Navigating the Mid-2025 Crypto Landscape: Ethereum’s Outperformance, Bitcoin’s Bullish Surge, and Market Dynamics

—

Captivating Introduction: A New Season of Crypto Awakening

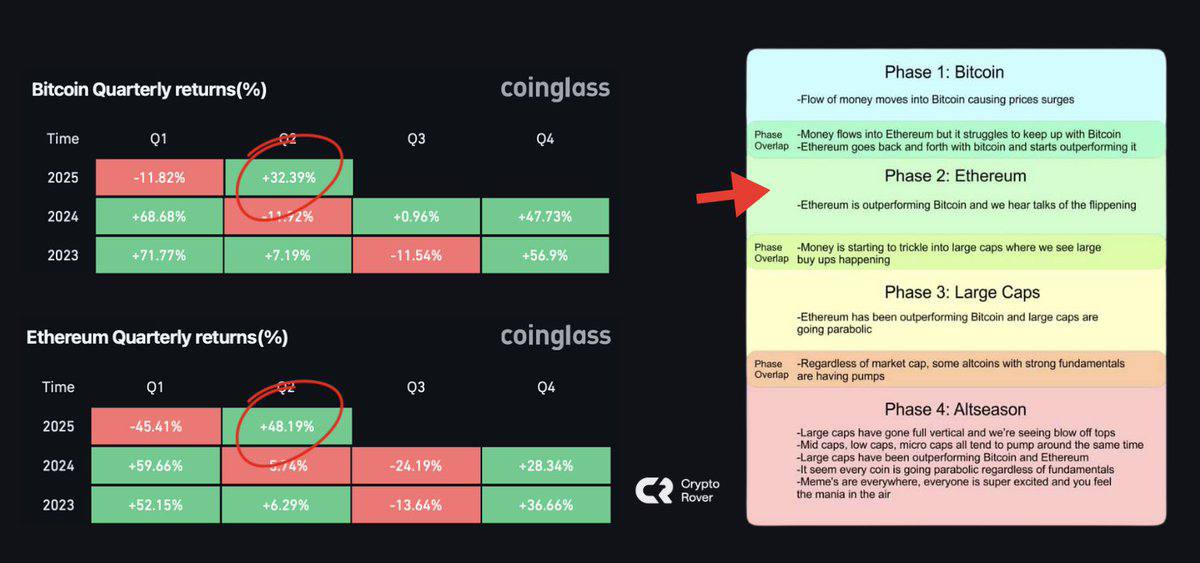

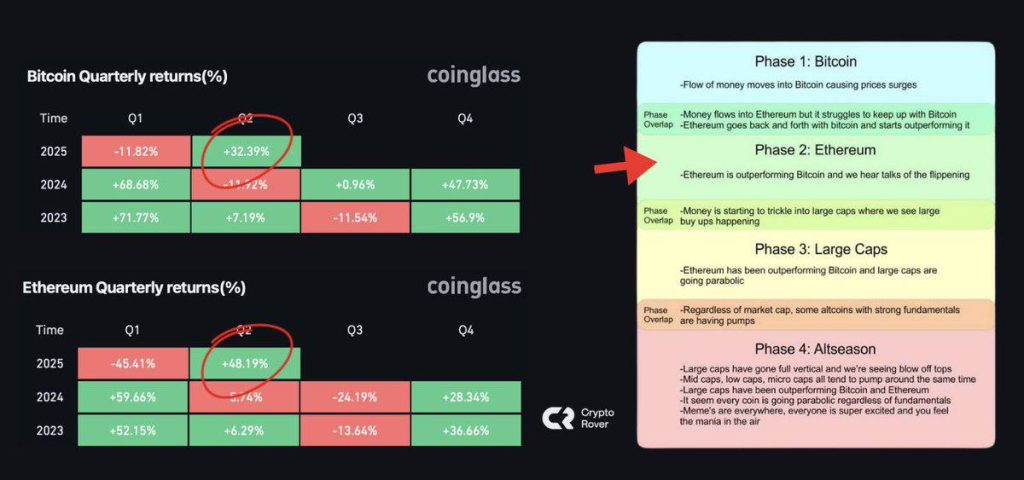

As we reach mid-2025, the cryptocurrency space finds itself at a fascinating crossroads. Ethereum (ETH), emerging with notable momentum, is outpacing the traditional titan Bitcoin (BTC) in Q2, igniting a renewed wave of “altseason” enthusiasm. On parallel tracks, Bitcoin is pushing toward new historical highs, with prices inching closer to the $110,000 mark. Behind these headline moves are deeper market dynamics influenced by macroeconomic shifts, investor sentiment, technological advancements, and global trade dialogues, especially between the U.S. and China. This analysis breaks down the forces at play, exploring what makes this period unique and where this pivotal moment might lead investors and enthusiasts alike.

