqto, a platform facilitating private equity investments. As anxieties rippled through the XRP community, fueled by Linqto’s precarious financial position and whispers of a potential bankruptcy, Ripple’s CEO, Brad Garlinghouse, stepped into the fray to address the growing concerns. His concise, yet forceful, statement, declaring “No Business Relationship” between Ripple and Linqto, represents a crucial moment in managing the narrative surrounding this developing situation. This report will dissect the implications of Garlinghouse’s statement, analyze the potential ramifications for Ripple and XRP, and explore the broader context of the Linqto scandal, including the alleged involvement of Argentinian President Javier Milei.

Unpacking Garlinghouse’s Statement: A Strategic Denial

Garlinghouse’s declaration of “No Business Relationship” is a carefully chosen phrase. It’s not merely a denial of investment; it’s a strategic attempt to distance Ripple from any direct association with Linqto’s operations and potential liabilities. This distancing is vital for several reasons:

– Protecting Ripple’s Reputation: Association with a failing or fraudulent platform could severely damage Ripple’s credibility, which is already sensitive due to the ongoing legal battle with the SEC.

– Safeguarding XRP’s Value: Investor confidence is the lifeblood of any cryptocurrency. Rumors of entanglement with Linqto could trigger a sell-off, plummeting the price of XRP.

– Mitigating Legal Risks: Any demonstrable link between Ripple and Linqto could potentially expose Ripple to legal challenges from disgruntled Linqto investors.

The brevity of the statement suggests a desire to contain the situation quickly and prevent further speculation. However, it also leaves room for interpretation. What constitutes a “business relationship”? Does this preclude previous collaborations, indirect investments, or informal partnerships? The lack of specifics invites further scrutiny and demands more transparency from Ripple.

The Linqto Scandal: A Tangled Web

Linqto, once hailed as a revolutionary platform democratizing access to pre-IPO companies, now finds itself at the heart of a scandal. The platform allowed individuals to invest in private companies before they went public, a privilege traditionally reserved for institutional investors and high-net-worth individuals. However, recent reports suggest that Linqto is facing severe financial difficulties, with rumors circulating about a potential bankruptcy filing.

The exact nature of Linqto’s troubles remains somewhat opaque, but several factors appear to be contributing:

– Market Downturn: The broader economic downturn and the cooling of the tech market have likely impacted the valuations of the companies Linqto offered, making it difficult for investors to realize profits.

– Liquidity Issues: Matching buyers and sellers in the private equity market can be challenging, leading to liquidity problems and difficulty in fulfilling investor redemption requests.

– Allegations of Mismanagement: Whispers of mismanagement and potentially fraudulent activities have further eroded investor confidence in the platform.

The potential collapse of Linqto has sent shockwaves through the investment community, particularly among those who invested through the platform. The involvement of President Javier Milei, who reportedly promoted the platform before its downfall, adds another layer of complexity and controversy to the situation.

The Milei Connection: A Political Quagmire

The alleged involvement of Argentinian President Javier Milei in promoting Linqto is a particularly troubling aspect of the scandal. Milei, known for his pro-crypto stance and libertarian ideals, reportedly endorsed Linqto as a viable investment platform. Now, with the platform teetering on the brink of collapse, Milei faces accusations of misleading investors and potentially contributing to their financial losses.

The situation is particularly sensitive given Argentina’s economic turmoil and the widespread adoption of cryptocurrency as a hedge against inflation. Many Argentinians, seeking to protect their savings, may have invested in Linqto based on Milei’s endorsement, only to face significant losses.

The political ramifications of this scandal could be significant for Milei, potentially undermining his credibility and jeopardizing his economic reform agenda. Lawsuits from defrauded investors are already surfacing, adding further pressure on the Argentinian president and his administration.

Ripple’s Exposure: Direct vs. Indirect

While Garlinghouse has vehemently denied any direct business relationship between Ripple and Linqto, the possibility of indirect exposure remains a concern. The cryptocurrency ecosystem is interconnected, and even without a formal partnership, there may be links through shared investors, common advisors, or previous collaborations.

It is crucial for Ripple to conduct a thorough internal audit to identify any potential indirect exposure to Linqto and to assess the potential risks associated with these connections. Transparency is paramount in this situation. Ripple must be forthcoming with its findings and proactively address any concerns raised by the community.

Navigating the Storm: Ripple’s Next Steps

Garlinghouse’s statement is just the first step in navigating this complex situation. To effectively manage the fallout from the Linqto scandal, Ripple needs to take the following actions:

– Increase Transparency: Provide more details about the nature of Ripple’s relationship with Linqto, including any past interactions or indirect connections.

– Engage with the Community: Address investor concerns directly and transparently through AMAs, blog posts, and other communication channels.

– Conduct an Internal Audit: Thoroughly investigate any potential exposure to Linqto and assess the associated risks.

– Reinforce Compliance: Strengthen internal compliance procedures to prevent future entanglement with potentially problematic platforms.

– Focus on Core Business: Reiterate Ripple’s commitment to its core business of providing enterprise blockchain solutions for cross-border payments.

By taking these steps, Ripple can demonstrate its commitment to transparency, accountability, and investor protection, ultimately mitigating the damage caused by the Linqto scandal and preserving its long-term credibility.

The Lingering Shadow: Lessons Learned

The Ripple-Linqto saga serves as a cautionary tale for the cryptocurrency industry. It highlights the importance of due diligence, transparency, and responsible promotion. The allure of high returns in the private equity market can be tempting, but investors must be wary of platforms that lack transparency or exhibit signs of financial instability.

The case also underscores the potential risks associated with celebrity or political endorsements. While endorsements can generate buzz and attract investment, they can also create a false sense of security and lead to significant losses if the endorsed platform or product fails to deliver.

Ultimately, the Linqto scandal serves as a reminder that the cryptocurrency world, while brimming with innovation, is not immune to fraud, mismanagement, and market volatility. Investors must exercise caution, conduct thorough research, and diversify their portfolios to mitigate risk.

Conclusion: Weathering the Controversy

The Ripple-Linqto controversy is far from over. While Garlinghouse’s swift denial of a business relationship was a necessary first step, the situation demands continued vigilance and proactive management. Ripple’s ability to weather this storm will depend on its commitment to transparency, its willingness to engage with the community, and its unwavering focus on its core business. The shadows cast by Linqto may linger for some time, but by learning from this experience, Ripple can emerge stronger and more resilient, solidifying its position as a leader in the evolving landscape of digital finance.