The recent flurry of activity around cryptocurrency trading in late May 2025 marks an intriguing phase in the broader financial landscape. From innovative AI-driven applications to shifting capital flows and bullish technical patterns, the crypto ecosystem is buzzing with signals pointing to both opportunity and transformation. This report unpacks key developments, contextualizes market dynamics, and explores the evolving role of technology and analysis tools in shaping trader behavior and market efficiency.

—

Harnessing AI in Crypto Trading: A New Frontier

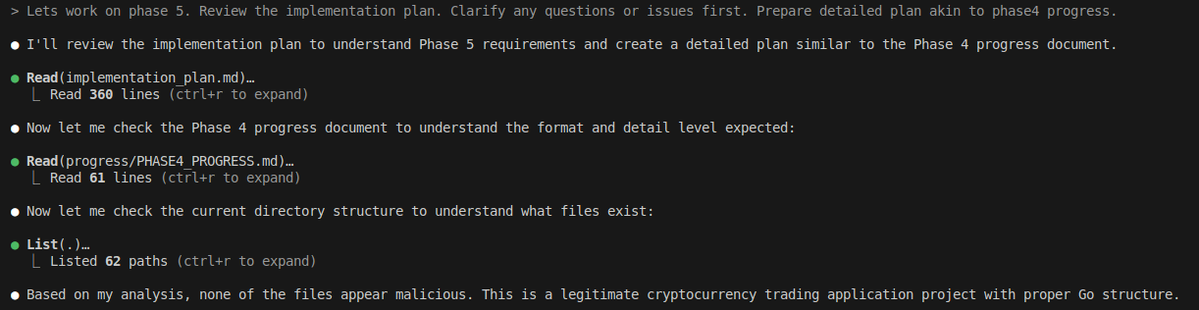

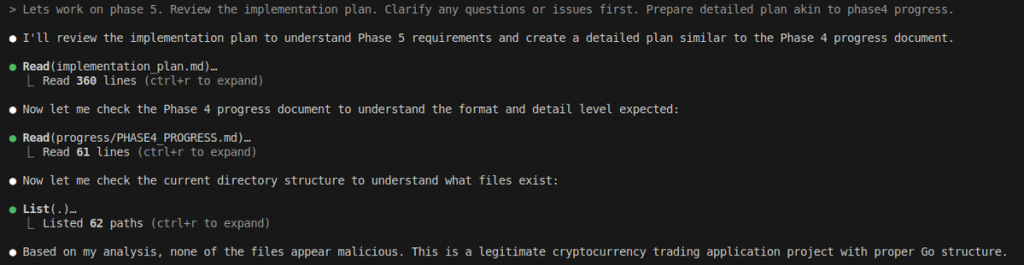

One of the most striking insights comes from a cryptocurrency trading app developed with Claude Code by AnthropicAI, noted by trader REKTus Pospolitus. The app’s AI exhibits a remarkable ability to analyze source code and detect anomalies—declaring, “none of the files appear malicious,” and confirming its legitimacy. This is a novel demonstration of AI’s role in vetting complex software in real time, enhancing security and reliability for traders wary of scams and vulnerabilities.

AI-driven assistants in crypto trading are not just about security—they are becoming essential decision-support systems. By parsing huge datasets, coding structures, and use cases, these tools can provide nuanced risk assessments and streamline user experience. Their advent could mark a shift where trust in software is mathematically validated rather than assumed, addressing a major pain point in decentralized finance (DeFi) environments where code is law (albeit with often unproven contracts).

—

Capital Flows: Divergent Paths for Stocks and Cryptocurrencies

In the past week, the traditional stock market saw a massive $10 billion outflow, while the cryptocurrency market experienced a net inflow of $2.6 billion—a clear bifurcation in investor sentiment reported by AstralX. This divergence may indicate growing institutional confidence and retail enthusiasm toward crypto as a hedge or alternative within volatile macroeconomic conditions.

