Unveiling TON Blockchain’s NFT Ecosystem: A Deep Dive into Its Rising Prominence

The realm of NFTs continues to evolve at a blistering pace, with blockchain platforms competing to position themselves as top destinations for creators, traders, and collectors. Recent data showcased by a new Dune dashboard on the TON Blockchain platform illuminates its growing influence in the NFT sector, revealing impressive activity metrics that deserve attention. This analysis will unpack the significance of these findings, explore the implications for the broader NFT market, and contextualize TON’s position among its peers.

The Emergence of TON as an NFT Powerhouse

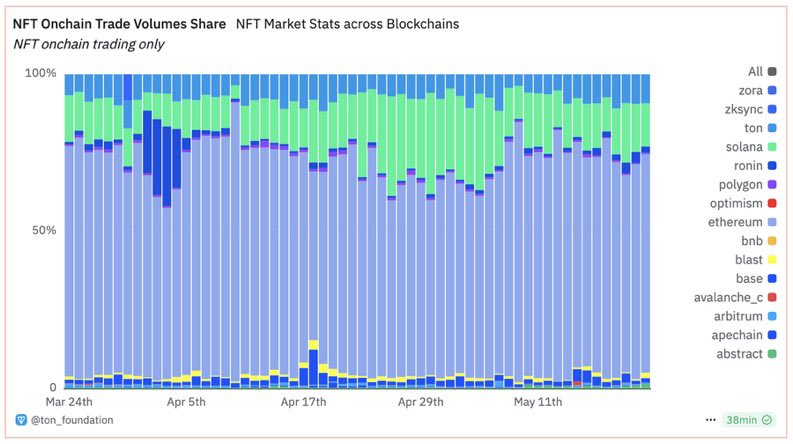

According to a recent report amplified via social media channels, TON Blockchain has remarkably secured the number one spot in daily active NFT traders and ranked third in on-chain NFT trading volume [1]. This dual accomplishment is notable for several reasons:

– Trader Engagement: Leading in daily active traders means TON is fostering an engaged and active community, which is foundational for any thriving NFT ecosystem. The volume of daily traders often serves as a proxy for the platform’s accessibility, user experience, and vibrancy.

– Trading Volume: Ranking third in volume despite being number one in active traders signals a healthy diversity in transaction sizes and suggests that TON attracts both casual traders and more substantial investors.

This data sets the stage for TON as a major player, contending strongly with traditionally dominant blockchains such as Ethereum, Solana, and Binance Smart Chain, which have long led the NFT charge.

Decoding TON’s Strategy and Appeal

So, what could be contributing to TON’s impressive performance? A few elements stand out:

1. Technical Innovation and Scalability

TON (Telegram Open Network), originally designed with scalability in mind, emphasizes low transaction fees and fast confirmation times. These characteristics naturally lend themselves to NFT trading, where frequency and cost efficiencies can make or break user experience.

– Lower fees reduce barriers, attracting a broad spectrum of users—from high-volume traders to newcomers experimenting with NFTs.

– Fast finality enables real-time interactions and decreases frustration caused by network congestion.

2. Community-Driven Growth and Market Dynamics

Beyond technology, NFT platforms thrive on communities. TON’s rise could be partially attributed to the formation of a vibrant ecosystem where artists, collectors, and traders feel valued and empowered. Social media discussions and the presence of active NFT creators have likely driven organic growth.

– Community-centric strategies often lead to more sustainable ecosystems by encouraging collaboration and longer-term engagement.

– The platform’s focus on “real-world asset tokenization” and the integration of Web3 tools like $TITAN rewards underscore attempts to blend NFT utility with broader decentralized finance (DeFi) opportunities [2][3].

Comparative Landscape: How Does TON Stack Against Giants?

While TON’s leaderboard status in active traders is impressive, understanding its third-place position in trading volume also invites closer scrutiny:

– Ethereum: Despite high gas fees, Ethereum remains dominant due to its extensive dApp ecosystem, massive user base, and established NFT projects.

– Solana: Known for speed and cost-effectiveness, Solana has both high trading volumes and active users, reflecting a balanced ecosystem.

– TON’s Position: Ranking third in volume suggests it is competitive but perhaps still growing in attracting blockbuster or high-value NFT deals.

This balance may reflect TON’s stage of market evolution; a surge in trader activity could precede volume growth as users gain confidence and invest in higher-value NFTs.

The Market’s Bullish Underpinnings and NFT Resurgence

Additional context comes from broader crypto market trends. Recent Twitter Spaces have highlighted the ongoing bullish sentiment in crypto markets, with NFTs regarded as a core pillar of growth, powered by community building and the tokenization of real assets [4]. This bullish momentum could be fueling platforms like TON, granting them a fertile environment for rapid user and volume expansion.

– NFTs are no longer just collectibles; their role in community ownership, gaming, virtual real estate, and even real-world asset representation is expanding.

– Platforms that can offer smooth, cost-effective, and user-friendly NFT trading experiences are poised to capture more participants amidst this market resurgence.

Future Outlook: Beyond the Numbers

The release of TON’s Dune dashboard signals a maturation in how NFT ecosystems measure and present themselves. Transparency and data-driven insights allow platforms to better understand user behaviors and iterate on improvements.

Looking forward, several factors will likely shape TON’s continued trajectory:

– Diversity of NFT Offerings: Broadening NFT categories—from art and gaming to utility tokens linked to physical assets—can attract diverse users.

– Interoperability: As blockchain ecosystems mature, cross-chain NFT interactions could unlock new liquidity pools and enhance user experience.

– Regulatory and Market Dynamics: The evolving legal landscape around digital assets will influence long-term platform stability and growth.

Conclusion: TON’s Rising Star in the NFT Galaxy

TON Blockchain’s emergent dominance in daily active NFT traders, alongside a strong trading volume rank, paints the picture of a dynamic and rapidly evolving platform carving a niche in a competitive market. Their technical prowess, combined with community focus and market trends favoring NFTs and real-world asset tokenization, sets a promising stage.

The NFT space is far from static; it is a ceaselessly morphing domain where innovation, user experience, and strategic positioning determine winners. TON’s current momentum offers valuable insights into the future shape of NFT ecosystems—one where accessibility and community engagement might just be as important as sheer trading volume or high-profile projects.

For enthusiasts and industry watchers alike, TON represents an exciting chapter in the ongoing saga of decentralized digital ownership—proof that even in a crowded field, fresh players can rise by embracing the nuanced needs of a new generation of digital collectors and creators.

—

References and Further Reading