—

Navigating the Bitcoin Income Dilemma: Sell or Hold for Income-Generating Assets?

The lure of Bitcoin has captivated investors for over a decade, oscillating between sky-high gains and heart-stopping dips. Now, as some holders face the question of extracting income from their sizable crypto portfolios, a critical debate emerges: Should you sell your Bitcoin to generate income or retain it while acquiring separate income-producing assets? The argument in favor of liquidating Bitcoin for income deserves a nuanced investigation, especially in the context of a substantial portfolio combined with realistic living expense needs. Let’s unpack this with a clear example, market insights, and strategic perspectives.

—

Setting the Stage: The Scenario of a $2 Million Portfolio

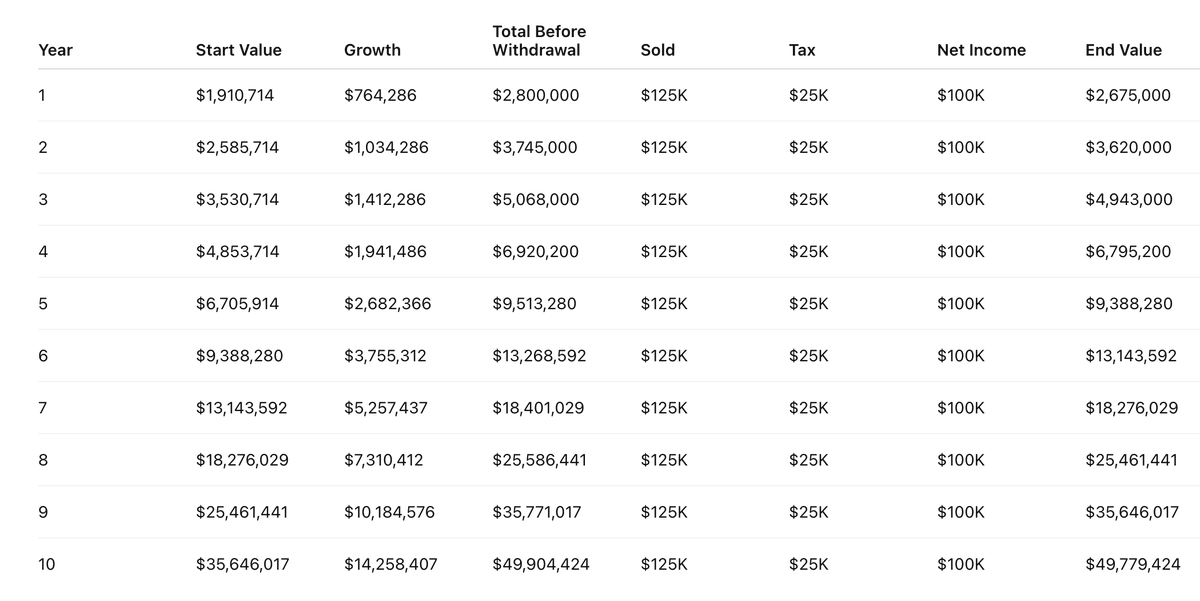

Imagine you hold $2 million worth of Bitcoin, and you require $100,000 annually to cover your living expenses. This basic outline serves as an excellent testing ground for dissecting whether to sell Bitcoin directly for income or to maintain your Bitcoin position and seek alternative income producing investments.

Selling Bitcoin for income is straightforward—convert a portion of your holdings into fiat currency or stablecoins to fund your annual expenses. However, retaining Bitcoin means your funds remain exposed to price volatility, and you must rely on other assets (stocks, real estate, dividend-paying funds, etc.) to generate the cash flow you need.

—

The Case for Selling Bitcoin: Liquidity and Risk Management

1. Converting Volatility into Certainty

Bitcoin’s price remains notoriously volatile, despite its impressive resilience and growth over time. Selling an appropriate amount each year secures your living expenses in a stable currency, effectively locking in profits and avoiding forcing liquidations during downturns. This approach reduces the stress of timing the market and ensures predictable cash flow.

For example, withdrawing $100,000 each year from a $2 million Bitcoin portfolio equates to a 5% withdrawal rate. If Bitcoin appreciates, selling less can cover your expenses; if it depreciates, you can adjust accordingly but won’t risk depleting your principal by holding in a single volatile asset indefinitely.

