Crypto Market Dynamics: A Deep Dive into June 2025 Trends and Predictions

Imagine the crypto market as a vast ocean, teeming with opportunities and challenges. As we navigate through June 2025, let’s explore the currents and waves shaping this digital financial landscape. From Bitcoin’s dominance to the potential impact of geopolitical events, we’ll dive into the trends and predictions that every crypto enthusiast should know.

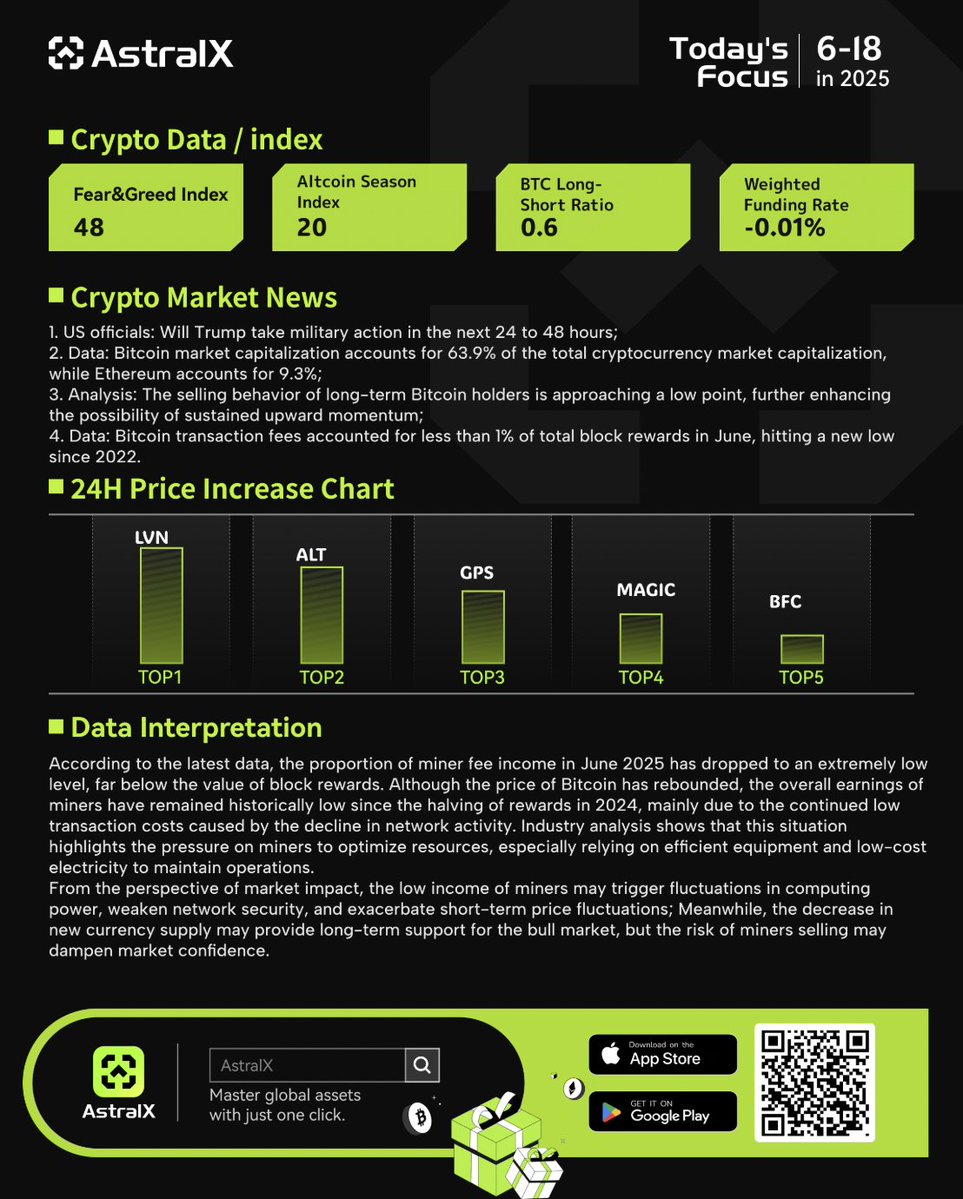

Bitcoin’s Dominance and Market Capitalization

Bitcoin, the titan of the crypto world, continues to assert its dominance. As of June 18, 2025, Bitcoin’s market capitalization accounts for a staggering 63.9% of the total cryptocurrency market capitalization[REF]astralxcom[/REF]. This dominance is a testament to Bitcoin’s enduring appeal and its status as the gold standard of cryptocurrencies. While other cryptocurrencies like Ethereum also hold significant market shares, Bitcoin’s lead is undeniable.

