Navigating the Current Landscape of Bitcoin Layer 2 and Market Dynamics

Bitcoin continues to cement its position at the forefront of the cryptocurrency universe, yet the ecosystem around it grows increasingly sophisticated and nuanced. Recent developments in Layer 2 solutions and market behavior in mid-2025 illustrate both innovation and volatility. This report delves into the latest strides in Bitcoin Layer 2 technologies, the mounting challenges Bitcoin mining faces, and the technical trade signals shaping traders’ expectations.

—

Layer 2 Innovations: More Than Just Scaling

Bitcoin’s core network, while secure and decentralized, inherently struggles with transaction throughput limitations. Enter Layer 2 solutions — secondary frameworks designed to handle transactions off the main blockchain while leveraging its security.

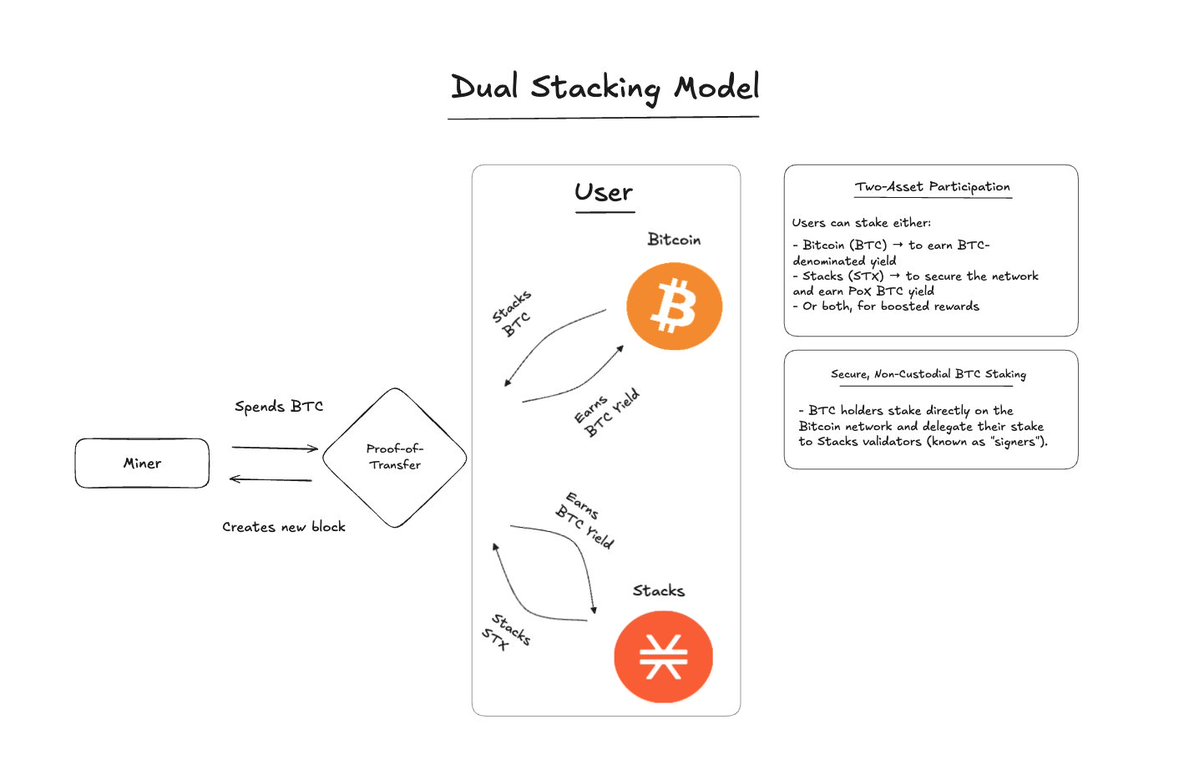

Stacks and SatLayer: Among the most promising innovations is the “Stacks” protocol, which integrates the sBTC token—a representation of Bitcoin on the Stacks blockchain. This integration brings faster transactions and enhanced smart contract capabilities. By adopting sBTC, Stacks effectively boosts Bitcoin’s usability beyond simple transfers into the realm of programmable finance, a critical aspect for decentralized applications (dApps) and DeFi ecosystems.

Additionally, “SatLayer” emerges as a novel Layer 2 that aims to facilitate decentralized finance on Bitcoin without relying on bridges. Bridges often introduce security and efficiency risks as they connect separate blockchains or layers. SatLayer’s bridge-less approach reduces these risks, allowing DeFi interactions that are more secure, faster, and potentially more user-friendly.