—

Ethereum’s Q2 Surge: The New Favorite Horse in the Race

Ethereum’s performance in the second quarter of 2025 is a clear standout. While Bitcoin commands the lion’s share of recognition as the flagship crypto asset, ETH’s price appreciation—reported at approximately +7.71% compared to BTC’s +3.25% on June 10—signals an intriguing shift in momentum.

Why is Ethereum outperforming Bitcoin?

This Ethereum momentum seems to be a driving force behind the current “altseason” — a market phase where alternative cryptocurrencies outperform Bitcoin. The excitement and “fastest horse in the league” hype are palpable among traders and crypto enthusiasts, buoyed by ETH’s uptick and supportive news cycles.

—

Bitcoin’s Bull Rally: Approaching Historical Highs

Bitcoin’s trajectory towards $110,000 — a record level — showcases its entrenched role as the pioneer of cryptocurrency markets. Despite Ethereum’s faster growth in the quarter, Bitcoin remains a benchmark asset. Technical analysis reveals a bullish dominant pattern, indicating sustained investor confidence and momentum.

Key Factors Propelling Bitcoin Upwards:

– Accumulation by Superholders: A noteworthy element is the activity by “Bitcoin superholders,” institutional and large-scale investors who are accumulating rather than selling. This accumulation sets the stage for supply tightening, typically a bullish signal.

– Macro Context – Rate Cuts on the Horizon: Markets are pricing in a near certainty (99.9%) of June interest rate cuts by the U.S. Federal Reserve. Lower interest rates tend to boost risk assets, including cryptocurrencies, as borrowing becomes cheaper and alternative investments seek higher returns.

– Trade Optimism: Positive trade talks between the U.S. and China, as indicated by Commerce Secretary Lutnick, further stabilize market sentiments. Reduced geopolitical tension generally favors risk appetite, benefiting cryptocurrencies.

—

Broader Market Pulse: Heatmap and New Entrants

The market heatmap reveals increased activity across other altcoins like Solana (SOL) with +4.51%, signaling a broadening interest beyond Ethereum and Bitcoin. The French company The Blockchain Group’s initiative to raise €300 million aimed at Bitcoin acquisitions speaks volumes about institutional appetite for crypto exposure, echoing similar moves by investment holding firm Belgravia Hartford.

Furthermore, emerging cryptocurrencies such as Ethereum Classic (ETC) and Launchcoin are drawing attention by displaying bullish market metrics and promising potential, offering more avenues for speculative gains during this altseason.

—

Technology and Trading: Tools for the Seasoned Trader

With the market’s volatility and complexity, traders rely increasingly on advanced analytical tools to stay ahead. Real-time data dashboards, predictive analytics, and volume activities provide crucial insights. This technological support enables investors to navigate the shifting sands of cryptocurrency valuations and make informed decisions amid fluctuating momentum.

—

Conclusion: Charting the Road Ahead

The mid-2025 crypto landscape paints a picture of dynamic evolution — where Ethereum’s utility-driven growth is nudging the market’s attention, even as Bitcoin, backed by strong institutional accumulation and favorable macroeconomic trends, aims for all-time highs. This interplay between the established giant and the rising star is emblematic of an maturing digital asset ecosystem.

Investors are advised to keep an eye on broader economic signals such as Federal Reserve policies and global trade developments, as these will continue to act as catalysts or dampeners. Moreover, the surge in altcoins suggests a more diversified market participation, potentially enriching the opportunities but adding layers of complexity.

Whether you’re a trader chasing momentum or a long-term holder banking on crypto’s revolutionary potential, this period demands a balanced, well-informed approach. As altseason heats up and Bitcoin’s bull rally unfolds, the crypto narrative remains fluid, promising excitement, innovation, and challenges ahead.

—

Sources and Further Reading

– Ethereum Q2 Performance Insights and Market Trends

– Bitcoin Bullish Patterns and Institutional Movements

– U.S. Federal Reserve Interest Rate Outlook June 2025

– Trade Talks Between U.S. and China

– Cryptocurrency Market Heatmaps and Analysis

– Investment Holding Companies Entering Crypto

– Real-Time Crypto Trading Tools Overview

—

This analysis fuses current market data with macroeconomic context to provide a comprehensive look at the evolving cryptocurrency milieu in June 2025. Whether for educational purposes or practical investing, understanding these developments equips market participants to engage more confidently with this rapidly shifting domain.