Cryptocurrency Market Dynamics and Investment Insights: A Contemporary Exploration

—

Introduction: Navigating the Digital Frontier

The cryptocurrency landscape in 2025 stands at a fascinating crossroads, blending rapid technological innovation, fluctuating market psychology, and evolving regulatory environments. Recent social media snippets and market commentaries provide a microcosm of this complex ecosystem, revealing how traders, analysts, and policymakers collectively shape the digital asset domain. This report dives deep into the nuanced insights shared by various crypto enthusiasts and experts, analyzing the interplay of technical trends, macroeconomic factors, and emergent tools that influence investment decisions.

—

Harnessing Technical Analysis for Strategic Positioning

One dominant theme from the shared content is the emphasis on technical analysis (TA) as a cornerstone of trading strategy. Ethereum (ETH), for instance, is highlighted as “bullish in the short term” based on prevailing patterns and momentum indicators. This suggests that market participants anticipate upward price trajectories driven by buyer confidence and volume surges. TA, when combined with real-time market data platforms and AI-powered tools like TraceonAI and $AIXBT, enhances traders’ ability to make timely and informed decisions.

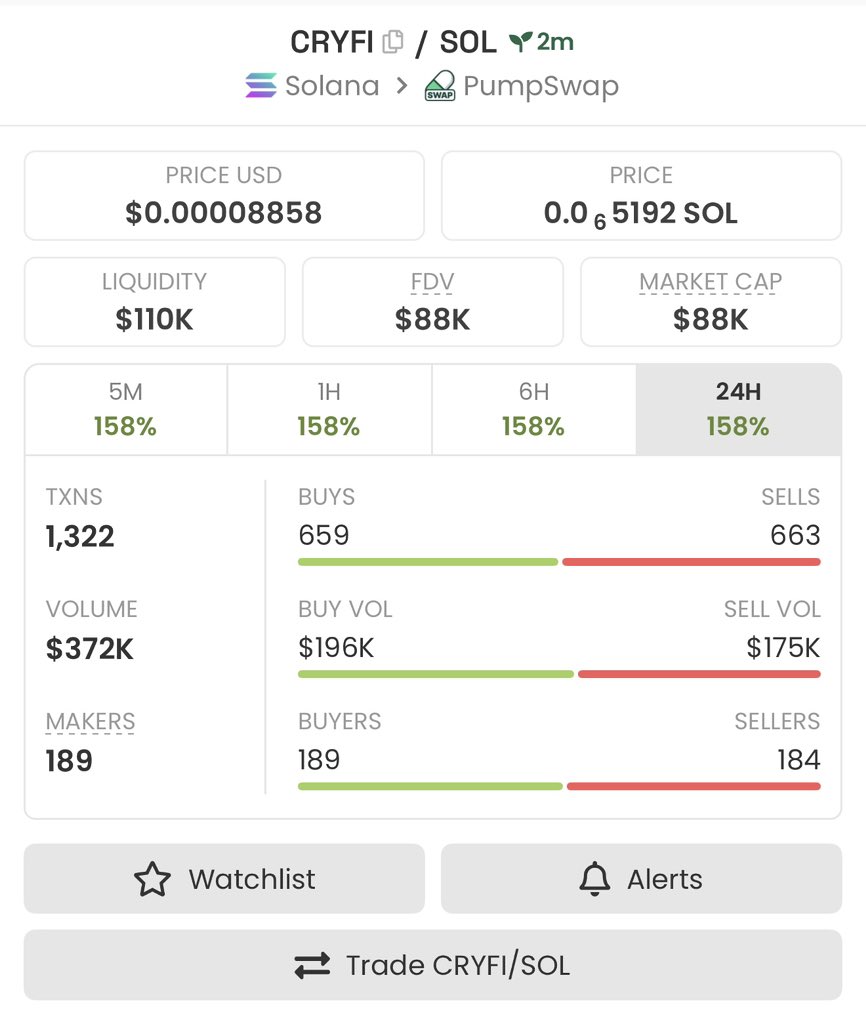

The use of AI in trading is highlighted as transformative. Platforms employing machine learning algorithms and data crunchers provide personalized alerts and portfolio insights that transcend traditional chart reading. This shift marks a democratization of sophisticated analysis, enabling retail investors to compete with institutional entities. Moreover, the mention of meme coins like $CRYFI and $ARB underscores how technical indicators are applied beyond blue-chip tokens, surfacing speculative opportunities that blend social sentiment with digital asset mechanics.

