—

Navigating the Vibrant Crypto Market: Insights from Real-Time Conversations and Innovations

Cryptocurrency is often likened to a bustling marketplace — volatile, fast-moving, and full of opportunities and pitfalls. The recent tweets and social media activity around trading instruments, blockchain innovations, and market sentiment offer a snapshot of this dynamic ecosystem. Let’s dive into the pulse of the crypto space, highlighting how expert engagement, emerging tools, and market trends come together to shape investor strategies today.

—

The Power of Expert Engagement

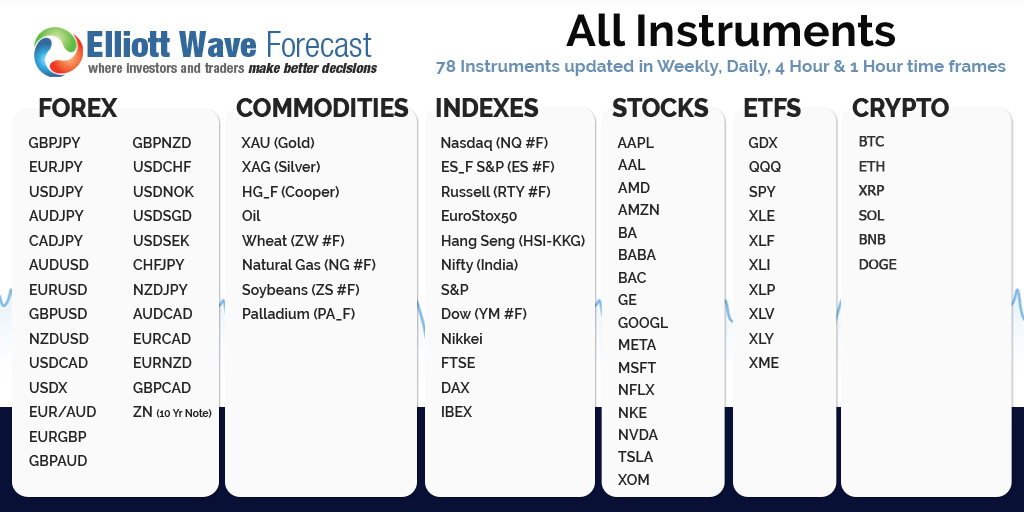

One striking theme from the conversations is the emphasis on accessibility to market expertise. For example, groups like Elliott Wave Analyst and Elliott Wave Trader actively invite traders to ask unlimited questions about 78 different instruments through their Chat Rooms. This is more than just customer service — it’s an interactive community-driven approach that fosters learning and timely decision-making.

Why does this matter? Crypto markets operate 24/7 and often react rapidly to news and events. Having a platform where investors can ask questions anytime and receive expert insights can reduce FOMO (Fear Of Missing Out) and help avoid impulsive decisions. It also democratizes information, making sophisticated Elliott Wave analysis — a technical analysis technique used to predict market trends based on crowd psychology — accessible to everyday traders.

This approach blends the best of expert-driven and community-oriented trading, highlighting how social engagement can lead to more informed participation in trading activities.

—

Sentiment Analysis: Reading the Market’s Emotional Pulse

Tweets like the one from user @mrhosein00 reveal a sophisticated way investors gauge market health: sentiment analysis. By tracking still-evolving tokens like Bitcoin, Chainlink (LINK), and newer ones like “FARTCOIN,” traders can classify sentiment as positive or negative, helping them forecast potential moves.

Notice the mention of Ethereum and a $500 million buy by BlackRock, one of the world’s largest asset management firms. This kind of institutional buy-in signals increased legitimacy and might be seen as a bullish indicator for Ethereum’s market value. Conversely, negative sentiment on DeFiApp (-4%) or BEARA (-4%) indicates areas traders might want to avoid or watch cautiously.

Sentiment analysis combines human psychology with data-driven tools to form a nuanced view of markets that are notoriously hard to predict. It’s a key example of how sophisticated analytics have become essential in crypto trading.

—

Blockchain Innovations Empowering Developers and Entrepreneurs

Beyond price action and market moods, the buzz around infrastructure and developer tools is equally exciting. The mentions of platforms like Tanssi Network and SimpleAI point to the increasing modularity and customization possible in blockchain deployments.

Tanssi Network offers a permissionless way to launch sovereign application-specific blockchains, or “app chains,” with Ethereum-aligned security built in. This means developers don’t have to wrestle with complex validator setups or infrastructure management while still enjoying the security Ethereum provides. It’s like a startup accelerator combined with a blockchain toolkit — smoothing the path to innovation in decentralized apps (dApps).

SimpleAI, for its part, bridges blockchain infrastructure with AI-driven tools to help creators analyze, build, and discover smarter on-chain solutions. The convergence of AI and blockchain promises to amplify the capabilities of developers by automating data analysis and enhancing decision-making — an intriguing glimpse into future Web3 landscapes.

—

What This Means for Traders and Investors

This newfound connectivity and tool availability mean the crypto landscape is no longer a lonely roller coaster ride. Traders can now:

– Tap into real-time expert advice, reducing blind spots.

– Understand market sentiment more deeply, balancing emotional dynamics with hard data.

– Leverage innovative tooling and infrastructure for more sophisticated strategies — whether launching new dApps or analyzing complex on-chain metrics.

– Feel supported by a vibrant ecosystem that combines community, research, and technology.

Yet, this also raises the bar: participants must cultivate a blend of technical knowledge, emotional intelligence, and adaptability to thrive.

—

Challenges and Forward Thinking

Despite these encouraging advances, crypto markets remain inherently risky and complex. Here are some considerations to keep in mind:

– Information Overload: With so many tools, chat rooms, and sentiment metrics, newcomers can feel overwhelmed. The key is developing focused approaches and verifying information carefully.

– Market Manipulation Risks: Sentiment and hype can be artificially influenced, so understanding source credibility and using cross-verification remains critical.

– Technological Fragmentation: While customization is great, the proliferation of app chains and tools might fracture liquidity or developer focus if not coordinated well.

Looking ahead, the integration of AI with decentralized finance (DeFi), the increasing institutional interest exemplified by players like BlackRock, and the continued rise of trading communities suggest a maturing market where smart strategies will outperform guesswork.

—

Conclusion: Crypto’s Multi-Dimensional Future

The snapshots from June 2025 paint a picture of a multi-faceted crypto market: vibrant, complex, and increasingly user-focused. From interactive expert chat rooms to cutting-edge blockchain platforms and real-time sentiment tracking, participants today enjoy unprecedented tools to decode market movements and innovate on-chain.

This layered ecosystem—combining human expertise, data analytics, and programmable infrastructures—is defining the next wave of crypto evolution. For traders and developers alike, the challenge is to harness these resources wisely, balancing optimism with critical thinking.

In the relentless tempo of cryptocurrency trading and development, the power belongs to those who connect the right data points, ask the sharp questions, and stay curious about emerging trends.

—

Sources

– Elliott Wave Analyst Twitter

– Elliott Wave Trader Twitter

– User @mrhosein00 Tweet

– TheMoonGuy Twitter

– SimpleAI Twitter

—

This analysis blends real-time social media insights with the broader context of technological developments, designed to help readers understand the pulse of crypto markets today in an engaging and digestible way.