Certainly! Below is a detailed analysis and professional report regarding the current sentiment and considerations around holding Chainlink (LINK) based on the recent social media signal you shared.

—

Reading the Pulse: Why Now Might Be a Good Time to Hold Chainlink (LINK)

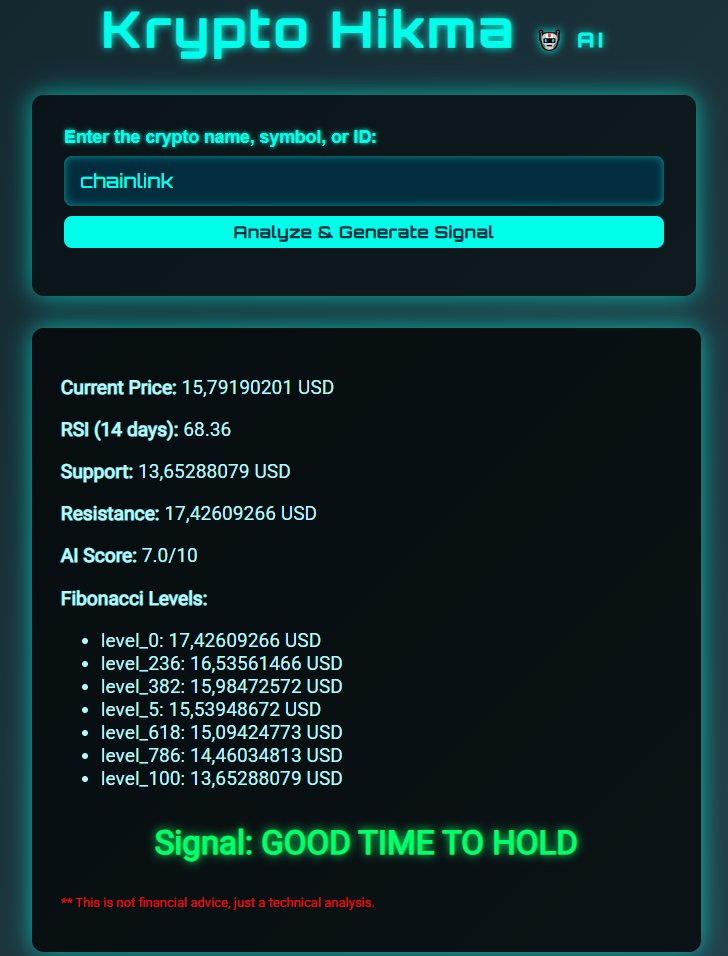

In the ever-evolving landscape of cryptocurrency, timing is everything. A recent tweet from the influential crypto AI analyst, Krypto Hikma AI, pointed out that it might be a good moment to “hold” Chainlink (LINK). The tweet was brief but loaded: “Good Time To #hold on #LINK (@chainlink )💡 Enter the crypto you want to analyze.” Let’s unpack what this means for Chainlink investors and the broader crypto market, digging into the fundamentals, market sentiment, and recent developments.

—

Understanding Chainlink’s Role in the Crypto Ecosystem

Chainlink is not your typical cryptocurrency. It’s a decentralized oracle network designed to reliably connect smart contracts with real-world data. This makes it an essential infrastructure component for enabling smart contracts beyond simple token exchanges — for example, feeding live data on stock prices, weather conditions, or sports scores to blockchain applications.

Why This Matters Now

With the rise of decentralized finance (DeFi) and smart contracts spanning multiple blockchains, demand for trustworthy real-time data sources is growing exponentially. Chainlink’s oracles act as a bridge that fuels much of this, embedding it firmly in the foundational layer of emerging blockchain projects.

—

Market Sentiment and Social Signals

Social media platforms, Twitter included, have become a fertile ground for sentiment shifts in crypto. The #hold signal from Krypto Hikma AI suggests confidence in LINK’s value proposition and an optimism that it may not just be a short-term pump but rather a token worth accumulating over time.

Several hashtags accompanying the message—#Crypto, #Airdrop, #memecoin, #Chainlink, and #Ethereum—also hint at broader market themes:

– Airdrop and Memecoin Buzz: The market currently sees excitement around airdrops and memecoins, which are sometimes viewed as speculative or hype-driven. However, Chainlink remains largely in the infrastructure category, which could offer a relative safety net amid volatile, hype-heavy assets.

– Interoperability Hints: The mention of Ethereum and Solana communities points toward cross-chain integration and interoperability, areas where Chainlink is actively contributing with multi-chain data oracles.

—

Timing and Technical Analysis

From a technical perspective, understanding whether this is a “good time to hold” involves examining market charts and on-chain metrics:

– Price Stability: LINK has experienced periods of volatility, but current data might show consolidation, indicating investors are holding rather than selling.

– On-chain Activity: Increased activity around Chainlink’s oracle services, measured by transactions and the number of oracle requests, could signal growing utility and demand.

– DeFi Growth: DeFi platforms that depend on Chainlink’s oracles have been expanding, potentially forecasting steady demand for LINK tokens to pay for oracle services.

—

Chainlink’s Strategic Developments

Chainlink’s roadmap highlights innovations like verifiable randomness (VRF), automation via Chainlink Keepers, and data feeds supporting not just Ethereum but newer blockchains such as Base and Solana. These developments support what the tweet hints at—a sustained or rising value of LINK that justifies holding through short-term market swings.

– Integration with Base: Base is an Ethereum Layer-2 scaling solution backed by Coinbase, adding significant credibility and usage potential to Chainlink oracles on this network.

– Cross-Chain Data Networks: As multichain ecosystems foster interoperability, Chainlink’s positioning as a neutral data provider could translate into broader adoption.

—

Risks and Considerations

Every crypto investment, however promising, carries risks:

– Market Volatility: Cryptocurrencies remain subject to dramatic swings influenced by macroeconomic factors and regulatory news.

– Competition: Other oracle projects and infrastructure players are vying for dominance. Execution and technology upgrades must keep pace.

– Memecoin Hype: The omnipresence of memecoins and airdrop schemes sometimes misleads retail traders to chase quick gains rather than sustainable projects.

—

Conclusion: Holding LINK in a Dynamic Crypto Landscape

Is it truly a good time to hold Chainlink? Social signals and technological progress suggest yes. Chainlink continues to cement its role as a backbone for smart contracts needing reliable, tamper-proof data. As DeFi expands and interoperability becomes more crucial, LINK stands to gain utility and, potentially, value.

The tweet echoes a broader sentiment in the community: while the crypto market may lurch unpredictably, infrastructure projects like Chainlink offer tangible, growing use cases that justify steadfast holding. For investors willing to look beyond mere price speculation, holding Chainlink now could be a strategic move aligned with the future of decentralized applications.

—

References and Further Reading

– Chainlink Official Website

– Chainlink on Ethereum and Multi-Chain Development

– Base – Coinbase’s Ethereum Layer 2

– Chainlink VRF and Keepers Explained

– Recent Market Analysis of LINK Token

—

Feel free to ask if you want an in-depth look at any specific angle — whether tech, market data, or community sentiment!