The Significance of Bitcoin’s Market Share

Bitcoin’s market share is more than just a number; it reflects investor confidence and the cryptocurrency’s role as a store of value. This dominance can influence market sentiment, with Bitcoin’s price movements often setting the tone for the broader crypto market. As Bitcoin goes, so often goes the rest of the market.

Geopolitical Factors: The Trump Factor

In the world of crypto, geopolitical events can have ripple effects. As of June 18, 2025, there are speculations about potential military actions by former US President Trump[REF]astralxcom[/REF]. While the direct impact on the crypto market is uncertain, such geopolitical tensions can lead to increased volatility. Investors often turn to Bitcoin and other cryptocurrencies as safe-haven assets during times of uncertainty, which can drive up prices.

Navigating Geopolitical Uncertainty

For crypto traders and investors, staying informed about geopolitical developments is crucial. Tools like chart analysis, market trackers, and portfolio managers can help navigate these uncertain waters[REF]marcus_rya74582[/REF]. By staying ahead of the game, investors can make more informed decisions and potentially capitalize on market movements.

The Role of AI in Crypto Analysis

Artificial Intelligence (AI) is revolutionizing the way we analyze and understand the crypto market. AI-powered tools can provide precise blockchain data and advanced forecasting, helping investors make better decisions. For instance, Sentient Chat is built with a crypto mode feature that offers detailed blockchain data, setting it apart from other AI tools like ChatGPT[REF]akratomi[/REF].

Leveraging AI for Better Insights

AI can analyze vast amounts of data quickly and accurately, identifying trends and patterns that human analysts might miss. By leveraging AI, investors can gain a competitive edge, making more informed and timely decisions. This is particularly important in a fast-paced market where seconds can make a significant difference.

The Power of Community and Education

The crypto community is a vibrant and dynamic ecosystem. Platforms like MatHloni provide the latest in cryptocurrency news, signals, and market updates, helping investors stay ahead of the game[REF]Jinduofweb3[/REF]. Additionally, resources like crypto podcasts and expert insights can offer valuable perspectives and analysis on the latest trends in the digital asset space[REF]TamaraWalk94448[/REF].

Educating Yourself for Success

Education is a key component of success in the crypto market. Whether you’re a seasoned trader or a newcomer, continuous learning is essential. Engaging with the community, attending webinars, and reading up on the latest developments can enhance your understanding and improve your trading strategies.

Risk Management: The Cornerstone of Successful Trading

In the volatile world of crypto, risk management is paramount. As one trader aptly put it, “Always prioritize risk management ABOVE ALL in TRADING”[REF]CRPTO_Kowalsky[/REF]. This means setting stop-loss orders, diversifying your portfolio, and being prepared to hedge your positions. By managing risk effectively, you can protect your investments and navigate market fluctuations more confidently.

Strategies for Effective Risk Management

The Future of Crypto: Trends and Predictions

Looking ahead, several trends are shaping the future of the crypto market. The increasing adoption of blockchain technology, the rise of decentralized finance (DeFi), and the growing interest in non-fungible tokens (NFTs) are just a few examples. As the market evolves, staying informed and adaptable will be key to success.

Embracing the Future

The crypto market is in a state of constant flux, with new technologies and innovations emerging rapidly. Embracing these changes and staying ahead of the curve can open up new opportunities. Whether it’s exploring new cryptocurrencies, investing in DeFi projects, or diving into the world of NFTs, the future of crypto is full of possibilities.

Conclusion: Navigating the Crypto Ocean

As we sail through June 2025, the crypto market presents both challenges and opportunities. From Bitcoin’s dominance to the impact of geopolitical events, understanding these dynamics can help you navigate the crypto ocean more effectively. By leveraging AI, staying informed, and prioritizing risk management, you can position yourself for success in this ever-changing landscape. So, grab your compass, chart your course, and set sail on the exciting journey of crypto trading.