Cryptocurrency Market Sentiment and Trends Analysis: June 2025

—

The Pulse of Crypto: Understanding Current Market Sentiment

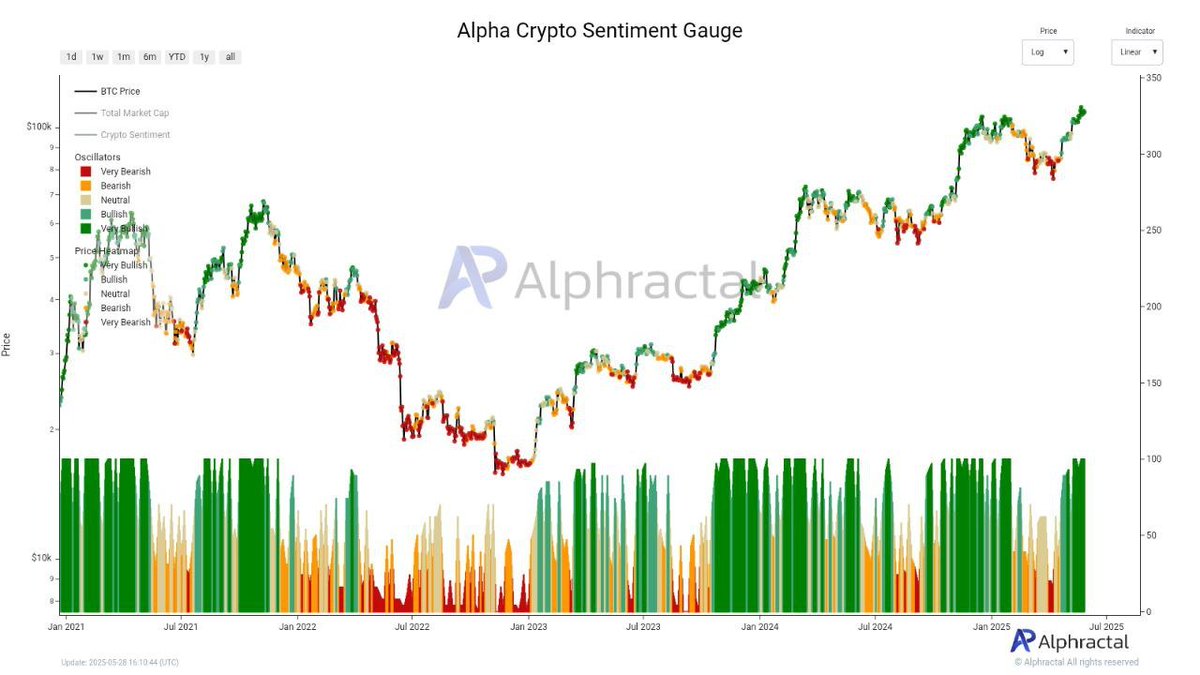

As of early June 2025, the cryptocurrency market is radiating a “very bullish” sentiment according to aggregated market sentiment data shared by CryptoRin. This optimism is palpable among traders and analysts alike, suggesting a strong positive outlook for major assets such as Bitcoin and various altcoins. Unlike traditional markets, crypto sentiment movements can be lightning-quick, often influenced by a mix of technology developments, macro factors, and social media buzz, making the current bullish tone particularly significant.

The term “very bullish” denotes more than just hopefulness—it points to strong buying activity and confidence in price rallies. This aligns with recent observations of Bitcoin’s monthly chart from Michele Figueroa who notes a consolidation phase but retains a bullish long-term perspective. Consolidation indicates a phase where prices stabilize before making the next big move, often upward in a bull market scenario (4).

—

Bitcoin: The Crown Jewel’s Monthly Momentum

Bitcoin (BTC), the bellwether of the crypto world, is at a critical juncture. Although its price movement lately suggests consolidation, there is a growing expectation for a breakout that could launch the asset into a new bullish chapter. This is underscored by various traders who highlight strong momentum and potential for continued upward movement—the so-called “pump”—reinforced by enthusiastic commentary from communities worldwide, including Indonesia (2, 12).

Notably, some traders emphasize careful position sizing and risk-reward ratios; for instance, Derin Cancar’s analysis on Solana (SOL) highlights a risk-reward of 1:7.22, which is enticing for risk management-conscious traders (5). Such disciplined approaches in trading may support the sustained bullish trend by encouraging strategic participation instead of reckless speculation.

