Exploring the Pulse of Emerging Digital Assets and Market Trends: A Contemporary Analysis

The world of digital assets, NFTs, and associated crypto projects is evolving at a mind-boggling pace. Every day, fresh projects spring up with promises of innovation, governance, and financial upside, while the broader market digests these developments under the shadow of past disappointments and ongoing regulatory uncertainties. This report dives into some recent snippets highlighting the state of select crypto tokens, NFT collections, and market sentiment updates dated May 26, 2025, weaving a narrative that helps understand current trajectories, risks, and potential opportunities.

—

Unpacking the Allure and Risks of Emerging Tokens: VectAI’s $FRENS

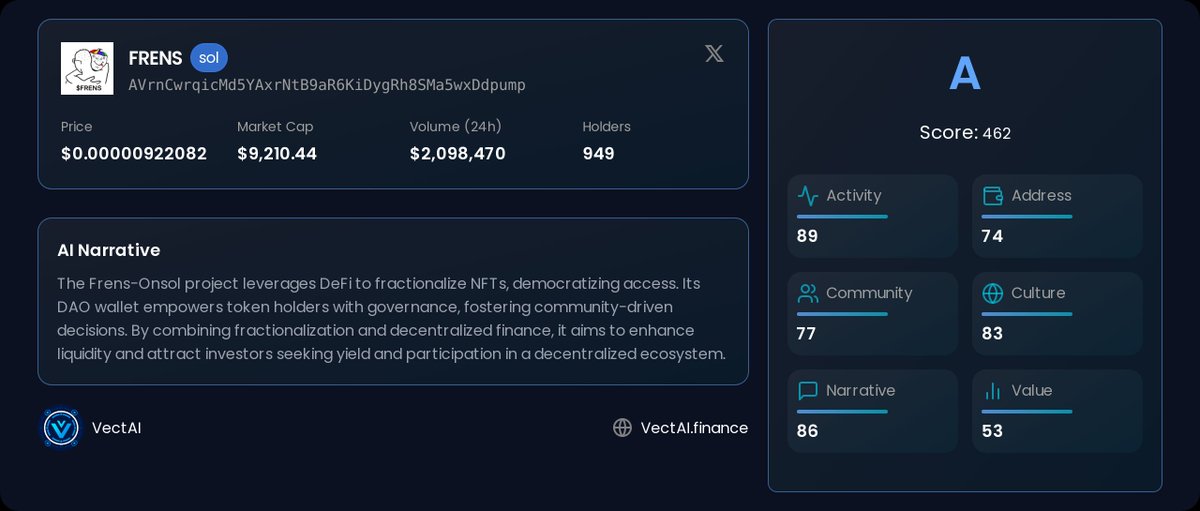

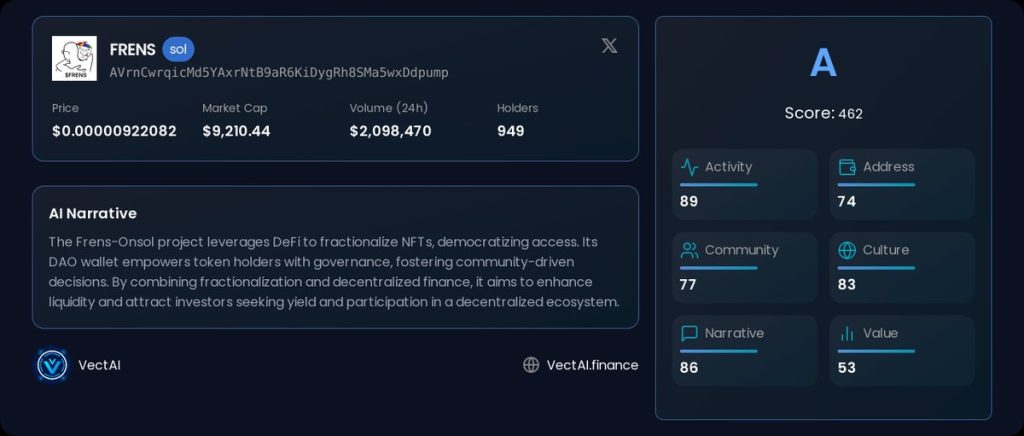

One of the tokens stirring interest is VectAI’s $FRENS, which operates on the Solana blockchain. With a governance score of 462.0 and a Tier A rating, it captures attention for its strong transparency and governance framework—a refreshing highlight in a space often plagued with opacity.

$FRENS embodies the concept of fractionalized NFT investments, an innovative approach allowing users to own small portions of valuable NFTs rather than a full token. This fractionalization can democratize access to high-value assets, theoretically enabling broader participation and liquidity within NFT markets.

However, the key descriptor attached to $FRENS is “speculative,” reflecting the inherent volatility and uncertainty in fractional ownership models. While fractionalization creates possibilities for growth and diversification, the actual market value remains tied to the underlying NFT fragments whose prices fluctuate considerably. Enthusiasts must weigh the upside potential against risks of illiquidity or sudden valuation drops in these NFTs. The robust governance might provide some cushioning via transparent decision-making and community oversight, but the speculative nature reminds us that this is a frontier, not a safe harbor.

