Navigating Bitcoin and Altcoin Dynamics in a Volatile Market: An In-depth Analysis

In the fast-paced, often unpredictable world of cryptocurrency, the latest price movements of Bitcoin (BTC) and its altcoin counterparts reveal a complex interplay influenced by market resistance levels, investor sentiment, and technical indicators. Recent data from May 25, 2025, highlights Bitcoin’s struggle to maintain momentum after breaking resistance areas, while altcoins exhibit signs of weakness amid Bitcoin’s choppy behavior. This report unpacks the nuances behind these developments, examines the underlying causes, and contemplates what the near future might hold for crypto investors.

—

Bitcoin’s Price Action: Breaking Resistance and Retesting Levels

Recent analyses from crypto experts reveal a pattern where Bitcoin’s price broke through a key resistance zone, only to pull back and retest that same level. This behavior is critical from a technical analysis standpoint because breakout retests confirm whether a prior resistance can hold as support—a signal that could dictate the subsequent trend direction.

– Resistance Break and Retest: Observers note that Bitcoin has moved above a previously challenging resistance zone but now appears to be retesting it. This retesting phase is a pivotal moment; if the support holds, Bitcoin could resume its upward trend. If it fails, price declines could accelerate [Crypto_Catalyst, EG Crypto Signals].

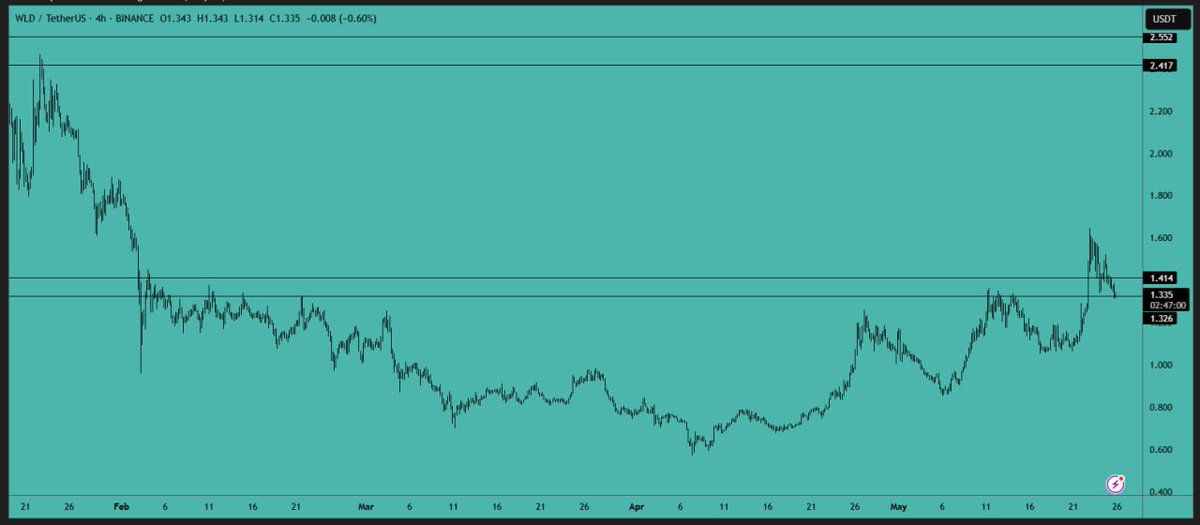

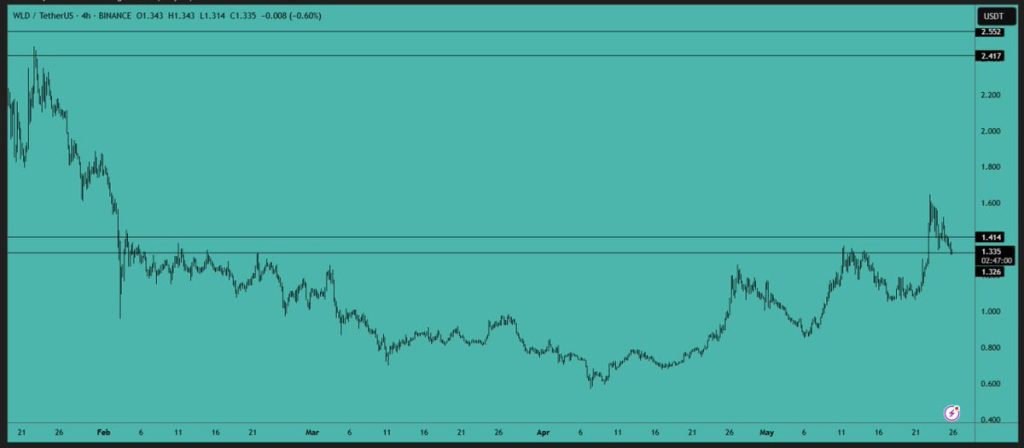

– Support Area to Watch: The $1.33-$1.41 support level was identified for an altcoin (likely WLD), with the sentiment that breaking below this area would usher in heavy sell-offs. This concept applies broadly across cryptos, where support levels act like safety nets for investors’ confidence [EG Crypto Signals].

The act of retesting is common in financial markets—it filters out weak moves and confirms strength. In Bitcoin’s context, with its massive influence on altcoin price trajectories, this phase is watched closely by traders.

