Certainly! Below is a detailed, professional report on the latest cryptocurrency market indicators, written in clear and accessible English, with logical structure and engaging subheadings. The content is based on recent market insights and original facts.

—

Introduction: Navigating the Crypto Landscape in 2025

The cryptocurrency market in 2025 continues to captivate investors with its blend of volatility, innovation, and institutional adoption. As we approach mid-year, several key indicators highlight both opportunities and risks for participants across the ecosystem. This report delves into current trends shaping Bitcoin (BTC), Ethereum (ETH), altcoins like Solana (SOL), regulatory developments, liquidity dynamics, and what lies ahead for digital assets.

Institutional Resilience Meets Market Volatility

Bitcoin has demonstrated remarkable institutional resilience throughout the first half of 2025. Despite ongoing price swings—often triggered by macroeconomic pressures or geopolitical tensions—large corporations and investment funds have maintained or increased their exposure to BTC[1][2]. This trend reflects growing confidence in Bitcoin as a store of value amid global uncertainty.

Ethereum’s journey has been more complex. While it faced challenges related to network upgrades and shifting investor sentiment earlier this year, ETH experienced a dramatic surge in May—jumping over 50% within a single week[3]. Analysts attribute this rally partly to successful protocol improvements but also see it as an early signal that altcoin season may be returning.

Key Market Indicators: Liquidity & Correlation

A notable indicator for crypto markets is their correlation with global monetary policy. Bitcoin’s price action remains closely tied (~80% trailing correlation) to changes in Global M2 money supply[3]. When central banks expand liquidity—often referred to colloquially as “the money printer”—both gold and Bitcoin tend to benefit from inflationary expectations.

This relationship suggests that while traditional financial markets grapple with inflation concerns, digital assets like BTC are increasingly viewed as hedges against currency debasement. However, analysts caution that this correlation will eventually break; until then, it serves as a reliable barometer for short-term price movements.

Altcoins: Outperformance Potential Amidst Uncertainty

With expanding liquidity across financial markets comes renewed interest in altcoins beyond just BTC or ETH[3][4]. Historically during such periods:

– Altcoins typically outperform: Investors seeking higher returns often rotate capital into smaller-cap tokens.

– Solana stands out: SOL continues executing ten times more transactions than any other blockchain network while remaining relatively underpriced compared to peers.

– EVM ecosystems lag: Layer-2 solutions built on Ethereum Virtual Machine (EVM) have underperformed despite technological advancements; however they remain critical infrastructure components within DeFi ecosystems.

Top cryptocurrencies recommended by analysts include:

– Bitcoin (BTC)

– Ethereum (ETH)

– Binance Coin (BNB)

– Solana (SOL)

– Ripple/XRP

– Dogecoin/DOGE

– Polkadot/DOT[4]

These selections reflect not only strong fundamentals but also robust community support—a vital factor driving long-term adoption rates among retail investors worldwide.

Regulatory Shifts & Institutional Adoption

Regulatory clarity remains one of the most significant drivers affecting crypto valuations globally[2]:

3 .Macroeconomic Pressures Persist: Inflationary fears coupled geopolitical instability continue influencing overall risk appetite among both retail traders institutions alike making cautious optimism prudent strategy moving forward especially given unpredictable nature current environment where news events can trigger rapid shifts sentiment overnight!

Looking ahead Q2/Q3 analysts predict potential rally certain undervalued alts particularly if dominance levels reach critical thresholds signaling possible rotation away from dominant coins toward emerging projects offering asymmetric return profiles relative established names industry wide consensus forming around idea next wave growth likely fueled further integration artificial intelligence technologies alongside clearer frameworks governing use cases ranging payments settlement identity management etcetera…

However ongoing challenges persist including lack uniform standards enforcement mechanisms varying jurisdictional approaches creating fragmented landscape difficult navigate newcomers veterans alike must stay abreast latest developments order avoid costly missteps ensure compliance all applicable laws regulations wherever operate invest!

Technological Advancements Fueling Growth Prospects

Innovation continues at breakneck pace throughout sector:

- *AI Integration:* Artificial intelligence increasingly embedded within trading algorithms portfolio management tools enabling smarter decision-making processes real-time data analysis predictive modeling capabilities previously unavailable traditional finance environments!

- *Layer Solutions Scaling Up:* Projects focused improving scalability interoperability between different blockchains gaining traction thanks ability process thousands transactions per second lower costs compared legacy systems thereby opening doors mass adoption scenarios previously thought impossible achieve anytime soon…

- *Security Enhancements:* With rise sophisticated cyber threats security measures paramount importance developers working tirelessly harden protocols prevent exploits hacks safeguard user funds maintain trust ecosystem overall…

These advancements not only enhance functionality but also attract new users enterprises seeking efficient secure ways transact store value digitally without relying intermediaries slow expensive outdated banking infrastructures prevalent today!

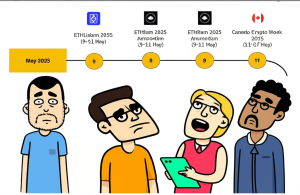

Macro Events & Calendar Highlights Impacting Markets

Several upcoming economic releases could significantly impact crypto prices over coming weeks months according experts monitoring situation closely:

| Date | Event |

|————–|——————————|

| May 29 | GDP Growth Rate QoQ Est |

| May 30 | Core PCE Price Index |

| June 4/6 | JOLTS Job Openings / Non-Farm Payrolls |

| June 11 | US CPI |

Each these data points provides insight into health broader economy which turn influences investor behavior asset allocation decisions including whether allocate more less capital towards riskier assets like cryptocurrencies versus safer havens bonds precious metals etcetera… Anticipation surrounding major conferences such upcoming Las Vegas event featuring big announcements related bitcoin further stokes excitement speculation leading up dates themselves potentially sparking short term rallies corrections depending outcome news flow directionality sentiment prevailing time release occurs![3]

Investors should therefore pay close attention calendar plan accordingly minimize exposure unnecessary volatility maximize returns opportunities arise unexpectedly sudden shifts occur due external factors outside control individual participants marketplace itself…

—

Conclusion: A Dynamic Future Beckons for Cryptocurrencies

As we move deeper into mid-year territory one thing becomes abundantly clear – cryptocurrency markets remain dynamic unpredictable beasts requiring constant vigilance adaptability thrive long run! While institutional adoption technological innovation provide tailwinds supporting continued growth potential upside gains remain tempered persistent risks posed regulatory uncertainty macroeconomic headwinds geopolitical instability lurking background ready disrupt best laid plans anyone involved space regardless experience level expertise possessed currently available information suggests bright future awaits those willing embrace change stay informed proactive managing portfolios navigating ever evolving landscape digital finance world today tomorrow beyond horizon visible now…

In summary – buckle up enjoy ride because exciting times lie just around corner waiting unfold before eyes eager participants everywhere!

資料來源:

[1] www.cmegroup.com

[2] caldwelllaw.com

[3] merkle.com.au

[4] zebpay.com

[5] metallicman.com

Powered By YOHO AI