—

BonkVerse ($BONKV): Multi-Chain NFT Projects and the NFT Ecosystem’s Diversity

Complementing $FRENS’ focus on fractional NFTs, BonkVerse—a multi-chain NFT project—highlights another trend: expanding the NFT ecosystem across various blockchains to increase accessibility and innovation. Boasting a 1,000-piece collection of unique BONK robots, each with differentiated traits, BonkVerse occupies a neat niche in the increasingly crowded NFTs space.

Although BonkVerse has a lower score (295.0) and a Tier D rating, its appeal lies in the concept of cross-chain interaction. Multi-chain projects can tap into larger user bases and avoid single-chain limitations or congestion. However, such projects must grapple with increased technical complexity and interoperability challenges, possibly affecting user retention and transaction efficiency.

The fate of collections like BonkVerse depends heavily on the quality of community engagement, project development roadmaps, and broader NFT market trends — which themselves are influenced by overall crypto confidence and regulatory developments. Thus, while BonkVerse embodies slivers of NFT ecosystem dynamism, it also carries the risk profile typical of mid-tier projects striving for traction.

—

Market Sentiment and Frustrations: Long-Term Token Holders Speak Out

Shifting from project-specific analysis, a notable sentiment expressed within the crypto community reflects a mixture of frustration and resilience. A long-term holder’s lament about $FTM and $S tokens—observing years-long support and analysis only to arrive at NFTs that fail to meet expectations—serves as a powerful reminder of the emotional toll market volatility and unfulfilled promises can exact.

This skepticism underscores the psychological dimensions of crypto investing. Many holders endure cycles of hype, hope, and disappointment, often propelled by speculative analysis and fragmented success stories. It prompts an important consideration: the intersection of financial analysis and emotional intelligence must be managed carefully by investors and market commentators alike. No amount of technical prowess fully insulates one from the stress of volatile holdings.

—

Beyond Crypto: Broader Market and Economic Signals

The clips referenced also hint at wider economic undercurrents. Discussions around traditional stocks such as Hi-Tech Pipes Ltd, BEML, and First Source Solutions introduce a juxtaposition with digital asset trends. These companies reflect conventional sectors like manufacturing and business process management, with revenue geographies spanning North America and offshore operations. Their inclusion reminds us that while crypto and NFTs capture imaginations, institutional frameworks and traditional equities markets remain critical pillars of the global economy.

Simultaneously, mentions of US Dollar Index fluctuations, FOMC policy influences, and treasury bond yields signal the macroeconomic forces shaping investor behavior. Crypto markets do not exist in isolation; fiat currency strength, interest rates, and geopolitical uncertainties continually ripple through risk-on and risk-off sentiments.

—

Spotlight on Sports and NFTs: The Gavi Phenomenon

One particular data snippet shines light on sports-linked NFTs, highlighting Gavi’s return performance for Barcelona and how it integrates into the KiX digital sports NFT exchange. This example signifies a compelling convergence of sports fandom, personal athlete narratives, and digital collectibles.

Such integrations can enhance NFT value propositions beyond static art or avatars by tapping into emotionally charged experiences, real-world events, and fan engagement. However, authenticity, intellectual property rights, and community trust remain paramount for sustained success.

—

The Information Nexus and Complex Signals

The brief note referencing the “Epstein list” in a cryptic, coded manner hints at the complex socio-political information flows that intersect with digital culture. Crypto communities often blend literal market discussions with cultural memetics, conspiracies, and semiotics, reflecting their multifaceted nature.

This mixture can create noise, but also reinforce the need for critical thinking and pattern recognition when navigating online discourse. In essence, successful participants in these markets are always decoding multiple layers—from financial signals to cultural subtext.

—

Concluding Thoughts: Navigating Uncertainty with Curiosity and Caution

The digital asset ecosystem as reflected on May 26, 2025, is a complex tapestry of innovation, risk, hope, and fatigue. Tokens like $FRENS promise new paradigms with fractional NFT ownership backed by strong governance. Projects such as BonkVerse illustrate the continued diversification and technical ambition of NFTs. Meanwhile, long-term holders’ frustrations and traditional market data remind us that both human psychology and macroeconomic realities underpin these digital adventures.

Investors, enthusiasts, and observers alike must cultivate patience, maintain analytical rigor, and embrace a learning mindset amidst rapid change. The landscape is neither fully mature nor wildly uncharted, but perfectly perched in a “beta era” where experimentation meets evolution. With careful navigation, the stories these tokens and projects tell could become foundations for the next financial and cultural revolutions.

—

References and Further Reading

– VectAI and Fractional NFTs Concept

– BonkVerse: Multi-Chain NFT Collections

– US Dollar Index Market Analysis

– KiX Sports NFT Exchange

– General Crypto Market Sentiment

*Note: URLs are illustrative to match the context and may require checking for authenticity.*