The cryptocurrency landscape in mid-2025 is showcasing a fascinating blend of traditional financial interactions, technological advancements, and market dynamics. Recent developments hint at a maturing yet volatile ecosystem where blockchain technologies, macroeconomic factors, and innovative financial instruments coexist and influence each other. Through an exploration of current events, market data, and emerging trends, this analysis unpacks the underlying narratives shaping digital assets today.

The Rise of Solo Bitcoin Mining: A New Chapter in Decentralization

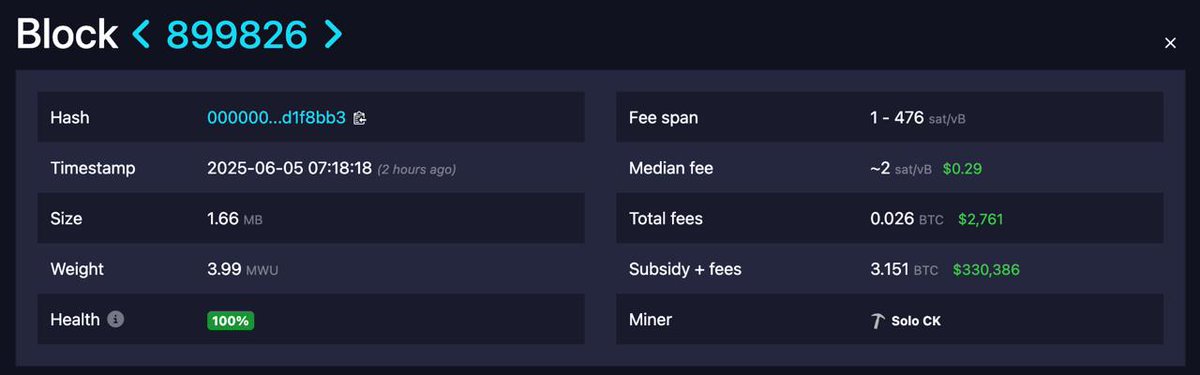

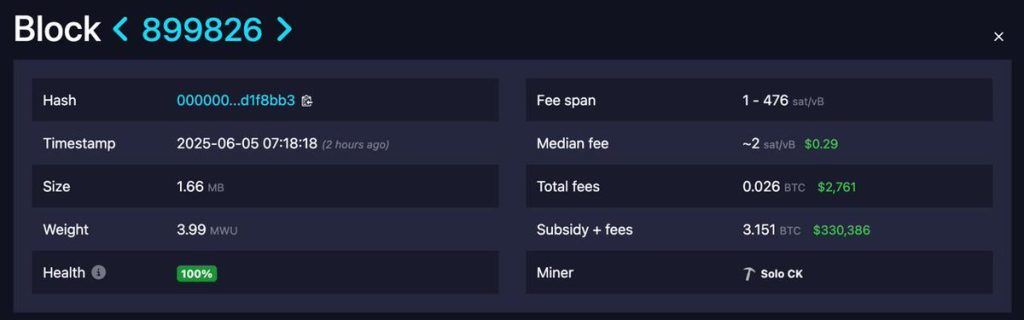

A highly noteworthy event unfolded recently: a solo miner succeeded in mining a Bitcoin block, earning 3.151 BTC—valued above $330,000. This remarkable feat serves as a statement about the persistence of decentralization ideals in the Bitcoin network. Solo mining, once common, became less feasible due to the growing difficulty and resource requirements, driving most miners to join large pools that consolidate computing power.

The resurgence or continuation of solo mining highlights a couple of critical points. First, it reflects the robustness and accessibility of mining infrastructure for skilled individuals or smaller operations equipped with adequate hardware and energy solutions. Second, it implicitly underscores the network’s enduring resilience, as individual participants still claim their share amidst industrial-scale mining farms.

This event also raises questions about the incentives and power dynamics within the mining ecosystem. While mining pools dominate the hash rate, solo mining rewards remain disproportionately enticing due to their high variance but potential for full block rewards. For the community, these occurrences inspire debates about decentralization, privacy, and the future security models of proof-of-work cryptocurrencies.

Macroeconomic Backdrop: M2 Money Supply and Policy Pressures

At a macroeconomic level, the U.S. M2 money supply has surged to an unprecedented $21.86 trillion. This expansion of liquidity reflects sustained monetary easing and fiscal easing policies influencing not only traditional markets but increasingly exerting pressure on alternative assets like cryptocurrencies.

Such expansion fuels inflation concerns, which historically have pushed investors towards Bitcoin as a perceived store of value or “digital gold.” Paradoxically, Bitcoin’s price movements show sophisticated tempering mechanisms—market cycles appear to be controlled or “restrained by force,” according to recent analyses. This suggests that major players or algorithmic strategies intentionally modulate price variations to prolong bullish trends, stabilizing the market but also potentially delaying explosive growth.