This trend showcases how Bitcoin, originally designed as a peer-to-peer digital cash system, is evolving to support complex financial instruments and decentralized applications without compromising its security model.

—

Bitcoin Mining: Increasing Costs Amidst Halving and Network Difficulty

The first quarter of 2025 has been particularly challenging for the Bitcoin mining industry. Two pivotal factors contributed to this:

– The Halving Event: A reduction in the block reward miners receive for validating transactions, which happens approximately every four years. The most recent halving reduced miner rewards, squeezing profit margins.

– Rising Network Difficulty: As more miners compete to solve cryptographic puzzles, the network adjusts the difficulty level to maintain a roughly 10-minute block time. An increase in difficulty means that mining is computationally harder and requires more electricity.

The combined effect has driven mining costs upward, particularly for less efficient operations. Publicly listed mining companies, monitored closely through their disclosed financials, reveal tightening profit margins and a pressing need to optimize operations or innovate. Some are turning to cleaner and more affordable energy sources to stay competitive, while others may be forced out of the market, consolidating mining power into the hands of fewer, more efficient players.

This shift has implications for Bitcoin’s decentralization and overall network security, raising questions about long-term sustainability if costs continue to escalate.

—

Market Analysis: Signals, Patterns, and Expert Opinions

The Bitcoin price action remains in flux, characterized by mixed technical indicators and divergent expert perspectives. A synthesis of recent analyses highlights several key themes:

– Bearish Rising Wedge: Several technical analysts identify a bearish rising wedge pattern on Bitcoin’s charts, indicating a possible price decline from recent highs around $102K toward the $92K–$93K range. This pattern typically suggests weakening momentum and potential trend reversals.

– Symmetrical Triangle Formation: Concurrently, other traders point to Bitcoin being caught in a symmetrical triangle, bouncing off support but capped by a 100-day moving average resistance. A breakout above this resistance could trigger bullish momentum, while a breakdown might lead to a dip.

– Oversold RSI Conditions and Relief Bounce: With Bitcoin’s Relative Strength Index (RSI) signaling an oversold state after a sharp price drop below $103.9K, there are anticipations of a relief bounce. Whether this bounce will be sustained or merely a dead cat rebound remains a point of debate.

– Potential Capitulation and Long-Term Trends: Some macro analysts suggest a deeper correction is possible, potentially dragging prices down as low as $66K–$71K. This could represent a capitulation phase before Bitcoin resumes its upward trajectory, hinting at the cyclical nature of crypto markets.

– Debate on Market Manipulation vs. Natural Correction: Discussions around sudden sell-offs oscillate between suspicion of manipulation and technical analysis-backed corrections. While some point to possible abuse of power affecting prices, data-oriented perspectives lean towards conventional market dynamics and profit-taking.

—

The Role of AI and Algorithmic Trading

In light of the volatile and complex market conditions, artificial intelligence (AI) and algorithmic trading emerge as crucial tools. AI-driven platforms like Scorehood AI promote the use of evolutionary algorithms to analyze patterns and guide trading decisions, aiming to reduce emotional bias and improve accuracy.

Subscribers to such AI tools find value in predictive analytics, liquidation warnings, and real-time signals, which can be decisive in fast-moving markets. However, users are cautioned to consider these as aids rather than crystal balls, balancing automated insights with their own due diligence.

—

Conclusion: Navigating Bitcoin’s Complex Terrain with Eyes Wide Open

The advances in Bitcoin Layer 2 solutions like Stacks and SatLayer signal a meaningful transformation — expanding Bitcoin’s functionality into JavaScript-friendly programmability and secure DeFi ecosystems, all while remaining anchored to its robust base chain.

Simultaneously, the increasing operational costs of Bitcoin mining remind us that the backbone of this ecosystem faces economic pressures that could reshape its landscape and centralization risks.

Market dynamics reinforce the timeless lesson that Bitcoin’s price journey remains anything but linear—fueled by technical patterns, trader psychology, macroeconomic factors, and sometimes, debates over manipulation or fundamentals.

For investors, traders, and enthusiasts alike, the key will be to integrate insights from evolving Layer 2 technologies, mining economics, and market signals—while remaining flexible and critically minded in an ever-shifting space.

—

References for Further Exploration

– Stacks Protocol and sBTC Integration

– Bitcoin Mining Economics Q1 2025

– Technical Analysis on Bitcoin Price Patterns

– SatLayer Layer 2 DeFi Solutions

– Scorehood AI Trading Platform

These resources offer additional technical, economic, and strategic insights into Bitcoin’s ongoing evolution and market behavior.