The Role of AI in Financial Forecasting and Market Analysis

The Evolution of Financial Forecasting

Financial forecasting has evolved significantly over the years. From simple spreadsheet models to complex algorithms, the tools and techniques used to predict market trends have become increasingly sophisticated. Today, artificial intelligence (AI) is at the forefront of this evolution, offering unprecedented accuracy and efficiency in financial forecasting and market analysis.

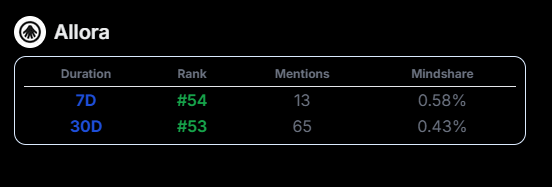

AI-powered models, like those provided by AlloraNetwork, leverage sophisticated algorithms to predict market trends in both cryptocurrency and traditional financial markets. These models analyze vast amounts of data, identifying patterns and trends that human analysts might miss. This capability is crucial in the fast-paced world of finance, where even minor market shifts can have significant impacts.

The Impact of AI on Market Analysis

Enhanced Accuracy

AI’s ability to process and analyze large datasets quickly and accurately is one of its most significant advantages. Traditional methods of market analysis often rely on historical data and manual interpretation, which can be time-consuming and prone to human error. AI, on the other hand, can analyze real-time data, providing more accurate and up-to-date predictions.

For example, AlloraNetwork’s AI models can predict market trends with a high degree of accuracy, helping users make informed decisions. This enhanced accuracy is particularly valuable in volatile markets, where rapid changes can occur.

Speed and Efficiency

AI models can process information much faster than human analysts. This speed is essential in financial markets, where timing can be crucial. AI can identify trends and patterns in real-time, allowing for quicker decision-making and more effective trading strategies.

Adaptability

AI models can adapt to changing market conditions more effectively than traditional methods. They can learn from new data and adjust their predictions accordingly, providing a more dynamic and responsive approach to market analysis.

Real-World Applications

Cryptocurrency Markets

The cryptocurrency market is particularly suited to AI-driven analysis due to its volatility and the large amount of data involved. Projects like Irys & Kaito PUSH are actively involved in the Kaito Yaps ecosystem, providing community members with opportunities to showcase their knowledge and be rewarded for their contributions to cryptocurrency discussions and analysis.

The Currency Analytics provides detailed price analyses, such as the recent breakout above a long-term pattern in Dogecoin, which could drive a major rally. This kind of analysis is crucial for traders looking to capitalize on market movements.

Traditional Financial Markets

In traditional financial markets, AI is also making a significant impact. AstralX provides in-depth analyses of Federal Reserve dynamics and ETF funds flow, helping investors understand the broader economic context in which they are operating. This kind of analysis is essential for making informed investment decisions.

The Future of AI in Finance

Continued Innovation

As AI technology continues to advance, its role in financial forecasting and market analysis is likely to become even more significant. New algorithms and models are constantly being developed, offering even greater accuracy and efficiency.

Ethical Considerations

However, the increased use of AI in finance also raises ethical considerations. Issues such as data privacy, algorithmic bias, and the potential for market manipulation need to be addressed. It is crucial that AI is used responsibly and ethically, ensuring that it benefits all market participants.

Education and Awareness

As AI becomes more prevalent in finance, there is a need for increased education and awareness. Traders and investors need to understand how AI works and how it can be used effectively. This will help them make better-informed decisions and avoid potential pitfalls.

Conclusion: Embracing the AI Revolution

The role of AI in financial forecasting and market analysis is undeniable. Its ability to process large amounts of data quickly and accurately, adapt to changing market conditions, and provide enhanced accuracy makes it an invaluable tool for traders and investors. As AI continues to evolve, it will play an even more significant role in shaping the future of finance.

However, it is essential to approach this revolution with caution. Ethical considerations and the need for education and awareness are crucial. By embracing AI responsibly, we can harness its power to create a more efficient, accurate, and fair financial system.