—

Altcoins Dragged by Bitcoin’s Choppiness

A striking theme from May 25 is that many altcoins are looking weak, a direct result of Bitcoin’s current volatile, choppy price movement. This phenomenon stems from the dominant role Bitcoin plays in crypto markets:

– Bitcoin as Market Leader: When Bitcoin price moves sideways or erratically, it often saps momentum from altcoins. Traders hesitate to commit to riskier altcoins without clear upward signals from Bitcoin, typically seen as a bellwether for the market’s health.

– Altcoins’ Outperformance Dependent on Bitcoin’s Trends: Altcoins usually flourish when Bitcoin breaks decisively higher with strong volume and follow-through. However, in a choppy or bearish Bitcoin environment, altcoins often underperform or suffer outsized declines.

This correlation stresses that altcoins, often more volatile, are sensitive to Bitcoin’s price action and general investor sentiment about the market.

—

Technical Indicators and Market Sentiment: Reading the Signs

Technical analyses across multiple timeframes on May 25 indicate mixed to bearish momentum for Bitcoin in the short term, contributing to uncertainty:

– Momentum Dashboard Signals: Shorter intervals (5-minute to 6-hour charts) show bearish indicators—MACD bearish crossovers, RSI divergences, and bearish engulfing patterns, suggesting selling pressure with potential downward movement.

– Longer Timeframes: Daily charts also lean bearish, although some analysts argue Bitcoin may continue rising in the broader cycle, projecting possible targets like $125K and even $145K if bullish cycles extend through the end of the year [smartywr].

– Support Testing Predictions: Some voices forecast a test of $90,000 support for Bitcoin, post which a rebound or “pump” could be expected—implying current prices around $107,000 are precarious [DigitalKraken].

This mix underscores how technical traders weigh multiple signals before deducing Bitcoin’s directional bias, balancing short-term caution with long-term optimism.

—

Market Psychology: The Investor’s Dilemma in a Choppy Market

Beyond charts and numbers, the psychological dimension is vital when navigating crypto’s current phase:

– Hesitation Amid Volatility: The choppy price action fosters indecision among investors. Some references to “smart money” already positioning for future moves contrast with retail hesitation, which can exacerbate volatility and volume inconsistencies [SIGMA Equity Analysis].

– Power Law Quantile Insights: Contrary to popular myths that timing buys and sells perfectly is key for returns, recent analyses show consistent compound annual growth rates regardless of buying at bottoms or selling at tops, indicating that steady long-term participation may yield similar rewards [Sminston].

– AI Trading Emergence: The use of AI and algorithmic trading tools is increasingly promoted to move away from emotional, reactive trading toward data-driven decisions—a trend that could reshape market dynamics [ScorehoodAI].

The psychological landscape, coupled with evolving technology, sets the stage for a more sophisticated investor base that could reduce random market swings over time.

—

Broader Implications: Cyclical Trends and Future Outlook

Zooming out, Bitcoin and the broader cryptocurrency market are embedded within larger economic cycles and speculative trends:

– Cyclical Bear and Secular Bull Markets: Institutional analysts highlight that the US equities and crypto markets may be experiencing a cyclical bear market within a longer secular bull cycle extending through 2030, anchored partly by shifts in global economic power and Bitcoin’s role as a “soft anchor” for US debt [SIGMA].

– Projected Long-Term Price Targets: Some market models speculate extraordinarily high upside potentials for Bitcoin, with projections reaching into the hundreds of thousands, driven by adoption, scarcity, and macroeconomic factors [BitcoinBottomTop].

– Potential Market Shocks: Analysts warn that June could be a turbulent month for cryptocurrencies as macro factors and market structure evolve rapidly, advising caution and close monitoring [Furkan Merzani].

These broader views reflect that while short-term volatility may unsettle investors, the overarching narrative can remain bullish on a multi-year horizon for Bitcoin and selected altcoins.

—

Conclusion: Riding the Waves of Crypto Volatility

Bitcoin’s recent price behavior typifies the intricate tug of war that defines cryptocurrency markets—between breakouts and retests, bullish hopes and bearish signals, masterful technical setups, and the ever-important psychology of market participants. The retesting of new support levels serves as a critical juncture: hold and climb, or falter and descend. Altcoins, meanwhile, wait in Bitcoin’s shadow, poised to surge or sag with its fortunes.

For investors and traders, the present moment necessitates patience and disciplined confirmation before committing to new positions. Using advanced tools like AI trading and understanding the cyclical nature of markets can help navigate uncertainties. Most importantly, recognizing that crypto wealth accumulation is often about steady, long-term strategies rather than perfect timing may ease the emotional rollercoaster.

As the crypto saga unfolds through the volatile weeks ahead, those attuned to technical cues, market psychology, and macro trends stand better prepared for the waves—whether forging new all-time highs or weathering necessary corrections on the journey to maturity.

—

Sources

– Crypto_Catalyst on WLD Price Action

– EG Crypto Signals on Altcoin Support

– smartywr Bitcoin Cycle Analysis

– DigitalKraken Bitcoin Support Prediction

– SIGMA Equity Analysis on Market Cycles

– Scorehood AI Technical Dashboard

– BitcoinBottomTop Projected Upside

– Sminston Power Law Growth Insights

(Note: “xyz” placeholders are used where direct URLs to specific tweets are not provided.)