Exploring the Current Landscape of Cryptocurrency Markets and Trends: Insights from June 27, 2025

Cryptocurrency markets never sit still. Every day, a flurry of developments—from market movements and regulatory shifts to technological innovation—shapes the dynamic contours of digital assets. On June 27, 2025, several noteworthy updates captured the pulse of the crypto ecosystem. This analysis dives into these updates with the intent to demystify recent market behavior, dissect investor sentiment, and identify emerging trends in the broader crypto economy.

I. Shifts in Crypto-Related Stocks and Macroeconomic Signals

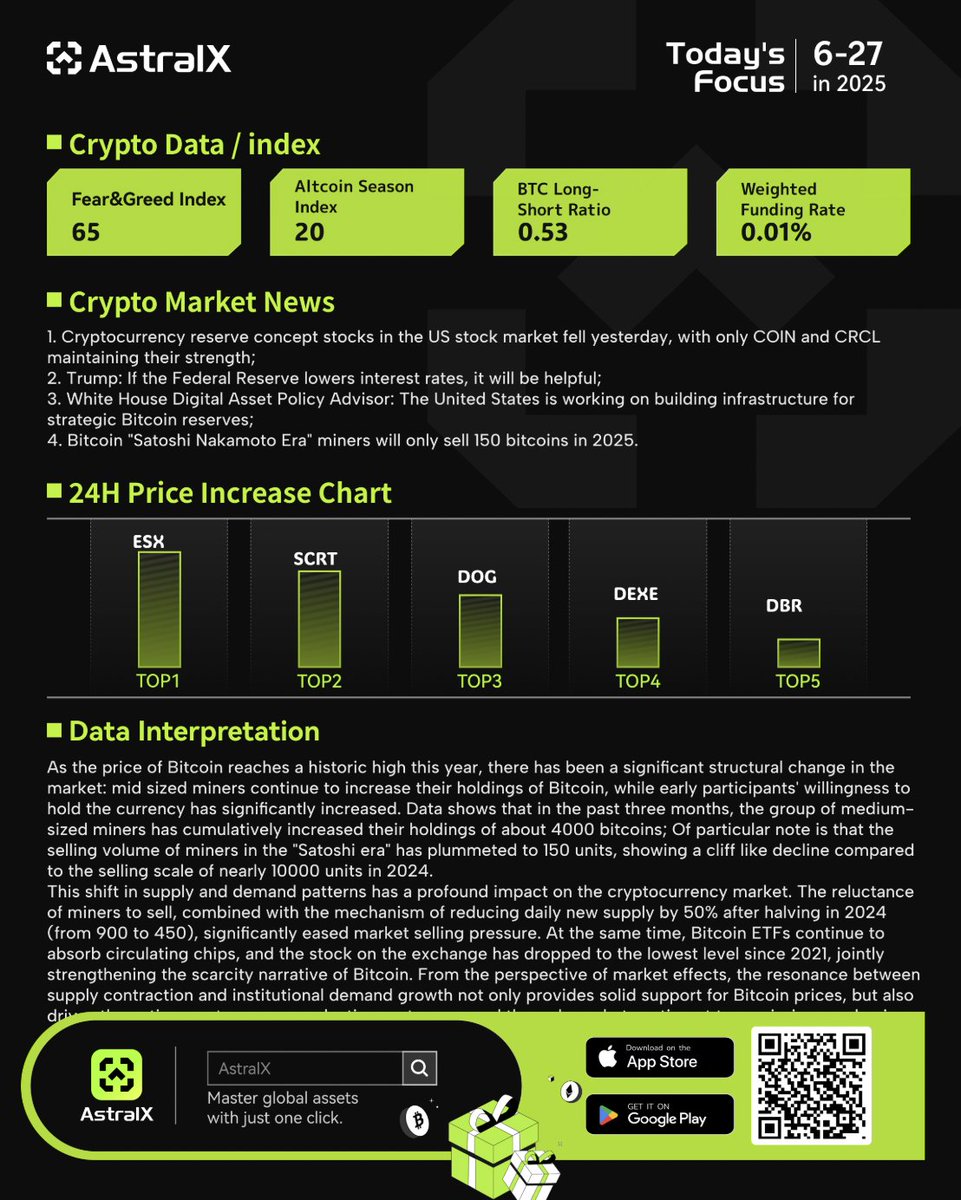

The narrative of cryptocurrency reserve concept stocks in the U.S. stock market paints a story of volatility coupled with resilience in select players. On June 26, 2025, most such stocks fell sharply. However, two—Coinbase (COIN) and Circle (CRCL)—stood their ground amidst the decline [#AstralX]. Their relative strength suggests either company-specific catalysts or investor confidence in their operational foundations amid a pressured market environment.