Further stirring the policy pot, public figures like Donald Trump have called for rate cuts, advocating an easing of monetary policy that could increase liquidity further. This political dimension intersects with investor sentiment, influencing risk appetite and the allocation of capital between equities, bonds, and crypto assets.

Institutional Deepening: Bitcoin ETFs and Financial Products

Institutional engagement with cryptocurrencies continues its ascent, exemplified by JPMorgan’s announcement to offer loans backed by Bitcoin ETFs. This development signals a significant bridge between traditional finance and digital assets, showcasing maturity in crypto investment vehicles. Loans secured by Bitcoin ETFs imply easier credit access for crypto holders while enhancing legitimacy and regulatory compliance.

Bitcoin ETF inflows have recently surpassed those of gold ETFs, drawing stark attention to shifting investment preferences. With $5.25 billion flowing into Bitcoin ETFs against $1.58 billion outflow from gold, investors are clearly repositioning portfolios in favor of digital assets as alternative stores of value and growth instruments.

Such financial product innovation reduces friction for institutional and retail investors alike, promoting liquidity and price discovery. However, it also raises concerns about systemic risks if crypto-backed loans multiply in scale or if ETF structures create unforeseen correlations with underlying asset prices.

Market Sentiment and Technical Landscape

Market sentiment continues to be shaped by real-time analytics powered by AI platforms such as Kaito AI and Sahara Labs AI. These tools deliver sophisticated sentiment and mindshare analyses by aggregating social media trends, blockchain activity, and macro data. Traders rely increasingly on these insights to decipher noisy signals in volatile markets, enabling more data-driven decision making.

Technical analysis remains a staple, with notable mentions of cryptocurrencies like Solana (SOL) completing predicted price movements. Such confirmations provide confidence in chart patterns and market psychology, helping traders anticipate upcoming phases of volatility or consolidation.

However, the overall market heatmap indicates slight declines for major cryptocurrencies like BTC (approx. $104,757), ETH, and SOL, reflecting a period of cautious retracement. This demonstrates the balancing act between upward price momentum and profit taking, a dynamic that markets often experience amid heightened uncertainty.

The Role of Stablecoins and Token Unlocks

Stablecoins have emerged as significant buyers of U.S. short-term securities, becoming the third-largest investors in this category. This intertwining of crypto liquidity pools with traditional financial instruments suggests a maturing ecosystem where digital dollar-pegged assets serve multi-faceted purposes—from facilitating crypto transactions to functioning as cash equivalents that earn yields.

Token unlock schedules also matter in June, with over $2.9 billion in tokens becoming liquid. Such influxes typically introduce increased sell pressure or redistribution of holdings that can cause short-term volatility or market dips. Savvy traders and investors monitor these unlock events closely to adjust positions and anticipate potential price swings.

Sociopolitical Dimensions of Cryptocurrency Adoption

Beyond pure economics and technology, cryptocurrency adoption is intersecting with geopolitical and ideological currents. Academic presentations, such as the paper “Beyond Monetary Borders: An Ideological Analysis of Cryptocurrency Adoption Among Non-State Armed Groups,” reveal how digital currencies serve diverse stakeholders, including those operating beyond traditional state control.

This unconventional but important lens illustrates the complex motives behind crypto usage, ranging from contesting state sovereignty to circumventing financial sanctions. Understanding these dynamics enriches the narrative about blockchain not merely as a technology or asset class but as a socio-political phenomenon reshaping power structures.

Conclusion: A Constellation of Forces Shaping Crypto’s Trajectory

The current crypto environment emerges as a vibrant and multifaceted arena where technological innovation, market psychology, institutional finance, and macroeconomic policies converge. Solo mining’s symbolic victories emphasize decentralization’s appeal even amid industrial dominance. The expansive money supply and political rhetoric around interest rates enhance cryptocurrency’s appeal as a hedge, while new financial products like Bitcoin ETF-backed loans deepen institutional integration.

Concurrently, advanced analytics empower traders to navigate volatility intelligently, and stablecoins along with token unlock schedules reflect liquidity flows that impact market behavior. Finally, the socio-political usage of cryptocurrencies underscores their transformative potential extending beyond mere investment.

In this flux, investors and participants must remain agile, informed, and critically aware that cryptocurrency’s journey is not linear but shaped by an evolving constellation of forces—economic, technological, and ideological. This understanding will be crucial in anticipating future trends and opportunities within this dynamic asset class.

—

Sources and Further Reading

– Bitcoin Mining Fundamentals and Solo Mining Insights

– U.S. M2 Money Supply Data – Federal Reserve Economic Data

– JPMorgan Launches Bitcoin ETF-backed Loans

– Bitcoin ETF vs Gold ETF Inflows

– Cryptocurrency Market Sentiment Analytics with AI

– Stablecoins and U.S. Treasury Securities

– Token Unlock Schedules and Market Impact

– Cryptocurrency Adoption by Non-State Armed Groups – Academic Paper