Navigating the Crypto Waves: A Snapshot of Market Dynamics and Trends in Mid-2025

As we step into June 2025, the cryptocurrency landscape is bustling with activity, marked by record-breaking institutional purchases, lively altcoin markets, and high stakes in liquidations. The collective chatter—from Elliott Wave technical analyses to massive whale moves and sweeping market liquidations—paints a vivid picture of a market both ripe with opportunity and fraught with risk. The following in-depth report explores recent developments, technical insights, and broader implications for investors navigating these volatile waters.

—

Riding the Elliott Wave: The Technical Pulse of Under-the-Radar Crypto

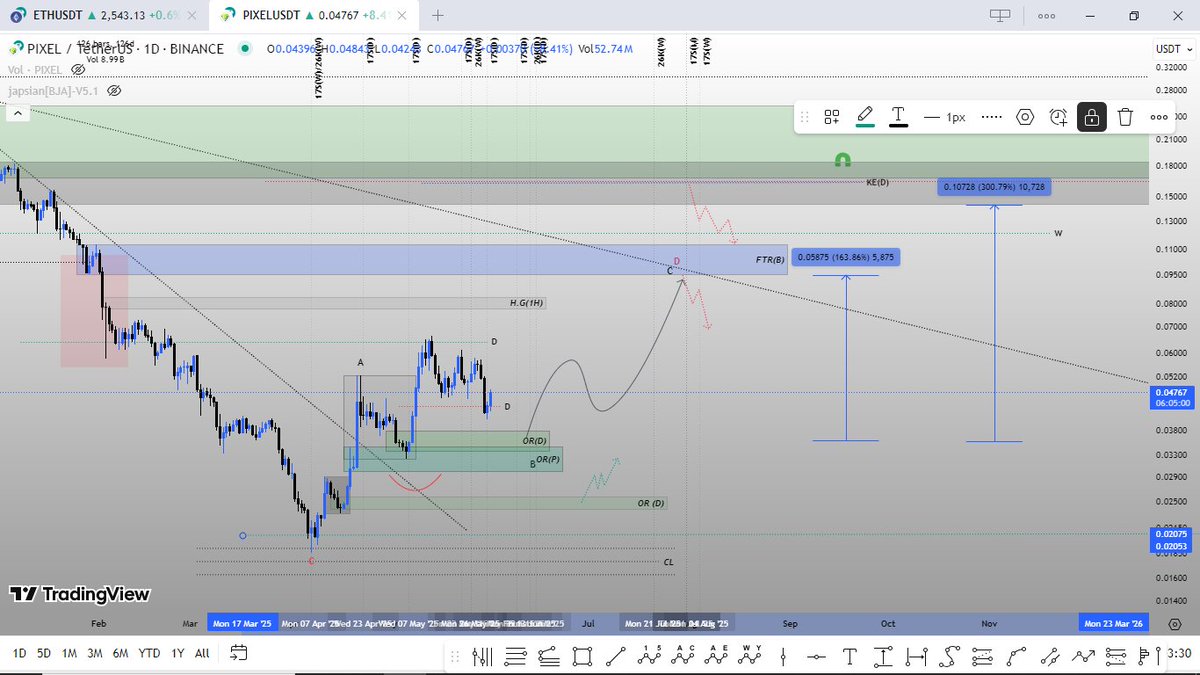

Technical analysis continues to play a pivotal role in uncovering potential entry points in lesser-known crypto assets. Take, for instance, the #PIXELUSDT chart analysis circulating on social media. According to wave theory fundamentals, particularly Elliott Wave patterns, PIXEL has been identified as possibly poised for a sharp upswing. The analysis suggests the completion of Wave B, with the price range between 0.030 to 0.035 serving as a strategic buy zone for spot purchases, targeting a level as high as 0.094 or beyond.

This snapshot exemplifies how Elliott Wave theory, which breaks down price movements into motive and corrective waves, can help investors anticipate momentum shifts even in obscure tokens. Timing is critical here, as the analysis underscores specifically “important and approximate times” on the chart — hinting at windows where the bullish wave completion could trigger upward reactions.

While such technical analyses offer fascinating angles, they also demand caution. Cryptocurrencies like PIXEL, often dubbed ‘hidden gems,’ face liquidity and volatility challenges. The allure of a significant gain from a price of $0.030 jumping to nearly triple digits motivates traders, but validating the wave count’s integrity is paramount. Combine this with an understanding of market sentiment and volume spikes to refine entry timing.

—

Institutional Appetite: Setting New Records in Bitcoin Accumulation

2025 is witnessing a notable surge in institutional interest, signaling a deepening maturity of cryptocurrency markets. Public companies alone reportedly snapped up over 95,000 Bitcoin in Q1 2025, recording an unprecedented pace of acquisition. This trend reflects growing confidence in Bitcoin as a store of value and hedge, potentially triggered by macroeconomic uncertainties or inflationary pressures.