This stock behavior also echoes political and macroeconomic commentary. Former President Trump’s statement endorsing lower Federal Reserve interest rates to catalyze market growth adds a political lens to crypto’s environment. Lower interest rates traditionally encourage investment in riskier assets like cryptocurrencies by reducing the opportunity cost of holding them. Whether these political signals will concretely sway Fed policy or investor behavior remains speculative, but they certainly inject an additional layer of investor psychology and potential volatility [#AstralX].

II. Critical Examination of SRM Entertainment’s Capital Strategy

A deeper dive into individual crypto-related entities reveals contrasting reactions to strategic financial decisions. SRM Entertainment’s recent $100 million capital raise encapsulates the high-stakes balancing act many crypto firms face. On one hand, significant capital inflows provide fuel for development and scaling—the bullish case that investors can rally behind, betting on exponential growth opportunities. On the other, substantial dilution risks alienating current investors who fear their ownership and voting power diminish. This fear is heightened by cryptocurrency market volatility and shifting corporate governance structures, both of which can introduce new layers of uncertainty [#BeeestMod].

Analysts and investors tracking SRM’s form 8-K disclosures will weigh these competing factors closely. The ability of the company to use this fresh capital effectively while managing community and investor expectations will be pivotal.

III. Navigating Cryptocurrency Complexity: Education and Analysis Tools

The cryptocurrency space, with its burgeoning number of tokens (including thousands of altcoins), poses a significant challenge for newcomers and even seasoned investors. Education platforms and protocols like Spur Protocol aim to bridge this knowledge gap through accessible resources and evaluation frameworks [#spurprotocol]. Learning how to decode market signals, project fundamentals, and technological viability is increasingly crucial.

Further supporting this trend is the predictive use of technical analysis by some market analysts. The Elliott Wave Theory’s application in forecasting price surges for Solana’s WIF token exemplifies this approach. Elliott Wave Theory seeks to interpret recurring wave patterns in price movements, allowing technical enthusiasts to anticipate bullish or bearish phases in token prices. According to analyst Bluntz, such a bullish phase could drive up $WIF’s value significantly, triggering increased interest from traders who rely on pattern-based predictions [#AlertsViaWeb3].

IV. The Evolution of Platforms and Sentient Agents: Technological Frontiers

The rapid pace of crypto innovation is reflected in platforms like WEEX, which focus on integrating next-gen features to stay competitive and capture new market segments. Their commitment to evolving functionality is a microcosm of the sector’s relentless pursuit of technological advancement, which often spells opportunity for investors and users alike [#feelittoo_].

Of particular interest is the rise of sentient agents—autonomous, on-chain analytics bots that interpret market sentiment and behavioral data. A series on Sentient Community agents highlights “OpenAgent,” a tool deployed for DeFi traders and market participants to glean powerful insights from sentiment flows and blockchain activity [#akratomi]. These agents could reshape how traders interface with decentralized finance (DeFi) by transforming raw data into actionable intelligence, potentially changing trading strategies and risk management approaches.

V. Technical Indicators and Regulatory Insights: Layering Market Analysis

Complementing the technological tools are technical indicators such as the MACD (Moving Average Convergence Divergence), which continue to be a staple for traders’ buy/sell decision-making processes. Alerts indicating a MACD cross-up for tokens like ALGO suggest potential upward price momentum, although disclaimers remind users to combine these signals with their independent analysis to avoid pitfalls [#NooraliRah48216].

Meanwhile, long-term enforcement trend analysis in cryptocurrency regulation is gaining prominence. Multi-client projects scrutinizing a decade’s worth of enforcement patterns are uncovering signature schemes that hint at where regulators might focus their attention next. This anticipatory regulatory insight helps businesses and investors brace for legal shifts that could materially affect market operations and compliance costs.

A Thought-Provoking Conclusion: Evolving Dynamics in Crypto’s Ecosystem

June 27, 2025’s snapshot offers a glimpse into a maturing but complex crypto universe, blending finance, politics, technology, and regulation. Investors and analysts must remain agile, equipped not only with sharp data analysis tools but also an understanding of macroeconomic and political undercurrents. The introduction of autonomous agents heralds a future where machine intelligence aids human decision-making, while capital moves and regulatory foresight shape market dynamics in profound ways.

Navigating cryptocurrency’s future means continuously parsing diverse signals and layering insights—from technical price patterns to sentiment analysis and policy trends. It also invites a broader reflection: as crypto ecosystems intertwine ever deeper with traditional finance and governance, their resilience and adaptability will determine the trajectory of this revolutionary asset class.

—

Sources

– AstralX Twitter updates: https://twitter.com/astralxcom/status/

– Equity Connoisseur’s SRM analysis: https://twitter.com/BeeestMod/status/

– Spur Protocol educational content: https://twitter.com/spurprotocol/status/

– Alerts Via Web3 technical forecast: https://twitter.com/AlertsViaWeb3/status/

– WEEX platform trends: https://twitter.com/feelittoo_/status/

– Sentient Chat and OpenAgent analytics: https://twitter.com/akratomi/status/

– Cryptocurrency MACD alerts: https://twitter.com/NooraliRah48216/status/