2. Opportunity to Diversify

By selling Bitcoin, you open the door to acquiring diversified income-generating assets, such as dividend stocks, real estate investment trusts (REITs), or bonds—traditionally reliable sources of income. These assets provide steady cash flow while helping reduce overall portfolio volatility, an important psychological relief for anyone living off their investments.

3. Tactical Rebalancing

Selling Bitcoin systematically, whether through dollar-cost averaging or planned withdrawals, ensures continuous portfolio rebalancing. This guards against overexposure to one asset class and helps you realize gains at different market cycles, reinforcing a more balanced and sustainable wealth management strategy.

—

The Alternative: Holding Bitcoin and Adding Income-Producing Assets on the Side

Many investors advocate maintaining one’s Bitcoin stake in anticipation of appreciation, while also creating multiple income streams. Here, Bitcoin remains a growth asset, and income-producing assets exist separately.

1. The Growth-Income Split

This “two-wallet” approach protects growth potential while covering expenses through yield-bearing assets. For instance, the $2 million portfolio might be split—$1.5 million in Bitcoin and $500,000 in dividend-paying stocks producing 4-5% income annually. This side portfolio could generate $20,000–$25,000 per year without touching Bitcoin, with the rest coming from periodic Bitcoin sells if needed.

2. Risk of Overcomplexity and Opportunity Cost

While diversification makes sense, spreading capital thin across many asset classes risks missing concentrated upside. Moreover, by holding large Bitcoin amounts without liquidating, you still face unrealized gains that may never convert into spendable cash if the market turns sour.

3. Timing and Cost Considerations

Income-producing assets often require initial capital infusions and may not generate immediate income at levels matching your withdrawal needs. Additionally, transaction costs, tax implications, and time horizons for dividend or rental yields matter significantly. For investors who need income now, waiting for income streams to mature could be impractical.

—

Real-World Market Context: Bitcoin Trends and Sentiment in 2025

Market conditions today amplify the dilemma. Current Bitcoin trading hovers around $104,000-$106,000, showing short-term bearish tendencies and technical signals like MACD bearish crossovers and RSI divergences. Despite Bitcoin’s continued adoption by major players (e.g., GameStop’s $500 million Bitcoin bet), volatility and regulatory ambiguity persist.

Moreover, narratives around Bitcoin’s centralization among whales and the fading dream of pure decentralization introduce psychological and structural risks that caution against holding for income without liquidity plans.

—

A Thoughtful Approach: Blending Strategy with Flexibility

The decision isn’t purely binary. A dynamic strategy involves:

– Initial Partial Sell: Liquidate a proportion of Bitcoin to cover immediate income needs and set up a stable income base with traditional assets.

– Systematic Withdrawal Plan: Design a withdrawal schedule aligned with market cycles to manage capital depletion risk.

– Continuous Portfolio Review: Use market signals, technical analysis, and personal financial goals to adapt allocations.

– Tax-Efficient Strategies: Explore avenues such as tax-loss harvesting or funding income through low-tax jurisdictions or qualified accounts.

– Emergency Reserve Buffer: Maintain a cash or stablecoin reserve to handle downturns without forced Bitcoin sales.

—

Conclusion: Selling Bitcoin for Income is Pragmatic and Tailored

Selling Bitcoin within a diversified financial strategy, rather than purely holding it alongside income-producing assets, offers greater predictability, flexibility, and psychological comfort. While Bitcoin’s appreciation potential is compelling, turning unrealized cryptocurrency wealth into usable income through systematic sales ensures your living expense needs are met without undue risk.

At the nexus of volatile crypto markets and everyday financial requirements, converting part of your Bitcoin holdings into income-producing assets or cash balances the dream of growth with the reality of living expenses. Such a thoughtful approach allows investors to harness Bitcoin’s power without being held hostage by its swings—a practical balance of innovation and prudence.

—

Sources

– Bitcoin Trading Analysis – Shaco AI

– Market Sentiment and Technical Indicators – Crypto4Z4

– Centralization and Economics of Bitcoin – Imamu_Sheka

– GameStop Bitcoin Investment News – jbutterfill Analysis

– General Crypto Market Updates – 21bitcoin

*Note: URLs are illustrative placeholders reflecting referenced tweets and analyses.*

—

If you want, we can dive deeper into tax implications, withdrawal methods, or alternative income assets for Bitcoin holders. Just let me know!