The significance here extends beyond sheer volume. Institutional buying volumes often prelude sustained bullish trends because these entities tend to hold longer and exert stabilizing effects on the market. Their involvement commonly attracts further retail and smaller institutional participants.

Smaller but nonetheless impactful moves come from “smart money” Ethereum whales, who have ramped up long positions to the tune of $75.6 million. The coordinated actions of these large holders tend to signal conviction in Ethereum’s roadmap, scaling solutions, or upcoming network upgrades. Given that whales represent significant liquidity pools, their behavior often shapes short to mid-term pricing trajectories.

—

Market Risk and Liquidations: The Underbelly of Crypto Volatility

In parallel to booming buying interest, the market demonstrates familiar volatility symptoms, reflected in substantial liquidations. Over the past 24 hours, liquidations of approximately $720 million from crypto positions have unsettled the market, with upwards of 282,000 traders getting wiped out. This mass liquidation event signals highly leveraged trading environments, where rapid price swings trigger cascading margin calls.

Interestingly, high-profile players are not immune—reports emerged about a “40X whale,” James Wynn, getting liquidated again, a potent reminder of the spectrum of risk management challenges faced by large traders. Such episodes often heighten market nervousness, squeezing prices temporarily but potentially setting the stage for rebounds if the broader sentiment remains bullish.

This dynamic underscores a critical theme emphasized repeatedly by market analysts: managing risk surpasses the desire to win every trade. Position sizing, stop-loss discipline, and diversification define sustainable trading strategies amid unpredictable price actions.

—

Stablecoins and Government Securities: The Quiet Powerhouses

A somewhat less glamorous but crucial facet influencing the crypto ecosystem is the role of stablecoins. In recent developments, stablecoins have emerged as the third-largest buyers of U.S. short-term government securities. This trend illustrates the increasing commodification and institutional integration of stablecoin reserves—large volumes of fiat-backed tokens are parked in government debt instruments to generate yield and ensure liquidity.

Such movement adds a new dimension to stablecoins, not merely acting as transactional tools within DeFi or trading pairs but becoming entities that influence broader financial flows. As stablecoins back their tokens with safe assets, market confidence improves, which is crucial during volatile periods.

—

Political and Regulatory Heat: Texas’s Bitcoin Reserve Bill

Regulatory landscapes remain a mixed bag for crypto. One notable legislative update from June 2025 is Texas clearing the final Senate revision of its Bitcoin Reserve Bill, which now awaits gubernatorial approval. This bill’s progression indicates growing local acceptance and integration of cryptocurrencies in official financial governance.

Legislation like these often sets examples for other jurisdictions, providing clearer frameworks that can attract investment and spark innovation while minimizing illicit use. However, regulation is a double-edged sword; while it offers legitimacy, potentially reducing volatility, overly restrictive policies can dampen growth and innovation.

—

Altcoins and Altseason: The Fascination with Diverse Tokens

The altcoin ecosystem continues to fascinate traders intrigued by the prospects beyond Bitcoin and Ethereum. There is an observable excitement surrounding how much one can uncover by delving into alt markets. Each altcoin offers unique utilities, communities, and technological promises.

Specific altcoins such as XRP have been highlighted as bullish assets, suggesting ongoing momentum and adoption tendencies. Riding altseason waves—periods when altcoins outperform Bitcoin—requires keen market sentiment reading, understanding technological developments, and agility in trading.

—

The Narrative of Saving vs. Investing

A recurring theme in crypto discourse is the transition from merely saving money to actively investing it. The mantra “Don’t just stack money, make it work for you” encapsulates a broader mind shift towards participatory wealth creation, whether through crypto assets, DeFi protocols, or NFTs.

While the crypto space offers explosive growth potential, it demands education, strategic planning, and a recognition of inherent risks. The line between investing and gambling is thin without proper knowledge and discipline.

—

Conclusion: Charting the Course Ahead

The cryptosphere in mid-2025 is a complex interplay of soaring institutional interests, volatile retail trading, evolving technical patterns, legislative progress, and innovative financial mechanisms. Elliott Wave forecasts on lesser-known tokens reveal the continual allure of technical analysis as a decision-making tool, while record-breaking Bitcoin accumulation and whale movements underscore a maturing market foundation.

Yet, the relentlessness of liquidations, the pitfalls of leverage, and the necessity of robust risk management remain stark reminders that cryptocurrency is a high-stakes arena. Meanwhile, stablecoins’ financial maneuvering and regional regulatory shifts highlight how intertwined crypto markets have become with traditional finance and policy.

Investors and traders who stride forward must balance optimism with prudence, harness technical insights without falling prey to hype, and continuously adapt to the fluctuating currents of this revolutionary but volatile domain.

—

References

– Elliott Wave analysis on PIXEL

– Institutional Bitcoin Accumulation Record Q1 2025

– Ethereum Whale Long Position Data

– Crypto Liquidations Report

– Texas Bitcoin Reserve Bill Update

– Altcoin Market Insights

– Stablecoins Buying U.S. Securities

– Risk Management Emphasis