—

Macro Forces and Regulatory Underpinnings

Beyond chart patterns, macroeconomic factors and regulatory developments wield significant influence. For example, the suspension of tariffs previously imposed during the Trump administration has triggered a surge in treasury bond yields, which traditionally affects risk asset appetites, including Bitcoin (BTC). Analysts question whether this environment benefits BTC investors, suggesting a complex feedback loop between global trade policies and crypto market flows.

On the regulatory front, country-specific initiatives highlight the global fragmentation and experimentation with digital currencies. Pakistan’s proposal for a Bitcoin strategic reserve and Russia’s plans for a national cryptocurrency exchange indicate divergent approaches to embracing blockchain technology and digital sovereignty. Similarly, South Korea’s recent interest rate cut by 25 basis points introduces monetary easing that could increase liquidity and, by extension, catalyze higher crypto market participation.

These developments reflect an ongoing balancing act: fostering innovation while managing systemic risks. Knowing how to interpret and anticipate regulatory moves becomes a vital skill for investors aiming to stay ahead of market shifts.

—

Analyzing Sentiment and Community Dynamics

Social media remains a key arena where sentiment is formed and disseminated rapidly. Tweets from figures like “MEMECOIN PRESIDENT” and “Crypto_SunCruise” highlight the enduring popularity of meme coins and their volatile, community-driven nature. Speculation around tokens such as $CRYFI suggests that micro-cap projects with dedicated Telegram “families” can surprise markets with rapid price swings and pumping activity.

Community-led initiatives play a dual role: while they can amplify price momentum through coordinated buying and hype, they also introduce risk as these movements are less tethered to fundamental valuation metrics. This dynamic stresses the importance of balancing enthusiasm with due diligence, encouraging investors to perform their own research (DYOR) and scrutinize underlying project information.

—

Innovative Education and Risk Management Strategies

Interestingly, the shared content emphasizes learning and education via “Learn & Earn” courses that cover everything from crypto basics to the psychology of market cycles. This approach acknowledges that understanding human behavior is as crucial as technology or macrotrends. Cryptocurrency trading is emotionally charged, with fear and greed driving many decisions. Formalized education equips traders with mental frameworks to navigate volatility and avoid common psychological traps.

Risk management is another recurring motif. By integrating AI-powered alerts and portfolio management tools, investors can automate safeguards against impulsive moves and price swings. The mining of data for real-time adjustments creates an adaptive strategy distinct from the traditional buy-and-hold mentality.

—

The Future Landscape: Potential and Challenges

Looking ahead, several factors could reshape the crypto investment climate:

—

Conclusion: Embracing Complexity in Cryptocurrency Investment

The cryptocurrency environment is a pulsating, multifaceted arena where technical mastery, market psychology, geopolitical shifts, and cutting-edge technologies intertwine. A successful investor in 2025 combines rigorous data analysis and the wisdom of community insights, while staying adaptable to macroeconomic and regulatory shifts. Education and innovative tools, especially AI-enhanced platforms, empower traders to manage risk intelligently and seize emerging opportunities.

Ultimately, investing in digital assets is less about following prescriptive paths and more about navigating an evolving narrative, sensing collective behavior, and interpreting subtle signals — whether they come from candlestick patterns, tweets, or policy announcements. This multidimensional awareness distinguishes the adept from the casual participant and heralds a future where cryptocurrency investment is both a science and an art.

—

Useful References

– Ethereum Technical Outlook and Market Sentiment – https://twitter.com/VladimirRibakov/status/1652056754269938688

– AI Tools Enhancing Crypto Trading – https://twitter.com/neoncry_104/status/1652067153294189824

– Regulatory Shifts: Pakistan Bitcoin Reserve & Russia’s Crypto Exchange – https://twitter.com/OkayPayBot/status/1652067932863099392

– Meme Coins and Community Dynamics – https://twitter.com/memecoinprez/status/1652073541634329345

– Macroeconomic Context: Trump Tariffs and Treasury Yields Impact – https://twitter.com/Astral_Global_/status/1652068984070492672

– Learn & Earn Crypto Education Resources – https://twitter.com/Ajayconsult_001/status/1652069027285738496

– Solana Price Projections and Technical Analysis – https://alertsvi aweb3.com/solana-analysis

These sources offer rich, up-to-date insights that illuminate the current state and future direction of cryptocurrency markets.