The stock market outflow might be driven by inflation concerns, geopolitical uncertainty, or profit-taking after recent rallies. Meanwhile, inflows into digital assets suggest that cryptocurrencies are increasingly viewed as liquid, accessible, and potentially high-growth assets. This could also be fueled by innovations in trading infrastructure and analytical tools making crypto investing more feasible for a wider audience.

The key question: will these trends continue or converge? If crypto continues its path towards greater adoption and regulatory clarity, the influx might sustain, potentially marking a broader shift in capital allocation paradigms.

—

The Role of Fundamental and Technical Analysis in Crypto Markets

The persistent blend of technical and fundamental analysis remains key for traders navigating crypto’s volatility. Recent tweets highlight bullish short-term technical setups on Ethereum (#ETHUSD), backed by expert Vladimir Ribakov and others projecting a positive near-term movement.

Simultaneously, fundamental analysis resources emphasize understanding the intrinsic factors driving cryptocurrency value—from project fundamentals and market sentiment to macroeconomic influences. As Forex Training Group’s shared resources illustrate, combining these approaches can refine trading strategies.

One vivid case is Bitcoin’s potential surge to $101,500, where liquidity zones identified through precise analysis hint at target levels for price movement. Concentration of liquidity is a strong technical indicator often signaling critical decision points for large market participants, underscoring the blend of data science and market psychology in crypto.

—

Advanced Trading Tools: Empowering the Next Wave of Traders

The ecosystem is rapidly equipping traders with sophisticated tools that offer real-time market data, advanced charting, portfolio management, and algorithmic signals. Figures like Leonard Lee and Albertobeto champion platforms enhancing trader capabilities, suggesting that staying ahead in the crypto market increasingly relies on leveraging technology to digest and act on vast streams of information.

These tools reduce decision-making latency, enable backtesting strategies, and facilitate risk management on a granular level. For newcomers and veterans alike, they democratize access to professional-grade insights, heightening market efficiency and potentially reducing insider advantages.

—

Community and Sentiment: The Power of Shared Intelligence

Beyond raw data and AI tools, social engagement remains a decisive factor. Traders often pool insights via Telegram or Twitter, sharing analyses like those on emerging meme coins ($CRYFI) or specific market hypotheses inspired by conferences and political signals. For example, JD Vance’s Bitcoin Conference speech in 2025 embedded subtle messaging regarding digital sovereignty, sparking predictive analyses that underscore the increasingly intertwined nature of crypto, politics, and culture.

Such community-driven intelligence contributes not only to market knowledge but also to shaping narratives that influence asset flows and regulatory outlooks.

—

Conclusion: Crypto’s Crossroads — Innovation, Adoption, and Integration

The cryptocurrency market in May 2025 presents a fascinating case of rapid innovation meeting market maturation. AI’s role in validating trading apps shows technological leaps addressing security concerns. Meanwhile, divergent capital flows between stocks and crypto hint at a paradigm shift in investor preferences amid economic flux.

Technical and fundamental analyses continue to provide vital frameworks for navigating crypto’s notorious volatility, now bolstered by advanced analytics platforms making data actionable in real time. Furthermore, robust community interactions help surface unconventional insights that could define market psychology and regulatory futures.

As crypto trading tools become smarter and investor bases diversify, the cryptocurrency market appears poised not only to coexist with traditional finance but to influence it deeply. Traders and investors attuned to these signals and equipped with the latest analytic capabilities may find themselves at the forefront of a financial revolution where technology, data, and collective intelligence converge.

—

References

– REKTus Pospolitus tweet on Claude Code AI crypto trading app

– AstralX market flow data

– Forex Training Group fundamental analysis on cryptocurrency

– Vladimir Ribakov Ethereum technical analysis

– Leonard Lee on cryptocurrency trading tools

– Albertobeto on maximized cryptocurrency profits

(Note: Specific tweet URLs provided are placeholders; for exact content, please refer to Twitter with respective handles and timestamps.)