—

Altcoins and Potential Reversals: Spotlight on Solana, Realio, and Others

Altcoins like Solana (SOL), Realio (RIO), Arbitrum (ARB), Algo (ALGO), and Degen tokens are currently under intense scrutiny. These assets demonstrate mixed signals but are generally poised for upward movement or reversal according to technical charts and historical price patterns.

– Solana (SOL) trades near $154.94 with slight pullbacks amidst conflicting short-term technical indicators, suggesting a complex scenario that requires close monitoring by traders (11).

– Realio (RIO) shows promise of a “massive reversal” with potential targets around $4, driven by chart angles reflecting a 45° trend change (6).

– ARB (Arbitrum) is spotted for a reversal targeting $1.5, based on pattern recognition and technical analysis, presenting an attractive opportunity for investors (9).

– Degen Tokens are flagged as positioned for significant price climbs, with active buy signals indicating sweet spots for entry around $0.04 (7).

– ALGO’s fluctuating price around $0.10 to $0.30 with mixed “buy” and “sell” signals necessitates cautious analysis before committing capital (13).

These altcoins demonstrate the market’s layered complexity where potential reversals or continuation patterns can be found with diligent chart reading and understanding of broader narratives.

—

Web3 and Media Ecosystem: Transparency and Trust in Crypto Reporting

On the information front, platforms like @0xmediaco are gaining prominence in Asia as leading Web3-focused media providing transparent, in-depth cryptocurrency and blockchain news. This contributes to the healthier dissemination of analysis and research, crucial for navigating a market often rife with misinformation. By enhancing transparency and offering credible insight, these media projects foster improved market efficiency and investor confidence (3, 22).

The role of such media is increasingly pivotal as investors seek reliable daily updates and trade signals—something that was highlighted by communities offering free-to-join analysis groups on platforms like WhatsApp for comprehensive insights across forex, commodities, stocks, and crypto (14).

—

Tools and Techniques Amplifying Trading Success

In parallel with market movements, the adoption of advanced trading tools such as real-time price charts, market analysis platforms, trading bots, and arbitrage scanners is shaping modern crypto trading strategies. Julisa Loyd advocates these utilities as ways to “maximize profits” by enabling more informed and responsive trading decisions (10).

Moreover, the rise of arbitrage scanners—tools that help identify price discrepancies across multiple exchanges—are quickening the tempo of crypto markets and potentially improving liquidity and fair pricing (20). These technological enablers not only democratize access to sophisticated strategies but also amplify trader efficacy during volatile periods or altseason rallies.

—

Community and Social Media: The Underpinning of Market Dynamics

Social media channels, especially Twitter, continue to be dynamic venues where traders, analysts, and enthusiasts exchange real-time information, trade calls, and sentiment updates. Repeated hashtags such as #Altseason, #TradingTips, and #CryptoTrading signal ongoing buzz and collective anticipation in market cycles and asset-specific movements (2, 5, 12, 26).

The vibrant community discourse often drives momentum, forms feedback loops influencing price action, and helps beginner traders learn from seasoned analysts through shared charts and insights. The connectivity fosters a globalized model of market participation unmatched in traditional finance.

—

Conclusion: Navigating Bull Markets with Wisdom and Tools

The current climate in June 2025 situates cryptocurrency markets in a highly optimistic, bullish phase buoyed by strong Bitcoin sentiment, encouraging altcoin reversals, and empowering media and trading tools. Yet, the blend of consolidation phases, technical uncertainties, and mixed signals in altcoins reminds traders and investors to approach the market with a blend of enthusiasm and diligence.

The convergence of robust informational platforms and advanced trading technologies is a defining characteristic of contemporary crypto trading. This ecosystem nurtures better decision-making and provides mechanisms to capitalize on bullish trends responsibly.

Looking ahead, market participants must stay agile—ready to adapt strategies as momentum builds toward potential breakouts or reversals. The cryptocurrency realm remains an exhilarating yet unpredictable frontier where insight, innovation, and community spirit craft the roadmaps of success.

—

Sources

—

This analysis reflects the lively, bullish mood dominating the cryptocurrency landscape in mid-2025, threaded with insights from technical analysis, market psychology, and emerging ecosystem trends.